Overview: The holiday continues. In the Asia Pacific region, Hong Kong, Australia, and New Zealand, and the Philippines markets were closed. The regional bourses advanced but China. European markets remain closed. US equity futures are narrowly mixed. The 10-year US Treasury yield is off nearly three basis points to about 3.36%. The dollar is trading quietly mostly within ranges seen before the weekend. It is slightly softer against most of the G10 currencies, but...

Read More »FX Daily, January 02: Equities Start New Year with a Pop

Swiss Franc The Euro has fallen by 0.03% to 1.0845 EUR/CHF and USD/CHF, January 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities have begun New Year like, well, last year, with most Asia Pacific markets advancing, led by more than 1% gains in China, Hong Kong, and Thailand. Only South Korea and Indonesian markets fell. In Europe, the Dow Jones Stoxx 600 is up almost 1% in late morning turnover. US...

Read More »A Word on Q3 COFER-It Might not be What You Think

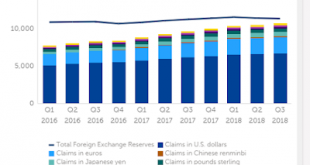

The IMF offers the most authoritative report on central bank reserves on a quarterly basis with a quarter lag. The report, the Currency Composition of Official Foreign Exchange Reserves (COFER), covering Q318 has been released. It may be have been overlooked during the holidays, but if and when the pundits see it, the leading takeaway is that the dollar’s share of global reserves fell below 62% for the first time five...

Read More »A Word About the Q2 COFER Report

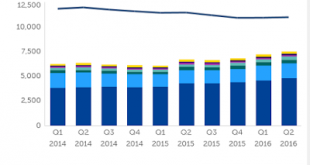

The IMF reports the most authoritative currency allocation of global reserves at the end of every quarter with a quarter delay. Invariably, an economist, strategist, or journalist is inspired to write why some data nugget confirms the demise of the dollar as the dominant currency. Given the unorthodox US President, his criticism of Fed policy, and desire for a weaker dollar, the protectionism, and trillion-dollar...

Read More »Inclusion in SDR Does Not Spur Official Demand for the Yuan

Summary: China’s share of global reserves is in line with expectations prior to its inclusion in the SDR. Three factors influencing allocated reserves – valuation, portfolio decisions, and China’s gradual inclusion in allocated reserves. The Swiss franc’s as a reserve asset diminished, but the “other” category appeared robust. The inclusion of the Chinese yuan in the SDR basket at the start of Q4 16 did not...

Read More »IMF’s Reserve Data: Dollar Share Little Changed, Yen Share Jumps, Helped By Valuation

Summary: The increase in the yen’s share of reserves was flattered by the yen’s 9% appreciation. The dollar and euro’s share of reserves were stable. Chinese integration has seen the share of unallocated reserves fall. Starting with Q3 data, (available end of March 2017) will break out the yuan’s share of reserves. The IMF provides the most authoritative data on central bank reserves. The composition is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org