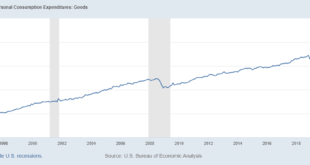

Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now. There was a shift in consumption preference during COVID for goods over services with the goods consumption rising well above the pre-COVID trend: . Now, some of that, as we know, is due to inflation so if we correct for...

Read More »ISM’s Nasty Little Surprise Isn’t Actually A Surprise

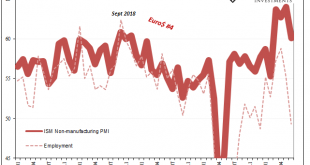

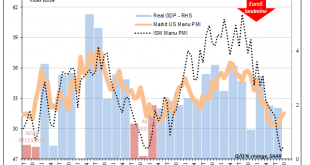

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention. Consistent with IHS Markit’s estimates as well as the ISM’s Manufacturing PMI released last week, there are growing (confirmed) concerns that...

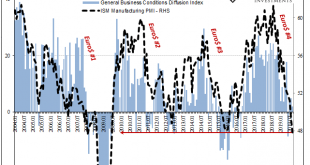

Read More »There’s Two Sides To Synchronize

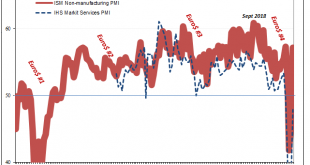

The offside of “synchronized” is pretty obvious when you consider all possibilities. In economic terms, synchronized growth would mean if the bulk of the economy starts moving forward, we’d expect the rest to follow with only a slight lag. That’s the upside of harmonized systems, the period everyone hopes and cheers for. What happens, however, when it’s the leaders rather than laggards who begin to shift toward the other way? It’s a question the global economy has...

Read More »Gratuitously Impatient (For a) Rebound

Jay Powell’s 2018 case for his economic “boom”, the one which was presumably behind his hawkish aggression, rested largely upon the unemployment rate alone. A curiously thin roster for a period of purported economic acceleration, one of the few sets joining that particular headline statistic in its optimism resides in the lower tiers of all statistics. The sentiment contained within the ISM’s PMI’s were at least in the same area as the unemployment rate, and...

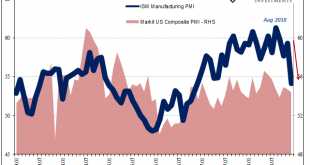

Read More »Take Your Pick of PMI’s Today, But It’s Not Really An Either/Or

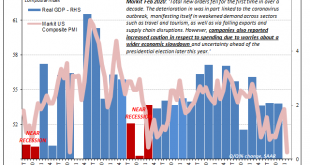

Take your pick, apparently. On the one hand, IHS Markit confirmed its flash estimate for the US economy during February. Late last month the group had reported a sobering guess for current conditions. According to its surveys of both manufacturers and service sector companies, the system stumbled badly last month, the composite PMI tumbling to 49.6 from 53.3 in January. Today’s update to that flash estimate with more survey responses in hand validated the 49.6....

Read More »All Signs Of More Slack

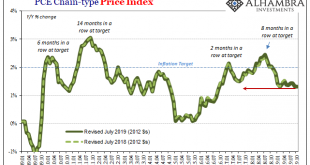

The evidence continues to pile up for increasing slack in the US economy. While that doesn’t necessarily mean there is a recession looming, it sure doesn’t help in that regard. Besides, more slack after ten years of it is the real story. The Federal Reserve’s favorite inflation measure in October 2019 stood at 1.31%, matching February for the lowest in several years. Despite constantly referencing a tight labor market and its fabulous unemployment rate, broad...

Read More »Still Stuck In Between

Note: originally published Friday, Nov 1 There wasn’t much by way of the ISM’s Manufacturing PMI to allay fears of recession. Much like the payroll numbers, an uncolored analysis of them, anyway, there was far more bad than good. For the month of October 2019, the index rose slightly from September’s decade low. At 48.3, it was up just half a point last month from the month prior. Most of that was related to a curious surge in New Export Orders. Having dropped to...

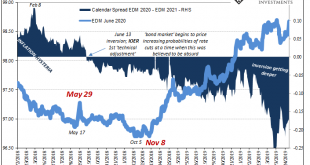

Read More »ISM Spoils The Bond Rout!!! Again

For the second time this week, the ISM managed to burst the bond bear bubble about there being a bond bubble. Who in their right mind would buy especially UST’s at such low yields when the fiscal situation is already a nightmare and becoming more so? Some will even reference falling bid-to-cover ratios which supposedly suggests an increasing dearth of buyers. Bid-to-cover, however, is irrelevant. That only tells you about one part of the buying equation, the number...

Read More »ISM Spoils The Bond Rout!!!

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out. Japan’s central bank says that it might refrain from buying JGB’s at the long end. This is upside down from when YCC was first attached to QQE...

Read More »If You’ve Lost The ISM…

These transition periods are often just this sort of whirlwind. One day the economy looks awful, the next impervious to any downside. Today, it has been the latter with the BLS providing the warm comfort of headline payrolls. For now, it won’t matter how hollow. Yesterday, completely different story. Apple got it started downhill and the ISM pushed it off the cliff. The tech giant’s CEO admitted the global economy is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org