Overview: The holiday continues. In the Asia Pacific region, Hong Kong, Australia, and New Zealand, and the Philippines markets were closed. The regional bourses advanced but China. European markets remain closed. US equity futures are narrowly mixed. The 10-year US Treasury yield is off nearly three basis points to about 3.36%. The dollar is trading quietly mostly within ranges seen before the weekend. It is slightly softer against most of the G10 currencies, but the Japanese yen and Swiss franc. Among emerging market currencies, the greenback is firmer. The Mexican peso is the chief exception, with about a 0.25% advance. Of note, the Russian rouble continues to fall. It fell by about 4.3% last week and has fallen in 10 of the past 12 weeks. Separately, the

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, COFER, Currency Movement, EU, Featured, Japan, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview: The holiday continues. In the Asia Pacific region, Hong Kong, Australia, and New Zealand, and the Philippines markets were closed. The regional bourses advanced but China. European markets remain closed. US equity futures are narrowly mixed. The 10-year US Treasury yield is off nearly three basis points to about 3.36%. The dollar is trading quietly mostly within ranges seen before the weekend. It is slightly softer against most of the G10 currencies, but the Japanese yen and Swiss franc.

Among emerging market currencies, the greenback is firmer. The Mexican peso is the chief exception, with about a 0.25% advance. Of note, the Russian rouble continues to fall. It fell by about 4.3% last week and has fallen in 10 of the past 12 weeks. Separately, the South African range is also trending sharply lower. It has fallen in nine of the past 12 weeks. It fell by 2.2% last week and is off nearly another 1% today. Gold peaked last week near $2032. It was sold to a three-day low today around $1989.A break of the $1980 area could squeeze some of the late longs. June WTI gapped higher to start last week in response to the OPEC+ output cut. It traded largely within Monday's range all last week. It is trading with a firmer bias today and held above $80.40. Last week's high was near $81.80. Look for a quiet North American session.

Asia Pacific

The Bank of Japan has a new Governor and surveys suggest most expect policy to be adjusted near midyear or early Q3. As Kuroda stepped down, he acknowledged that the sustained 2% target was get closer. At the conclusion of its meeting on April 28, the BOJ will update its macro forecasts. This may offer the first insight into Governor Ueda's thinking. Earlier today, Japan reported a dramatic swing in February trade and current account figures. Both improved from a record deficit in January. The current account was in surplus by JPY2.2 trillion (~$16.5 bln) after a JPY2.0 trillion deficit in January. The February trade deficit of JPY604 bln around three times higher than the year ago shortfall, and in February 2019 (pre-Covid), it was in surplus (~JPY474 bln). Japan runs a chronic deficit on services, and it accounted for a third of the of the February trade deficit. The data showed Japanese investors bought JPY4.5 trillion of US bonds, the most in three years (JPY357 bln in January). Overall, Japanese investors bought JPY5.07 trillion of foreign bonds in February, the most since July 2016.

Many small banks in China cut deposit rates over the weekend. Some rural lenders cut rates by as much as 45 bp on time deposits. The rates of one-year deposits fell to 1.9% from 2.25%. This is seen as an effort to bolster profits at small banks. The one-year benchmark deposit rate for household savings is 1.5% and the small banks pay more than the large banks. Note that China reports March CPI and PPI figures tomorrow. Bloomberg's latest survey results found a median expectation for CPI to rise 1% from a year ago, which is unchanged from February. Producer prices are expected to have fallen by 2.5% year-over-year, accelerating the deflation from February's -1.4% pace.

The dollar reached JPY132.80, a four-day high in Asia Pacific trading before falling back to JPY132. The 20-day moving average is near JPY132.15, and the greenback has not closed above it since March 9. The pre-weekend low was near JPY131.50 and a push below it would weaken the technical tone. The Australian dollar is trading within its pre-weekend range (~$0.6640-$0.6690) and is little changed at it hovers around $0.6670. A close above $0.6700 would improve the technical picture, but the daily momentum indicators have turned lower. The Chinese yuan continues to move in exceptionally narrow trading ranges. Today, the dollar has traded roughly between CNY6.8720 and CNY6.8820. Last week's range was about CNY6.8660 to CNY6.8945. The PBOC set the dollar's reference rate at CNY6.8764 compared with the median in Bloomberg's survey of CNY6.8786.

Europe

EC President Von der Leyen and French President Macron were in China together, and the messages have been characterized in different ways. Some cast as is Von der Leyen taking are harder line, while Macron was more congenial. Some the EC President as sticking close to the US, while the French President tried to navigate space between China and the US. Von der Leyen seemed to focus on trade, and the imbalance favoring China. She argued the tripling of the EU's deficit with China over the past decade is not sustainable (~400 bln euros in 2022). EU needs to be less dependent on China. Last year, China was the EU's third largest destination of exports and was the number one source of its imports. If that was the stick, the carrot that Macron seemed to offer was a vision of the EU as a superpower in its own right. In interviews over the weekend, Macron spoke of "strategic autonomy," which signal that on specific issues the China may be able split Europe from the US. Macron, who had previously tried to convince Putin from invading Ukraine, thinks that Beijing could exert more influence on Moscow. We had thought Russia's invasion of Ukraine forced tighter US-EU ties, especially in terms of energy and defense. "Strategic autonomy" is an aspirational goal but the generally shared values and the absence of an EU military force and other institutional issues, arguably, make it less relevant to address immediate challenges.

In holiday-thinned activity, the euro has been confined to about a quarter-of-a-cent range above $1.0890, inside the pre-weekend range (~$1.0875-$1.0925). A two-month high was set last week near $1.0975. It has been in a steep uptrend since the low on March 15 around $1.0515. The almost vertical trendline is found by $1.0880 today. The daily momentum indicators are turning down. Sterling is also trading within the narrow pre-weekend range (~$1.2390-$1.2455). For the past month, and with only a couple of exceptions, it has mostly closed above its five-day moving average. It did not do so before the weekend and is holding below the five-day moving average (~$1.2450) today. Here, too, the momentum indicators are turning lower.

America

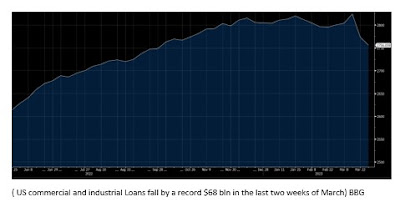

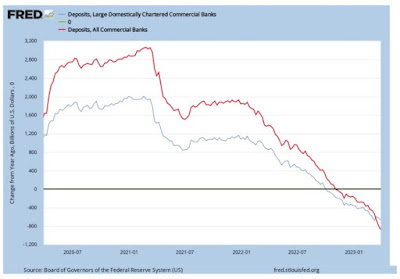

US labor market is still stronger than the Fed thinks is consistent with price stability, and consumer price increases are still higher than desired. There has been little meaningful change in the past month. What has changed is the bank stress. It is recognized as deflationary but how much so is a function of the magnitude and duration of the pull back in lending. Before the weekend, the US reported that commercial bank lending fell by $105 bln in the last two weeks of March. The drop in commercial and industrial loans accounted for two-thirds (~$69 bln) and the reduction of assets, primarily MBS, accounted for the remainder. These are record amounts. Still, at the end of the most recent three business cycles, commercial and industrial loans fall by 20-25%. They have fallen by 2.5% in the two weeks through March 29. Also, last week, the American Bankers Association index of credit conditions fell to their lowest level since the pandemic struck, as bank economists expected tighter conditions for much of the remainder of the year. At the same time, deposits at commercial banks fell by nearly $65 bln, which brings the 10-week uninterrupted run to almost $176 bln. That translates to about a 4.5% drawdown from the April 2022 peak. The 25 largest domestic banks reduced lending by $23.5 bln in the past couple of weeks, while smaller commercial banks cut lending by slightly more than $73.5 bln. Deposits left foreign banks, which also reduced their lending (~$7.5 bln).

The IMF releases the data on central bank reserve holdings at the end of each quarter with a quarter lag. We did not comment on the March release because it did not appear to be surprises. However, some are misconstruing what they see. The IMF reports the dollar value of the reserves. Most observers have long recognized the importance of adjusting those figures for shifting fx valuation. In fairness, though more complicated to do, a valuation adjustment is need for the instruments that the reserves are kept in, namely bonds. The dollar value of euro reserves, for example, rose by $152.40 bln. Sound impressive, but the euro appreciated by 9.2% in Q4 22. At the end of Q3, the dollar value of euro reserves was nearly $2.118 trillion. The Q4 22 appreciation "should have" lifted the value of euro reserves to $2.313 and instead, the IMF reported euro reserves at $2.27 trillion. This hold for the yen as well. The yen appreciated by 10.4% against the greenback in Q4 22. All else being equal, one would expect a commensurate rise in dollar value of yen reserves. But the IMF's figures showed a 7.8% increase. Sterling reserves look to have been a bit of an exception. Sterling appreciated by almost 8.2% in Q4 22 and sterling reserves rose by about 10.2%. In Q4, UK Gilts recovered smartly from the huge decline in Q3 22. Recall that the yield on the 10-year Gilt rose to 4.09% at the end of September 2022 from 2.23% at the end of June 2022. In Q4 the yield fell by 42 bp. This means that although sterling reserves rose by about $10 bln more than the fx valuation adjustment implied, the rise in Gilts offers an explanation. Bottom line: The changes in Q4 currency reserves does not suggest anything nefarious or unusual action took place. Nor is there much evidence for an exodus away from the US dollar as a reserve asset in the Q4 COFER data.

The North American session is likely to be subdued. The economic calendar is light and the week's key events lie ahead. The Bank of Canada and the US March CPI is due Wednesday. For the most part, the greenback continues to traded within last Monday's trading range (~CAD1.3410-CAD1.3535). It reached CAD1.3530 before the weekend and has stayed below CAD1.3525 today. The pre-weekend low was near CAD1.3480, and it has narrowly stayed above it so far today. It may fray a little but look for the greenback to hold above CAD1.3450. The momentum indicators are turning higher. Last week, the US dollar jumped from below MXN18.00 to MXN18.40 in the middle of the week. It quickly unwound most of the gains and approached MXN18.10 before the weekend. The retracement is a bit deeper than expected as the carry continues to appeal.

Tags: #USD,China,COFER,Currency Movement,EU,Featured,Japan,newsletter