Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia, and India managed to post modest gains today. Europe’s Stoxx 600 is off more than 2.5% to bring this week’s loss to a little more than 6%. It has risen only one week so far this year. US futures are around 0.7% weaker. The 10-year US Treasury yield is near 1.78%, a five-basis point decline on the week. The 2-10-year

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, CHF, China, Currency Movement, ECB, Featured, Federal Reserve, Germany, Iran, jobs, newsletter, SWIFT, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview: The capital and commodity markets are

becoming less orderly. The scramble for dollars is pressuring the cross-currency

basis swaps. Volatility is racing higher in bond and stock markets.

The industrial metals and other supplies, and foodstuffs that Russia and

Ukraine are important providers have skyrocketed. Large Asia Pacific

equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%,

while South Korea, Australia, and India managed to post modest gains

today. Europe’s Stoxx 600 is off more than 2.5% to bring this week’s loss

to a little more than 6%. It has risen only one week so far this year. US futures are

around 0.7% weaker. The 10-year US Treasury yield is near 1.78%, a five-basis

point decline on the week. The 2-10-year yield curve continues to flatten

and is slipping below 30 bp today. European benchmark yields are 2-4 bp

lower today and 14-16 bp lower on the week. The Australian and New

Zealand dollars are outperforming in the foreign exchange market. Both

are up around 0.5% today and nearly 2% and 1.4% for the week,

respectively. The euro and Swedish krona are off around 0.6% to bring the

weekly drop to 2.2% and 4%, respectively, and bring up the rear. Central

European currencies continue to fare the worst among emerging market currencies. Other

freely accessible emerging market currencies are falling in sympathy.

Latam currencies are performing best this week, with the Colombian peso (~4%)

and the Brazilian real (~2.5%) coming into today. Gold is firm, pushing

against $1950, the high for the week. It has spiked to $1975 last

week. April WTI is recovering from yesterday’s 2.6% decline. It is

up more than 18% this week. US natural gas is rising around 1.5% today to

bring the week’s gain to 7%. Europe’s benchmark is extending its advance and is up

about 85% this week, after a 27% gain last week. May wheat is limitedly up

and extends this week’s gain to over 40%. Although iron ore dipped (still

up nearly 15% for the week) and copper is a little softer too (up ~6.7% this

week), aluminum is at record highs and other industrial metals are

firm.

Asia Pacific

A powerful argument is

sweeping across the financial markets and political discourse. In its essence it says that as a

consequence of the sanctions on Russia’s central bank and banning most major

Russian banks from SWIFT will encourage other countries, and especially China

to find alternatives to the dollar. Fed Chair Powell acknowledged that it

could accelerate China’s efforts. However, unlike other observers, Powell

acknowledged that China has been trying to do so “for some

time.” They have their own messaging system, but few use it.

The same is true of the European payment system for that matter. Of

course, China chafes in a world that is still very American and dollar centric.

Yes, it would like an alternative, but no they haven’t found one. And that

“some time” that Powell referred to is more than a decade. The large

multi-year energy agreement struck between China and Russia will be settled in

euros, not dollars. Yet, the EU and UK (and others) have also sanctioned

Russian banks, banned trading with the Russian central bank, and the eviction

from SWIFT. In this regard, the alternative to the dollar cannot be the

euro.

The Asian Infrastructure

Investment Bank, a Chinese initiative for which it is a 27% shareholder, has

frozen Russian and Belarus activities. Russia is the third-largest shareholder (6%) after China

and India. Russia has one of the five vice presidents and oversees bank

lending. When the AIIB was launched, the US did not want its allies

joining, but many in Europe did and NATO countries account for almost a quarter

the votes. The World Bank has also halted programs for Russia and

Belarus.

There were two

high-frequency data points to note. First, Japan’s January unemployment rate unexpectedly

ticked to 2.8% from 2.7%. As the PMI (composite below 50 for the second

consecutive month) and other data have shown, the world’s third-largest economy

is struggling here in Q1. The job-to-applicant ratio jumped to 1.20 from

1.16. It is the highest since May 2020, giving hope that of a recovery in

Q2. Second, while inflation is not a problem in China or Japan, price

pressures are accelerating in South Korea. February CPI rose by 0.6% to

lift the year-over-year rate to 3.7%. The median forecast in Bloomberg’s

survey was for a 3.5% pace. The core stands at 3.2%, up from 3% and also stronger

than expected. The central bank does not meet until the middle of

April and the market appears to have largely priced in another 25 bp

hike. It lifted rates twice last year and one this year.

The dollar is little changed

against the Japanese yen around JPY115.40. It has been confined to about a

third of a yen range above JPY115.25. The greenback settled last week near

JPY115.55. Since it broke out and even since the US warned an attack could

happen at any moment on February 11, the yen has been largely

sidelined. The Australian dollar, in contrast, has been a chief

beneficiary. Today it reached $0.7375, its highest level in four months.

It closed above its 200-day moving average (~$0.7325) for the first-time since

last June. A trendline drawn off last year’s highs comes in near $0.7425

at the end of next week. It is above the upper Bollinger Band (~$0.7335)

and closed above it for the past two sessions. When the markets

turn more volatile, the relative stability of the Chinese yuan is frequently

underscored. Narrower than usual dollar ranges dominated

yesterday and today (roughly CNY6.3160-CNY6.3210). The greenback has

slipped a touch this week (~0.02%) for the fourth weekly decline and sixth time

in this year’s eight weeks. The PBOC set the dollar’s reference rate at

CNY6.3288, well above market expectations (Bloomberg survey) for

CNY6.3238.

Europe

Weaker exports and imports

saw Germany’s January trade surplus narrow to 3.5 bln euros from a revised 6.6

bln surplus in December. Exports fell 2.8%. The market looked for a 1% gain.

Imports were off 4.2%. The market had anticipated a 2% gain.

Germany’s 2021 trade surplus average 14.4 bln euros a month. It was

slightly lower than the 15.0 bln monthly average in 2020. However, before

the pandemic, Germany was reporting an average monthly surplus of around 19

bln euros.

While most of the eurozone

aggregate data is reported after a few national reports, not so with today’s

January retail sales.

German, Italian, and Spanish reports have not been released. Still, the

aggregate figure was much weaker than expected. The 0.2% increase

contrasts with the 1.5% median forecast (Bloomberg survey). It would seem

to reinforce ideas of a cautious ECB next week despite the surge in inflation

reported earlier this week (5.8% vs 5.1% in January).

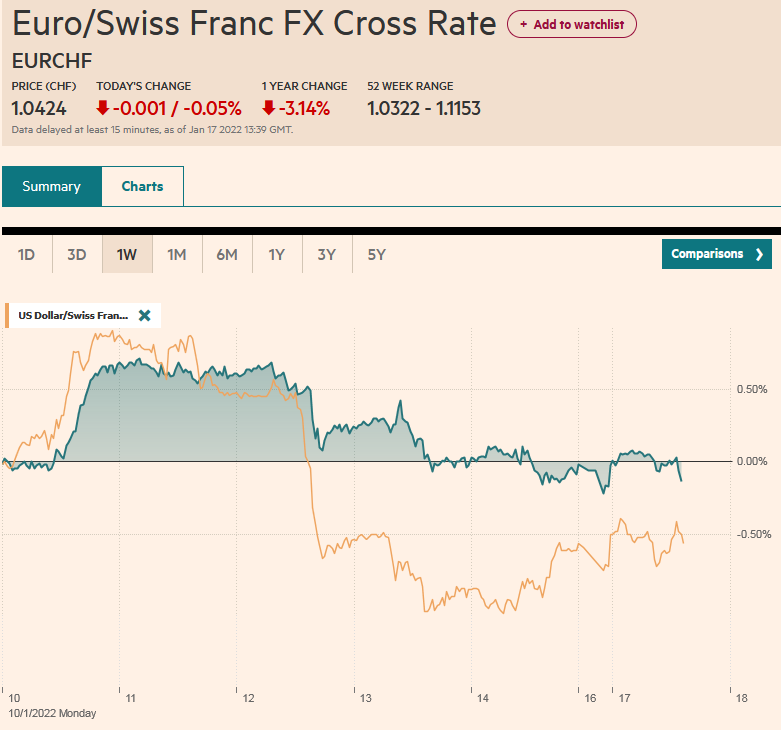

The euro has fallen by a

little more than 3% against the Swiss franc this week. Before the US warning about the

impending invasion on February 11, the euro was near the year’s high around

CHF1.06. It is approaching CHF1.01 today. The euro’s loss this week

is the largest since mid-January 2015, when the Swiss National Bank lifted its

cap on the franc, and the euro fell a dramatic 17.2% that week.

The euro set the high for

the year on February 10 near $1.15 before the US warning. Today’s low was 1/100 of a cent

above $1.10. Although we had highlighted the risk of $1.1000-$1.1050, it

does not appear to be the bottom of the euro. Below $1.10 the next

important chart area is seen around $1.08-$1.0850. Recall that the low in

March 2020 was near $1.06. The lower Bollinger Band is near $1.1045

today. Initial resistance is seen by $1.1070 and then $1.1100. Sterling

has swung in a $1.3270-$1.3440 range in recent days. The lower

end is also the low for the year. The 2021 low was sent last December

near $1.3165. Before that, there may be support near $1.3200. The lower

Bollinger Band is near $1.33 today.

America

The US monthly employment

data is often among the most important data points in the monthly

cycle. However,

its significance is often for the policy implications. In this week’s

testimony before Congress, Fed Chair Powell has signaled a 25 bp hike at the

mid-March FOMC meeting. Although St. Louis Fed’s Bullard, and his former

head of research Waller, who is now a Fed governor, seemed to make the

strongest case for a 50 bp hike, we suspected that they did not represent the

leadership. NY Fed Williams since shortly after taking the post has

generally reflected the leadership’s views and since around the middle of last

month suggested that the case for a large move at the lift-off was not

compelling. Of course, and Powell made it clear, a 50 bp move later in

the cycle remains an option. Powell suggested the balance sheet was on

the backburner. Yet he indicated that the pace would be discussed at the

upcoming meeting. Earlier this week, the head of the Fed’s market

operations, suggested that maturing Treasury issues would range from $40 bln to

$150 bln a month, with the average of about $80 bln. Maturing MBS securities

could average around $25 bln a month. We suspect that what Powell was

referring to was that there the immediate focus is on rates. The Fed

funds target could be raised three times before the balance sheet roll-off may

start (assuming early H2).

In any event, surveys look

for 400k-425k rise in February nonfarm payrolls. A note of caution comes from the

decline in employment component of the services ISM (48.5 vs. 52.3).

Hourly earnings are expected to have accelerated to 5.8% year-over-year from

5.7%, while the average work week may have increased to 34.6 hours from

34.5. The unemployment rate is forecast to slip below 4%. Even if

the job growth is a bit softer than the median, the general impression of a

tight labor market is unlikely to be challenged.

There are two other

developments to note.

First, the US premium over Germany for two-year borrowings have risen to about

218 bp today. It is almost 25 bp higher for the week, which is the fourth

consecutive weekly advance. It stood at 155 bp after the January

employment data on February 4. Second, the US State Department joined the

chorus yesterday suggesting that a nuclear deal with Iran was close, even

though several issues are unresolved. The International Atomic

Energy Agency’s direct general will meet Iranian leaders in Tehran this

weekend. Some news accounts indicated that Iran only wants to accept

euros for its oil. Despite the talk about the dollar’s petro-currency

status, the transactional demand for dollars is a small part of the overall

dollar turnover. Consider that a week’s turnover (volume) in the foreign

exchange market is enough to cover world trade for a year. This is to say that

the main force driving the dollar are capital flows, not trade flows.

The Bank of Canada will

likely announce next month its balance sheet strategy which may begin in

May. The US

dollar briefly dipped below CAD1.26 yesterday, but the breakout, like some many

others this year so far, proved premature. The greenback returned to

almost CAD1.27 yesterday and looks set to test nearby resistance around

CAD1.2750. The upper end of the range is around CAD1.28. The US

dollar has closed above it once this year. The Mexican peso is

under pressure. The US dollar is at new highs for the week near

MXN20.85. The high for the year was set in late January by

MXN20.9150. Note that the upper Bollinger Band is closer to MXN20.79.

Mexico is not in a position to capitalize on the surge in oil prices, and the

peso, the only emerging market currency to trade 24-hours a day often serves as

a liquid proxy for the EM FX asset class.

Tags: #USD,$CHF,China,Currency Movement,ECB,Featured,federal-reserve,Germany,Iran,jobs,newsletter,SWIFT,Trade