Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now. There was a shift in consumption preference during COVID for goods over services with the goods consumption rising well above the pre-COVID trend: . Now, some of that, as we know, is due to inflation so if we correct for that we still get a picture of goods consumption above the previous trend but working its way back down: . Consumption of services, at first glance, looks as if it is back on trend: . But again, if we correct for inflation we see a truer picture of services consumption still below the pre-COVID

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Research, economic growth, economy, Featured, Federal Reserve/Monetary Policy, GDP, inflation, ism manufacturing index, Markets, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now.

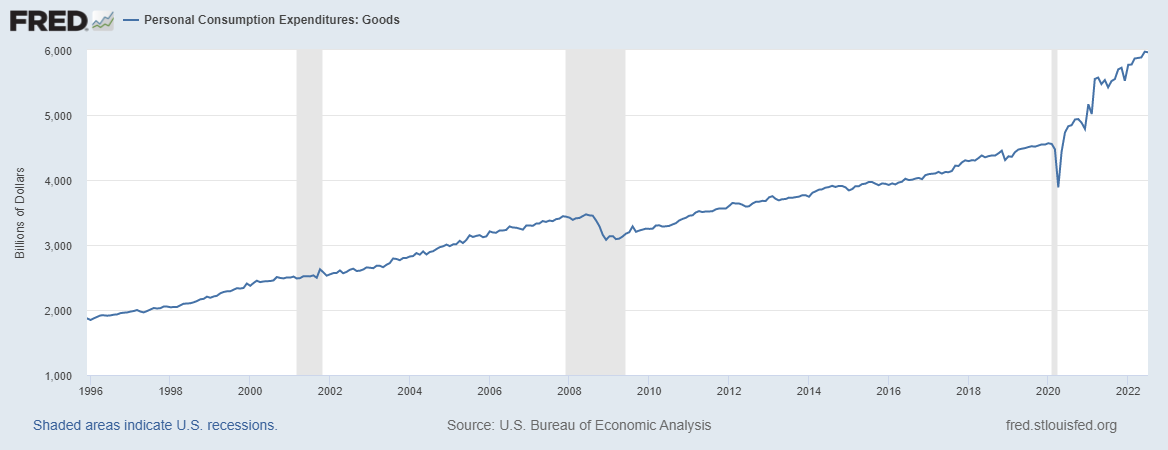

There was a shift in consumption preference during COVID for goods over services with the goods consumption rising well above the pre-COVID trend: |

|

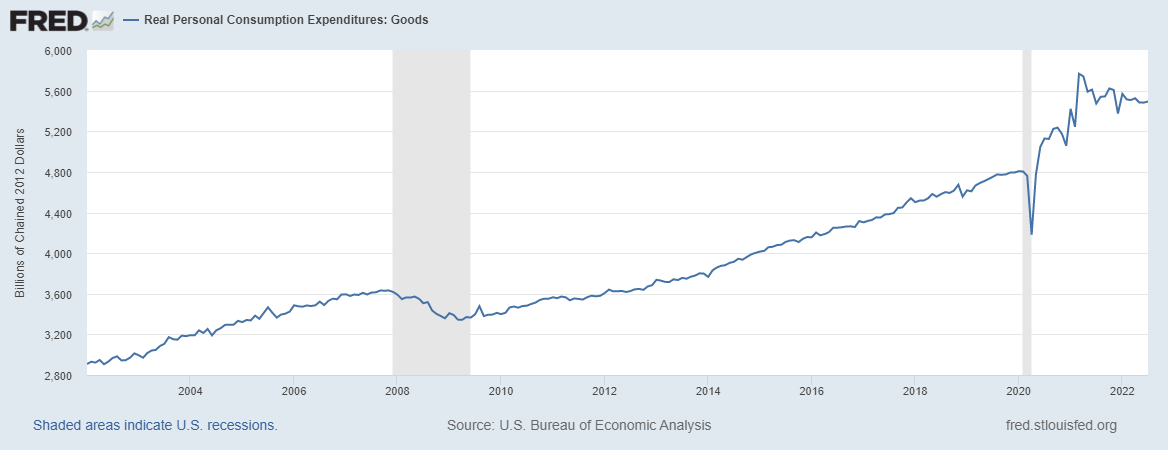

| Now, some of that, as we know, is due to inflation so if we correct for that we still get a picture of goods consumption above the previous trend but working its way back down: | |

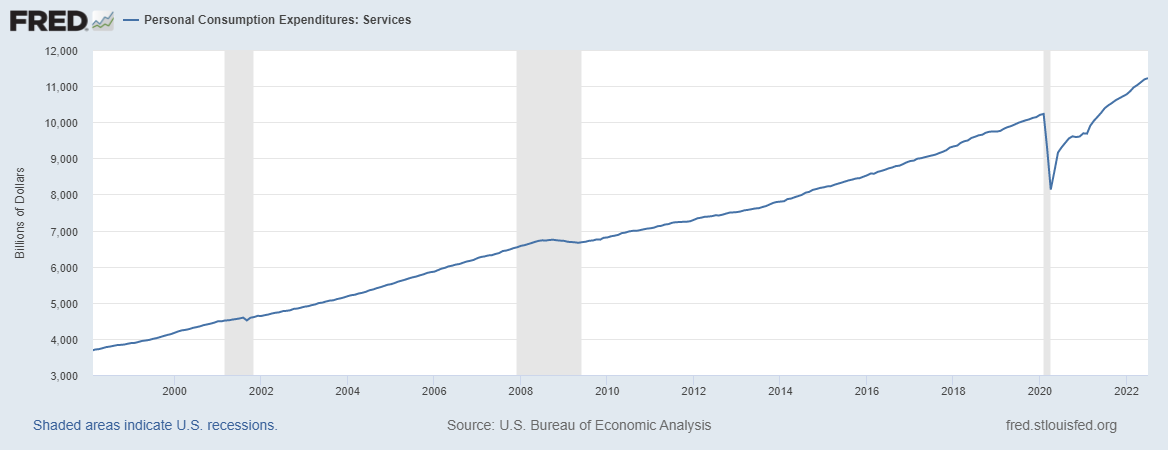

| Consumption of services, at first glance, looks as if it is back on trend: | |

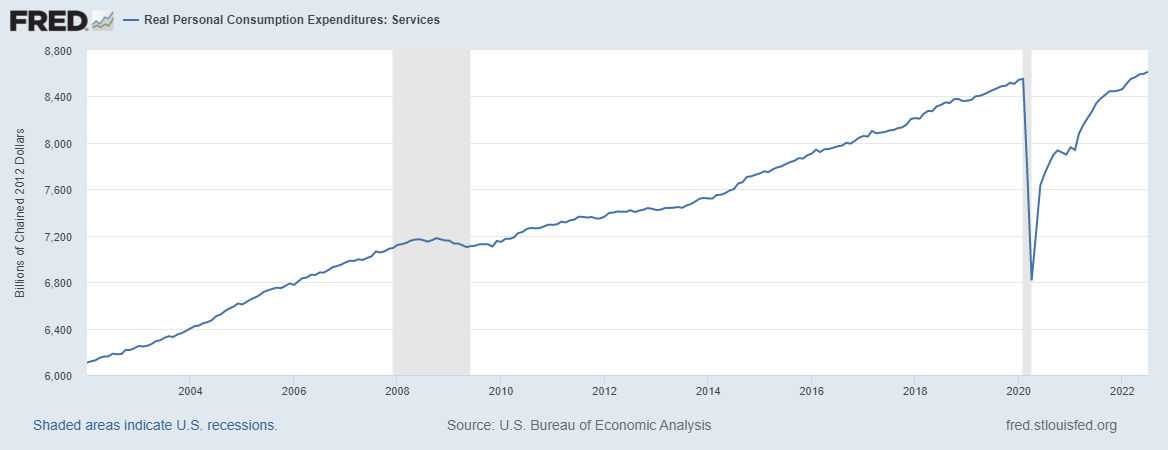

| But again, if we correct for inflation we see a truer picture of services consumption still below the pre-COVID trend but rising: | |

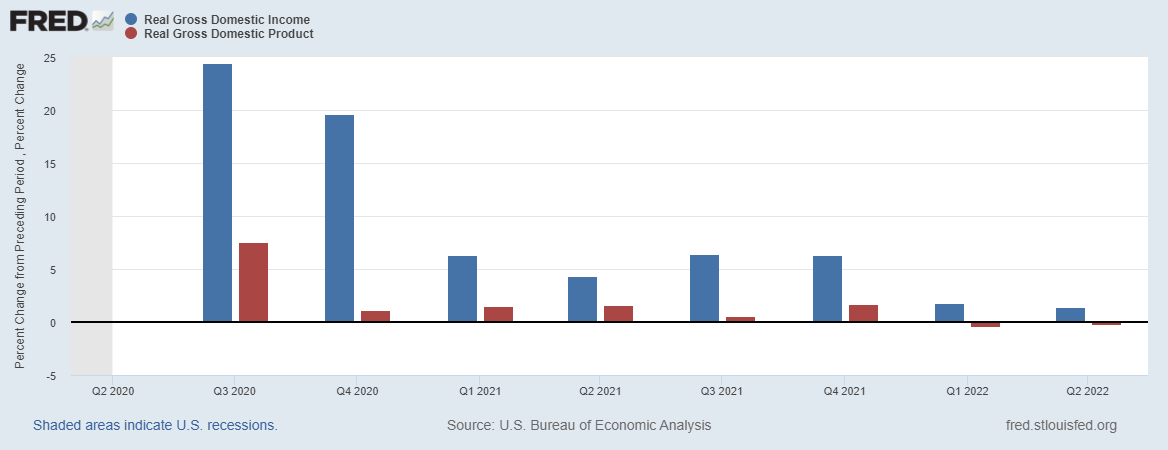

| We could break this down into smaller pieces – durable and non-durable goods for instance – and get a more detailed view of the economy but this is the big picture. The slowdown we’ve seen lately is really a flatlining as goods consumption corrects down to trend and services corrects up to trend. I know there are a lot of people out there who want – for some reason – for you to believe we are in recession. But 2 quarters of negative GDP growth don’t carry as much weight when it coincides with 2 quarters of positive growth in GDI (Gross Domestic Income) which both measure the same thing in different ways:

So, it seems to me that the economy is doing exactly what we expected and exactly what we need it to do. If the majority of the inflation we’ve seen came from a temporary supply/demand imbalance in the goods economy, this cooling of the goods sector should also cool inflation. And I think we see that in a number of things from shipping costs falling back rapidly to commodity prices coming down. |

|

| I understand if you look at that GDP/GDI chart above and you’re negative, you can just draw a trend line and extend into as deep a recession as your bearish heart desires. And if you’re positive, you can stop that downtrend right here and draw a new line that goes back up. But drawing lines on charts doesn’t mean a damn thing, won’t affect the future one bit.

What you need to do instead of trying to guess the future is take new data as it comes in and adjust your view as necessary. Which brings me to the reason for today’s post and the source of the title. ISM released its Manufacturing PMI for August today and the report was just about as perfect as you could ask for. The overall index was unchanged at 52.8, solidly in expansion. New orders, which contracted last month, rose to expansion but not excessively at 51.3. Production was 50.4, down 3.1 from last month while inventories (which have been a concern) fell 4.2 to 53.1. Customer inventories (38.9) continued to contract. Most importantly, the prices component fell 7.5 to 52.5. The only real negative in the report was a contraction in export orders which isn’t surprising in the least considering what’s going on in the world. To sum up, steady overall growth, new orders expanding at a slow pace, employment positive (and comments that indicate a falling quit rate), inventories down, backlog up and prices down. I’m not sure if the Fed could have ordered a better report. Their goal is to get inflation down without killing the economy and that’s exactly what this report shows. I have said in the past that I don’t put a lot of stock in these PMI reports because they are just glorified sentiment surveys, but I don’t ignore them either. They can offer information about the economy and, of course, the market pays attention to them so I must. Which is why I’m somewhat baffled by the market reaction to the report. Stocks and bonds both sold off immediately, as if any good news on the economy must mean bad things from the Fed. Maybe I’m wrong and Jerome Powell is just going to keep hiking rates until he “breaks something” as I keep seeing so many other people saying. But what I heard in his speech last week was that the incoming data would have an impact on what they do. And this report is, without a doubt, good news for the economy and for the Fed. One last note on sentiment and pundit reactions to incoming data. The last two quarters, the bears highlighted every little downtick in the Atlanta Fed’s GDPNow tracker. If you’re wondering why you haven’t heard anything about it this quarter, here’s your answer: |

We don’t do perma-anything here.

Tags: Alhambra Research,economic growth,economy,Featured,Federal Reserve/Monetary Policy,GDP,inflation,ism manufacturing index,Markets,newsletter