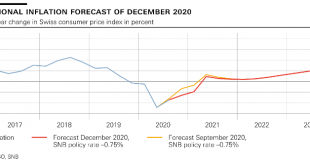

Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic is continuing to have a strong adverse effect on the economy. Against this difficult backdrop, the SNB is maintaining its expansionary monetary policy with a view to stabilising economic activity and price developments. The SNB is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. In light of the highly valued Swiss franc, the SNB remains willing to...

Read More »BIS, Swiss National Bank and SIX announce successful wholesale CBDC experiment

A Swiss national flag flutters in the wind atop the Swiss National Bank SNB headquarters in Bern, Switzerland April 16, 2015. REUTERS/Ruben Sprich/File Photo - Click to enlarge Project Helvetia shows the feasibility of two proofs of concept (PoCs), using “near-live” systems to settle digital assets on a distributed ledger with central bank money. A PoC linking the existing payment system to a distributed ledger and another issuing a wholesale central bank digital...

Read More »Issuance calendar for Confederation bonds and money market debt register claims in 2021

The Swiss National Bank (SNB) and the Federal Finance Administration (FFA) advise as follows: The Federal Finance Administration plans to issue bonds with a face value of CHF 6.5 billion in 2021. Taking account of bonds maturing, the volume of bonds outstanding will increase by CHF 2.4 billion. The volume of outstanding money market debt register claims will rise by approximately CHF 4 billion and will be kept within a range of CHF 12 billion to CHF 18 billion....

Read More »Romeo Lacher and Christoph Mäder nominated for election to the SNB Bank Council

Romeo Lacher ist Verwaltungsratspräsident von Julius Bär. Bild: ZVG At its meeting today, the Bank Council of the Swiss National Bank decided to propose to the General Meeting of Shareholders of 30 April 2021 that Romeo Lacher and Christoph Mäder be elected to the SNB Bank Council for the remainder of the 2020–2024 term of office. Romeo Lacher is Chairman of the Board of Directors of Julius Baer Group Ltd. and Bank Julius Baer & Co. Ltd. Christoph Mäder is...

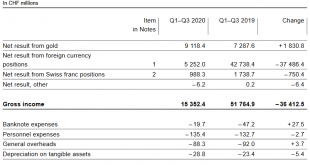

Read More »SNB Profit in Q1 to Q3 2020: CHF 15.1 billion Despite Covid19

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More »2020-10-30 – Swiss Financial Accounts: quarterly data published for first time

The Swiss National Bank is expanding its data offering with respect to Switzerland’s financial accounts. It will now publish quarterly as well as annual data, and the time to publication will be shortened from ten to four months. Today the SNB is releasing quarterly data for the period from Q4 2014 to Q2 2020. Annual data are available for the period 1999 to 2013. The data can be accessed in the form of charts and configurable tables on the SNB’s data portal...

Read More »Central banks and BIS publish first central bank digital currency (CBDC) report laying out key requirements

Seven central banks and the BIS release a report assessing the feasibility of publicly available CBDCs in helping central banks deliver their public policy objectives. Report outlines foundational principles and core features of a CBDC, but does not give an opinion on whether to issue. Central banks to continue investigating CBDC feasibility without committing to issuance. A group of seven central banks together with the Bank for International Settlements (BIS) today...

Read More »Adjustments to publication of data on money and foreign exchange market operations

Additional data on money market operations and more frequent publication of volume of foreign exchange market interventions From 30 September 2020, the Swiss National Bank will be publishing more detailed data on its money and foreign exchange market operations on its data portal. Regarding money market operations, the SNB will now publish information on the conditions and volume of individual monetary policy-related transactions at the end of each month for the...

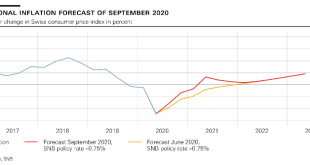

Read More »Monetary policy assessment of 24 September 2020

Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic continues to exert a strong influence on economic developments. The SNB is therefore maintaining its expansionary monetary policy. In so doing, it aims to cushion the negative impact of the pandemic on economic activity and inflation. The SNB is keepingthe SNB policy rate and interest on sight deposits at the SNB at −0.75%.In view of the fact that the Swiss franc is still highly...

Read More »Swiss balance of payments and international investment position: Q2 2020

Current Account Key figures: Current Account: Down 52.14% against Q2/2019 to 9.878 bn. CHF of which Goods Trade Balance: Minus 13.55% against Q2/2019 to 15.193 bn. of which the Services Balance: Minus 39.69% to 1.158 bn. of which Investment Income: Minus 70.07% to 3.012 bn. CHF. Current Account Switzerland Q2 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, )...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org