Hiking rates into a wildly overvalued market is potentially a mistake. So says Bank of America in a recent article. Optimists expecting the stock market to weather the rate-hike cycle as they’ve done in the past are missing one important detail, according to Bank of America Corp.’s strategists.While U.S. equities saw positive returns during previous periods of rate increases, the key risk this time round is that the Federal Reserve will be “tightening into an overvalued market,” the strategists led by Savita Subramanian wrote in a note.“The S&P 500 is more expensive ahead of the first rate hike than any other cycle besides 1999-00,” they said.” – Yahoo Finance While many media experts suggest that investors should not be concerned about rate hikes, BofA

Topics:

Lance Roberts considers the following as important: 9) Personal Investment, 9a.) Real Investment Advice, Featured, Investing, newsletter, Technically Speaking

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Hiking rates into a wildly overvalued market is potentially a mistake. So says Bank of America in a recent article.

Optimists expecting the stock market to weather the rate-hike cycle as they’ve done in the past are missing one important detail, according to Bank of America Corp.’s strategists.

While U.S. equities saw positive returns during previous periods of rate increases, the key risk this time round is that the Federal Reserve will be “tightening into an overvalued market,” the strategists led by Savita Subramanian wrote in a note.

“The S&P 500 is more expensive ahead of the first rate hike than any other cycle besides 1999-00,” they said.” – Yahoo Finance

While many media experts suggest that investors should not be concerned about rate hikes, BofA makes a very valid point regarding valuations.

Before we get there, we need to review current valuation levels and how we got here.

Valuations are a function of three components:

- Price of the index

- Earnings of the index

- Psychology

The price-to-earnings ratio, or the P/E ratio, is the most common visual representation of valuations. However, we tend to forget that ” psychology ” drives investors to overpay for those future earnings.

In other words, while valuations, in the long run, reflect future returns, in the short run, they reflect investor sentiment.

So, back to BofA, how could hiking rates now be problematic for stocks?

Historical Valuations And Fed Hikes

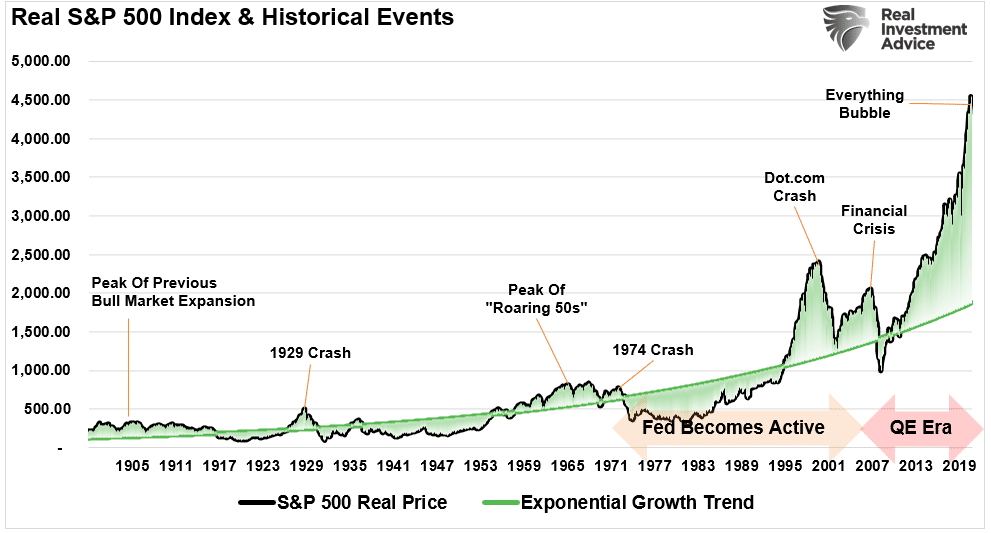

We recently discussed the massive deviation from long-term growth trends for the S&P 500. To wit:

Over the last 12-years, the pace of price increases accelerated due to massive fiscal and monetary interventions, extremely low borrowing costs, and unrelenting “corporate buybacks.” As shown, the deviation from the exponential growth trend is so extreme it dwarfs the “dot.com” era bubble.

That massive flood of liquidity from the Government checks to households, the Fed’s zero-interest-rate policy, and $120 billion in monthly bond purchases had to go somewhere. Instead, it showed up as inflation in both prices of goods and services and financial assets. Currently, market valuations are more extended than at any other point in history other than the “Dot.com” bubble.

Realigning the data above, we see that valuation extremes are a function of price extremes.

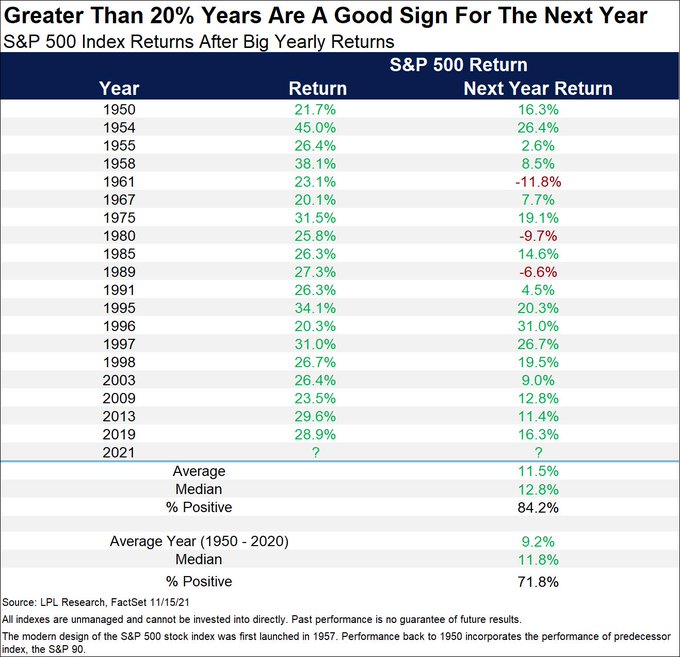

Jerome Powell clearly understands that a decade of monetary infusions and low rates created an asset bubble larger than any other in history. History shows that previous rate hiking cycles, particularly with elevated valuation levels in 1972, 1999, and 2007, led to poor outcomes.

Investors chase stocks on expectations of continued economic and earnings growth, so they risk disappointment. When the Fed tightens monetary policy to slow economic growth and quell inflation, such leads to a reversal in earnings.

Given already high valuations, the outcome will not be what investors were told to expect.

The Problem Of High Valuations And Forward Returns

For investors, the primary bullish arguments for overpaying for valuation over the last decade was three-fold:

- Earnings growth,

- Low interest rates; and,

- Quantitative Easing.

The premise was that with the Fed keeping rates at zero and earnings growth, the present value of future cash flows from equities would rise enough to justify their valuation. Furthermore, the Fed supporting asset prices with massive rounds of Quantitative Easing (QE) investment risk got removed. While true, assuming all else is equal, a falling discount rate does suggest a higher valuation.

“Instead of regarding stocks as a fixed-rate bond with known nominal coupons, one must think of stocks as a floating-rate bond whose coupons will float with nominal earnings growth. In this analogy, the stock market’s P/E is like the price of a floating-rate bond. In most cases, despite moves in interest rates, the price of a floating-rate bond changes little, and likewise the rational P/E for the stock market moves little.” – Cliff Asness

As Cliff notes, zero-interest rates and rising earnings growth supports high valuations. However, if earnings growth is declining as the Fed is hiking rates, such would logically denote lower future valuations. In this instance, to have a lower P/E ratio, as the (E) is declining, the (P) must also decrease.

Simply, if low-interest rates are bullish for equities, then higher rates can not be. They can’t be both.

Financial history confirms the logic.

As we already know, high valuations lead to low future returns, as noted by 120-years of data. (Data courtesy of Dr. Robert Shiller)

However, logic and data also show that future returns decline when the Federal Reserve hikes rates, particularly in combination with elevated valuations.

This Time Is Unlikely Different

While market analysts continue to develop a variety of rationalizations to justify high valuations, none of them hold up under objective scrutiny. As noted previously:

“The problem is while Central Bank interventions boost asset prices in the short-term, over the long-term there is an inherently negative impact on economic growth. As such, it leads to the repetitive cycle of monetary policy.

- Monetary policy drags forward future consumption leaving a void in the future.

- Since monetary policy does not create self-sustaining economic growth, ever-larger amounts of liquidity are needed to maintain the same level of activity.

- The filling of the “gap” between fundamentals and reality leads to economic contraction.

- Job losses rise, wealth effect diminishes, and real wealth reduces.

- The middle class shrinks further.

- Central banks act to provide more liquidity to offset recessionary drag and restart economic growth by dragging forward future consumption.

- Wash, Rinse, Repeat.

If you don’t believe me, here is the evidence.

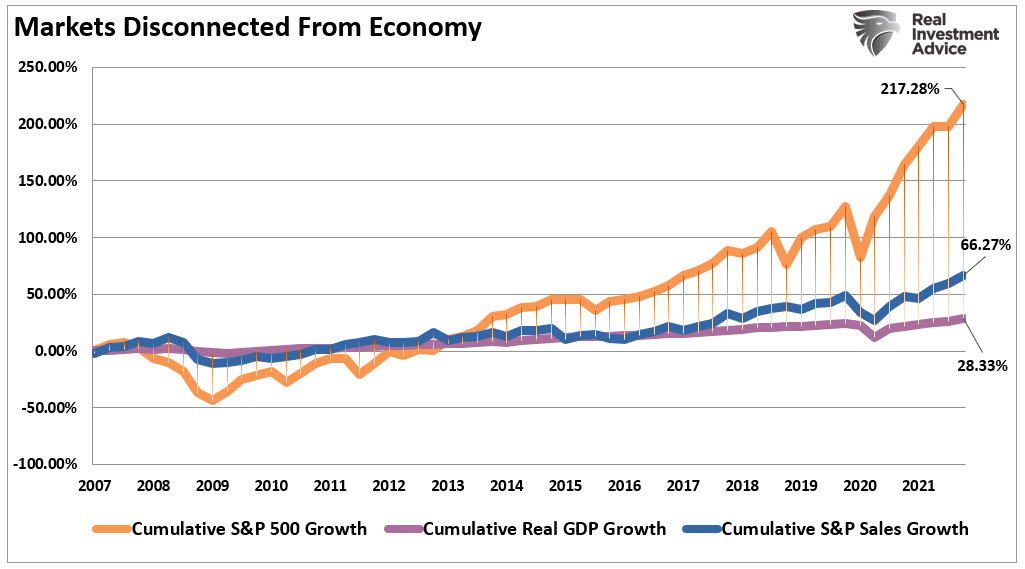

“Through the end of Q2-2021, using quarterly data, the stock market has returned almost 217% from the 2007 peak. Such is more than 7.5x the GDP growth and 3.2x the increase in corporate revenue. (I have used SALES growth in the chart below as it is what happens at the top line of income statements and is not AS subject to manipulation.)“

While it is “bullish” to come up with reasons to justify overpaying for assets in the short term, “fighting the Fed” is generally a “no-win” situation.

That means if a massive flood of liquidity, QE, and zero rates was your thesis for overpaying for earnings previously, the reversal of that policy is not.

You don’t get to have it both ways.

The post Hiking Rates Into Peak Valuations Is A Mistake appeared first on RIA.

Tags: Featured,Investing,newsletter,Technically Speaking