Overview: Central banks are committed to combatting inflation even as the economies weaken. This is taking a toll on investor sentiment and is dragging down equities. Outside of China, where the PMI confirms a recovery, and India, where most large bourses in the region were off 1-2%. Europe’s Stoxx 600 snapped a three-day rally yesterday with a 0.65% decline. Near midday, its loss today is approaching 2%. US futures are 1.5%-2.0% lower. Bond yields are falling. The US 10-year is around 3.05%, off 20 bp between yesterday and today. European bond benchmark yields are 4-9 bp lower. The US dollar is mixed, with the yen, Antipodeans, and sterling edging higher, while the Swiss franc, and Scandi are off 0.2%-0.3%, even the Swedish krona, where the central bank

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Canada, China, Currency Movement, Featured, Federal Reserve, inflation, Japan, newsletter, Riksbank, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview: Central banks are committed to combatting inflation even as the economies weaken. This is taking a toll on investor sentiment and is dragging down equities. Outside of China, where the PMI confirms a recovery, and India, where most large bourses in the region were off 1-2%. Europe’s Stoxx 600 snapped a three-day rally yesterday with a 0.65% decline. Near midday, its loss today is approaching 2%. US futures are 1.5%-2.0% lower. Bond yields are falling. The US 10-year is around 3.05%, off 20 bp between yesterday and today. European bond benchmark yields are 4-9 bp lower. The US dollar is mixed, with the yen, Antipodeans, and sterling edging higher, while the Swiss franc, and Scandi are off 0.2%-0.3%, even the Swedish krona, where the central bank delivered a 50 bp hike. A few Asian currencies, including the Chinese yuan, are showing some resilience among emerging market currencies. The Russian rouble is off nearly 4% and the Hungarian forint and Polish zloty are off 0.5%-1.0% to lead the emerging market complex lower. Gold is bleeding lower and near $1812 is at its lowest level since mid-month. August WTI reversed lower yesterday and is slightly lower today ahead of the OPEC+ decision to ostensibly allow more output but capacity constraints limit the actual output. US natgas is steady while the European benchmark is rising for the third consecutive session. It is up nearly 5% after yesterday’s 6.4% gain. A surplus of Chinese steel is said to be weighing on iron ore prices. It is off 3.25% today after falling 1.25% yesterday. September copper is ending a three-day rally (~1%) and is giving it all back today with a 1.35% pullback. September wheat is soft after slipping 0.65% yesterday.

Asia Pacific

China's economy is on the mend. The June manufacturing PMI rose to 50.2, the first time it is above the 50 boom/bust level since February. The non-manufacturing PMI surged to 54.7, the highest level since May last year. It had bottomed in April at 41.9. The combination lifted the composite PMI to 54.1 from 48.4. It is also the best in a year. The news helped lift Chinese stocks and the yuan. A stark contrast is suggested between the rising recession fears in the US and Europe and bounce back in China after a tough couple of quarters as the zero-Covid policy took a toll.

That toll extended beyond China. Japan reported a stunning 7.2% drop in industrial output in May. The median forecast in Bloomberg's survey called for a 0.3% decline after a 1.5% fall in April. Accounts are linking the unexpected steep contraction to China's lockdowns. The sharpest declines were in the production of electric machinery (-11%) and autos (-8%). Securing products and parts proved difficult but Japanese producers expected output to recover 12% this month and 2.5% in July. Separately, Japan reported that housing starts in May fell 4.3% year-over-year. Economists expected a 1.6% increase. Forecasts for Q2 GDP will have to be scaled back from the near 4% (median in Bloomberg's survey) after a 0.5% quarter-over-quarter contraction in Q1. Lastly, we note that the BOJ left its government bond buying at the same pace and amounts in Q3 as in Q2.

The dollar reached a new 22-year high against the yen to JPY137.00 yesterday and is consolidating in a yen range below it today. The US 10-year yield is at the lows for the week near 3.05%, having peaked Tuesday a little above 3.25%. The intraday momentum indicators suggest that North American operators may try taking the dollar higher again. The JPY136.50-JPY136.60 may offer initial resistance. The Australian dollar tested the month's low near $0.6850. It held and the Aussie recovered to $0.6900. Sustaining gains above $0.6920 would help stabilize the tone. The Chinese yuan has been confined to yesterday's range, which itself was within Tuesday's range. The dollar is recording lower highs and higher lows. It peaked on Tuesday near CNY6.7125 and the week's low has been about CNY6.6750. The greenback settled last week slightly below CNY6.69. The dollar's fix was at CNY6.7114, a little firmer again than expected (CNY6.7104 median projection in Bloomberg's survey).

Europe

News that Spain's CPI accelerated to 10% grabbed attention early yesterday, but the unexpected decline in German CPI was more on point. It fell to 8.2% from 8.7%. Knowing Spain's numbers alone would make the dramatic European bond rally inexplicable. The 10-year Bund yield fell almost 11 bp. The Spanish 10-year yield tumbled 13 bp. As is often the case, the peripheral premium narrowed as interest rates fell. France reported its preliminary CPI earlier today. It was in line with expectations. The harmonized measure rose 0.8% on the month for a 6.5% year-over-year rate. France's CPI had risen 5.8% year-over-year in May. European yields are lower today, led by the core not the periphery.

Germany, and others, are using fiscal policy to do what monetary policy is having a difficulty doing: easing the burden of the cost-of-living squeeze. Germany lowered fuel taxes and discounted public transportation, and next month will abolish the renewable charges on electricity. Other countries have cut taxes on gasoline and/or introduced subsidies. This also has the effect of lowering measured inflation. The purists worry that it just delays the pain. Maybe, but it is playing for time; time for the supply challenges to be addressed.

As widely anticipated, Sweden's Riksbank lifted its repo rate for the second time this year and doubled the pace to 50 bp. The repo rate now stands at 0.75%. Officials signaled that by the start of next year, it will be at 2.0%. Still, the central bank is less optimistic about the economic outlook and cut this year's growth projection to 1.8% from 2.8% two months ago. At the same time, it cautioned that inflation may remain above 7% for the remainder of the year. The Riksbank's move did not prevent the krona from weakening against the euro and extending its decline for the third consecutive session.

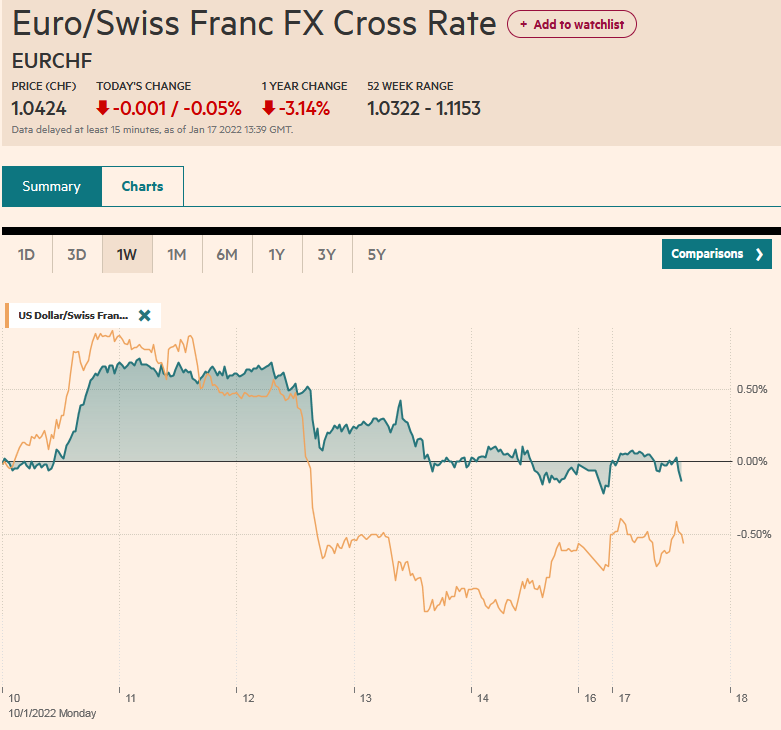

The euro itself is struggling to sustain even modest upticks against the dollar for the third session. After its attempt to sustain gains above $1.06 were rebuffed on Monday, the euro has fallen steadily to reach $1.0430 today. The month's low was set on June 15 near $1.0360. May's multiyear low was a little lower at $1.0350. Sterling is faring a bit better. Today's final look at Q1 GDP was in line with earlier estimates but the current account deficit (~GBP51.7 bln) was larger than expected (~GBP40 bln). Sterling is holding above yesterday's low (~$1.2105), albeit barely, and the North American market may give it another go. The mid-June low was more than two-cents lower near $1.1935.

America

Third revisions to US quarterly GDP are not the stuff that captures the imagination, but, yes, this time was different. The GDP estimate itself hardly changed (-1.6% vs. -1.5%) but the composition changed in an undesirable direction. What earlier estimates had as consumption turned out into inventories. Rather than accelerate after a 2.0% increase in Q3 21 and 2.5% increase in Q4 21 to 3.1%, it slowed to 1.8%. Inventories rose by $189 bln not $150 bln. The takeaway is that consumption was weaker than expected before the Fed hiked in March.

Today, the US reports May personal income and consumption figures. The risk is that Q1 PCE, which averaged a 1.3% increase a month is revised lower and that consumption in Q2 may not have improved. Recall that May retail sales (~40% of overall consumption) disappointed and the April series was revised lower. Without the fiscal support, personal income is less volatile. Through April, it has averaged a 0.4% increase a month this year. That was the average in 2017 and 2018 before slowing to a 0.2% average in 2019.

The Fed targets the PCE headline deflator, but cited the CPI to justify the 75 bp hike instead of 50 bp. Recall, Powell also cited the University of Michigan's 5–10-year consumer inflation expectation. It had appeared to jump to 3.3% from 3.0%. But, before last weekend, the final reading revised it to a less alarming 3.1% to match the high watermark set in January. Nevertheless, the point is that if the Fed is going to take its cues from the CPI, the PCE deflator loses some of its significance. For the record, the median forecast in Bloomberg's survey sees a 0.7% increase, which would lift the year-over-year rate to 6.4% from 6.3%. The core PCE deflator is expected to slow for the third consecutive month. The year-over-year rate peaked in February at 5.3% and stood at 4.9% in April.

Remember the argument that Powell endorsed too; headline inflation converges with core inflation and not the other way around. A case can therefore still be made that inflation is peaking. The idea that the labor market is strong and strong enough to withstand tightening without much disruption will increasingly be challenged. We note that the four-week moving average of weekly jobless claims has risen by 30% in the last two months. Danielle DiMartino Booth's team at Quill Intelligence found that a 50% increase in weekly jobless claims from their low has signaled a recession. Jobless claims have risen almost 40% from the March low. The early forecasts for June nonfarm payrolls are coming in around 250k, which would the least since the end of 2020. It would bring the three-month moving average to a little below 360k, the lowest since Q1 2021.

Canada's April GDP is expected to shift lower after expanding by an average of 0.8% in February and March. We also know for the first time since last June, Canada lost full-time positions (31.6k) in April. However, the data is too old to really matter, and for example, Canada reported a 135k increase in full-time jobs in May. The Bank of Canada meets on July 13. The market is more confident that the Bank of Canada hikes 75 bp than the Fed does next month. The swaps market sees the terminal rate in the US and Canada around 3.5%. The Fed funds futures strip had about 22 of an ostensible 25 bp cut discounted in Q4 23 at the close yesterday. In the Canadian Banker Acceptance futures, the implied yield of the December 2023 contract is about 20 bp below the implied yield of the December 2022 contract.

The risk-off push is taking a toll on the Canadian dollar. It is trading at four-day lows. The greenback bounced off Tuesday's two-and-a-half week low near CAD1.2820 and is above CAD1.29 now. It is holding just below the band of resistance seen in the CAD1.2920-CAD1.2940 band. Take your cue from the S&P 500. The US dollar bottomed against the Mexican peso at the end of last week and the start of this week near MXN19.82. It reached a six-day high today slightly below MXN20.24. The next target is seen closer to MXN20.3650 as the losses over the past couple of weeks are retraced.

Tags: #USD,Canada,China,Currency Movement,Featured,federal-reserve,inflation,Japan,newsletter,Riksbank