Swiss Franc The Euro has fallen by 0.05% to 1.0424 EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Russia is thought to be behind the cyber-attack on Ukraine at the end of last week, but a military attack over the weekend may be underpinning risk appetites today. The dollar’s pre-weekend gains are being pared slightly. Led by the Canadian dollar and Norwegian krone, the greenback is lower against most major currencies, with the yen being the notable exception, which is off about 0.2%. China cut its one-year medium-term lending facility rate by 10 bp to 2.85%, but the yuan edged higher. North Korea conducted another missile test, the fourth of the year. Most equity markets but

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, China, Currency Movement, Featured, Federal Reserve, Japan, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

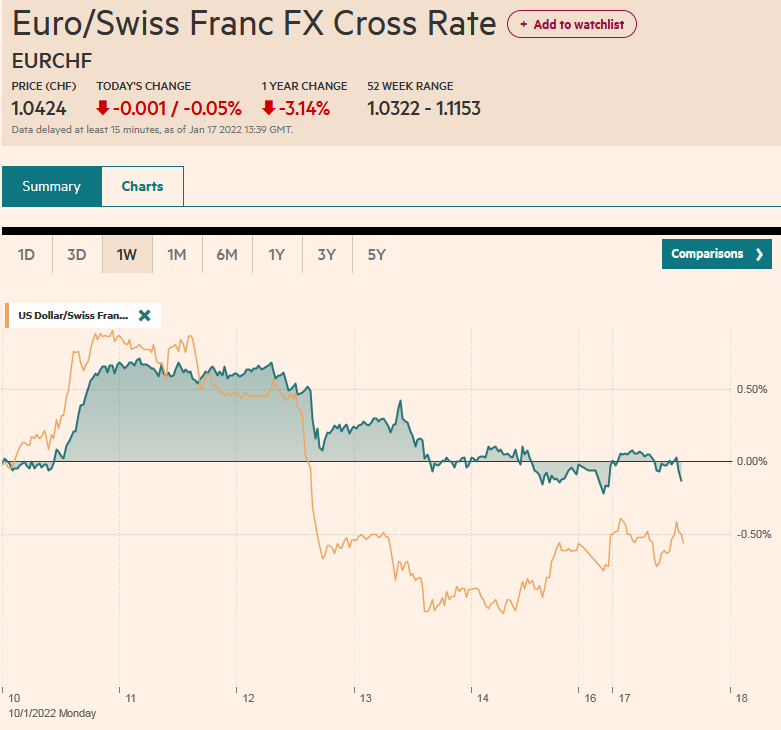

Swiss FrancThe Euro has fallen by 0.05% to 1.0424 |

EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

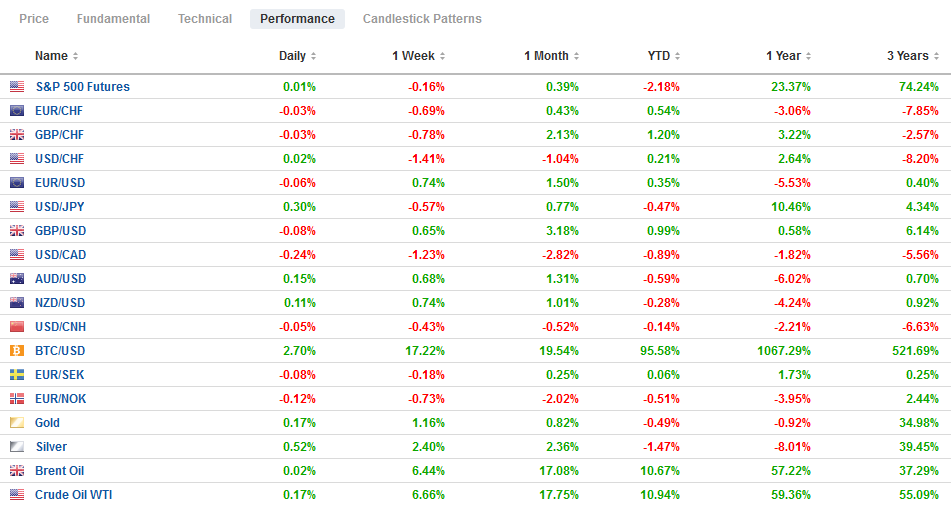

FX RatesOverview: Russia is thought to be behind the cyber-attack on Ukraine at the end of last week, but a military attack over the weekend may be underpinning risk appetites today. The dollar’s pre-weekend gains are being pared slightly. Led by the Canadian dollar and Norwegian krone, the greenback is lower against most major currencies, with the yen being the notable exception, which is off about 0.2%. China cut its one-year medium-term lending facility rate by 10 bp to 2.85%, but the yuan edged higher. North Korea conducted another missile test, the fourth of the year. Most equity markets but South Korea and Hong Kong advanced in the region. The South Korean won and the Russian rouble are leading the losers among emerging market currencies. The Thai baht and central European currencies are firmer. The JP Morgan Emerging Market Currency Index has edged lower. It has not risen since the middle of last week. Europe’s Stoxx 600 is up about 0.55% after sliding 1% before the weekend. It is snapping a three-day drop. European 10-year benchmark yields are up around 2 bp. The Antipodean yields played catch-up to the US 10-year yield as it rose eight basis points before the weekend to around 1.785%. Gold is firm, inside last Friday’s range. March WTI is hovering around $83.30 and is little changed after advancing 2% before the weekend and 6.2% last week. Natgas in the US has steadied around $4.30 after falling around 12.3% over the past two sessions. Europe’s benchmark is little changed after easing by less than 0.7% last week. The re-opening of Brazilian mines after the floods may be weighing on iron ore prices, which are off for a third session. Copper also begins the new week extending it weakness for a third session as well. |

FX Performance, January 17 |

Asia Pacific

In a mixed performance in December, the Chinese economy expanded by 1.6% quarter-over-quarter in Q4. The median forecast in the Bloomberg survey expected 1.2% growth after practically stagnating in Q3 (0.2%). Last year, the world’s second-largest economy expanded by 8.1%. The official target was “over 6%.” Property investment was weaker than expected (4.4% year-over-year), while fixed asset investment slowed a touch less than expected (4.9% from 5.2%). Industrial production picked up to 4.3% year-over-year from 3.8% in November. Retail sales disappointed. It rose 1.7% year-over-year in December, down from 3.9% in November and less than half what economists expected. The surveyed unemployment rate unexpectedly edged higher to 5.1% from 5.0%.

The PBOC allowed the one-year medium-term lending facility rate to ease by 10 bp to 2.85%. It is the first reduction since April 2020. As the Lunar New Year holiday approaches, the PBOC has become more generous with its liquidity provisions. It lowered the seven-day reverse repo rate to 2.1% from 2.2%. Chinese shares rose after the rate cut, which most economists did not give much of a chance for, and the CSI 300 rose by about 0.85% to pre-coup the pre-weekend loss. The PBOC’s efforts to put a floor under the economy may not be complete, and many expected another cut in reserve requirements. Separately, note that the Chinese demographic picture appeared to deteriorate with 10.62 mln births last year, down from 12 mln in 2020. However, deaths totaled 10.1 mln, allowing China to forestall the reduction of its population, which rose by 480k to 1.41 bln.

Japan’s core machine orders jumped 3.4% in November, nearly three times the gain economists (Bloomberg survey) expected. They are at their best level in two years. However, the tertiary industry index rose by 0.4% in November, less than half of what was expected (though the October series was revised to 1.9% from 1.5%). Still, the combination of heavy snow in the north and west and a dramatic rise in Covid cases (five-fold increases in the past week) will weigh on activity. Tokyo is planning on introducing stricter social measures if hospital occupancy reaches 20%. It was around 19.5% yesterday, according to reports. Tokyo and the surrounding three prefectures account for around a third of GDP. The BOJ meets tomorrow. It may lower its growth forecast and lift its inflation projection.

The dollar recovered from around JPY113.50 to almost JPY114.30 before the weekend (potential hammer candlestick) and advanced to JPY114.55 today. This nearly meets the (38.2%) retracement objective of the greenback’s slide since the multi-year high reached on January 4 near JPY116.35. The next retracement (50%) is slightly above JPY114.90. The Australian dollar fell 1% at the end of last week, its largest fall in about a month. It slipped briefly below $0.7200 and made a marginal new low today before bouncing to almost $0.7225. The first retracement target is near $0.7240. The greenback closed above CNY6.35 at the end of last week, thought to be the floor of the desired range by officials. However, despite today’s PBOC rate cut, the greenback remains below there, even if inside the pre-weekend range. The PBOC set the dollar’s reference rate at CNY6.3599. The market (Bloomberg survey) was for CNY6.3584.

Europe

There is a monetary and political story to tell of the UK. The implied yield of the March short-sterling interest rate futures rose 15 bp last week to 70 bp. The swap market is pricing in a nearly 90% chance of a hike at the February 3 meeting. All told, the market has four rate hikes discounted for this year. The importance of the Feb hike is that it would lift the base rate to 0.50%, which is the threshold to begin allowing the balance sheet to shrink,

The political uncertainty is entirely self-inflicted. Ironically, it is intensifying even as Omicron cases have been halved and the booster campaign is fairly successful, and social restrictions will likely be lifted at the end of the month. The Johnson government has been marred by favoritism, and what the tabloids call “sleaze”, but “partygate” seems to have been the drop of tea that overflows the cup. Reports suggest that around three dozen Tory MPs want Johnson to resign, but at least 54 are needed to trigger a leadership contest. Johnson will likely keep a low profile in the near-term. An immediate family member reportedly has tested positive for Covid. Gray is conducting an internal investigation, and some expect the results later this week. The results could prove to be more embarrassing than a legal issue. Moreover, the Prime Minister has made his share of enemies and some (e.g., Cummings) could still supply more fodder. Johnson has apologized (including to the Queen), but he did not appear contrite and seemed to be blaming his staff. The Tories are lagging Labour by as much as 10 percentage points according to some polls. Even if Johnson survives the current controversy, the voters can still punish the Conservatives in the local elections on May 5.

Reports suggest that the new German government will implement the planned global minimum 15% corporate tax for multinationals next year. A law will be drafted ahead of the European Union’s directive. The tax deal was agreed to by 140 countries last year. Although the OECD and G20 had been debating about such measures for a few years, the change in the US pushed it over the finish line. However, and few seem to appreciate it, but our best guess is that the US does not pass the necessary legislation, which was embedded in the Build Back Better initiative. Moreover, there seemed to be a push back against it by several in Senators.

By rising above Thursday highs (marginally) to new highs for the move, and then selling off to close below its low (~$1.1435), the euro recorded a key reversal ahead of the weekend. However, follow-through selling has not really materialized. The $1.1400-level held, and the euro recovered back to almost $1.1435. A break of the $1.1385-$1.1400 area is needed to confirm a near-term top is in place. After snapping a three-day advance before the weekend, sterling also has not experienced follow-through selling today. It is trading quietly in less than a third of a cent range below $1.3690. Initial resistance is seen in the $1.3700-$1.3715 area.

America

US markets are closed for Martin Luther King’s birthday. It gives observers and investors more time to digest the horrible retail sales report and the unexpected decline in industrial output last month. Many were quick to dismiss last year’s largest monthly decline in retail sales (-1.9%) to the virus. While there may be something to it, non-store sales (dominated by Amazon) fell by 8.7%, while department stores saw a more modest 7% decline. Still, due to other disruptions and delays, the holiday shopping may have been front-loaded. However, November retail sales were revised down (0.2% from 0.3%). Moreover, the “control” component (excluding auto, gasoline, building materials and food service sales) was revised down in November to -0.5% from -0.1%. Industrial output fell by 0.1% in December (-0.3% manufacturing). The strong imports and weaker domestic activity saw business inventories soar 1.3% for the second consecutive month in October. The rebuilding of inventories is well underway and may not be a strong tailwind after Q1 22.

Spurred by the Federal Reserve Waller’s comments, more observers are talking about the possibility of a 50 bp hike in March. We do not expect a consensus to crystallize around it. Rather than signal its anti-inflation credentials, it would likely be seen as a worrisome development. While the Fed may be reluctant to signal a gradual tightening cycle, it also can play its balance sheet card. In 2018, when the Fed last began unwinding its balance sheet we played down the tightening impulse because we emphasized the signaling aspect of QE/QT. However, this time, purpose of the coming QT (midyear?) is to remove accommodation.

Canada reports November securities transactions and manufacturing sales. December existing home sales are also on tap. The Bank of Canada also releases its quarterly survey ahead of next week’s (January 26 meeting). The swaps market is pricing in a 40-50% chance of a hike. After recovering smartly from CAD1.2455 on January 13, the greenback reached CAD1.2570 ahead of the weekend. No follow-through US dollar buying emerged, and it returned to CAD1.2500. We suspect CAD1.26 will be seen before CAD1.2400. That said, the head and shoulders pattern we are tracking points to the CAD1.2250 area. The US dollar continues to grind lower against the Mexican peso. A lower low has been recorded for the seventh consecutive session today near MXN20.28. The 200-day moving average is close to MXN20.2785. A convincing break could target the early November low near MXN20.25 and then the late October low closer to MXN20.12.

Tags: #USD,Bank of Canada,China,Currency Movement,Featured,federal-reserve,Japan,newsletter,U.K.