Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts. First up, yesterday the Federal Reserve published the November 2021 estimates for Industrial Production in the United States. As has been the case around the rest of the world, American domestic crude and natural gas output continues to be constrained. And not by a little. Compared to the prior peak way back almost two years ago, the Fed’s research staff figures the amount of overall energy pulled out of the industry remained about 7.6% less

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Alan Greenspan, bonds, CPI, Crude Oil, currencies, Deflation, economy, Featured, Federal Reserve/Monetary Policy, inflation, inflation breakevens, inflation expectations, irrational exuberance, Markets, newsletter, TIPS, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief.

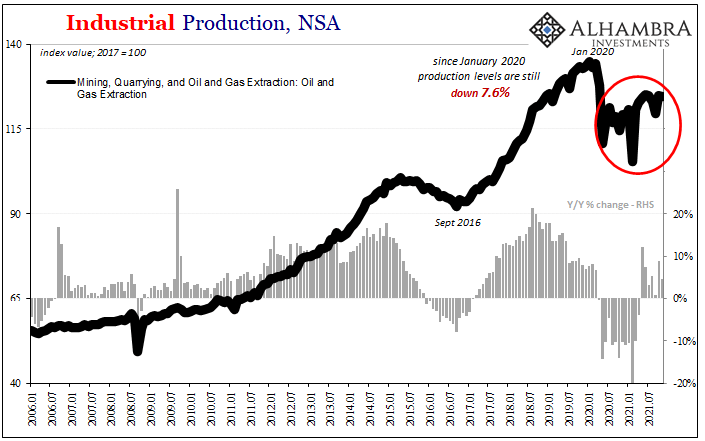

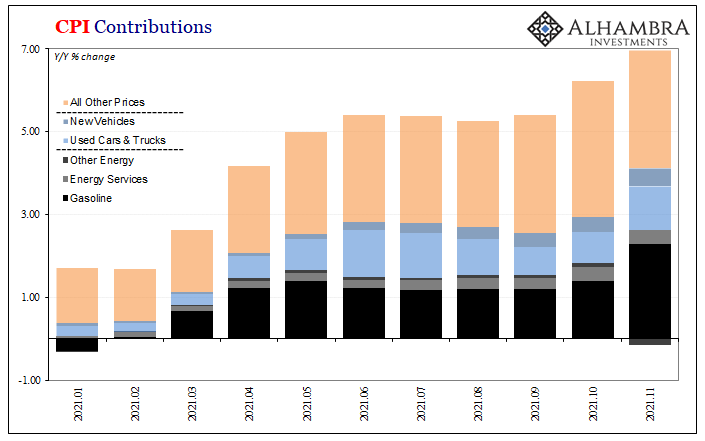

Let’s start by reviewing just the facts. First up, yesterday the Federal Reserve published the November 2021 estimates for Industrial Production in the United States. As has been the case around the rest of the world, American domestic crude and natural gas output continues to be constrained. And not by a little. Compared to the prior peak way back almost two years ago, the Fed’s research staff figures the amount of overall energy pulled out of the industry remained about 7.6% less last month than it had been twenty-two months ago. |

|

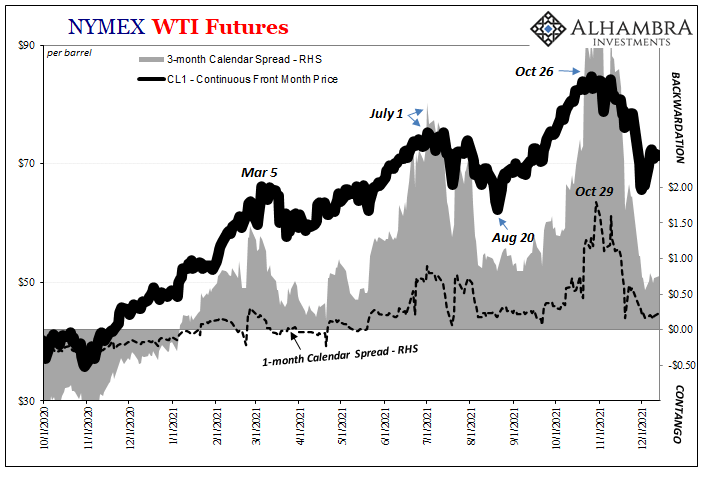

| No single-month anomaly, producers have maintained this compressed schedule all along. Regardless of any changes price-wise to both crude and natural gas, supply of each hasn’t really changed. Therefore, the key reason why price-wise each’s prices have skyrocketed.

Since we are sticking with facts, we won’t get into speculation (just yet) as to why this may still be the case. What has happened is textbook supply shock. |

|

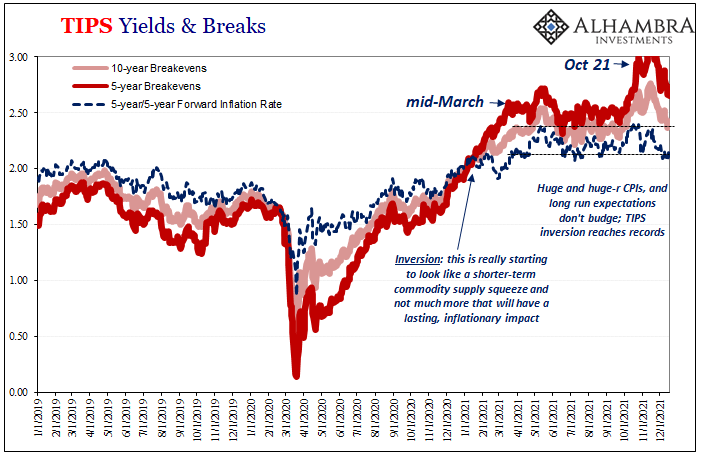

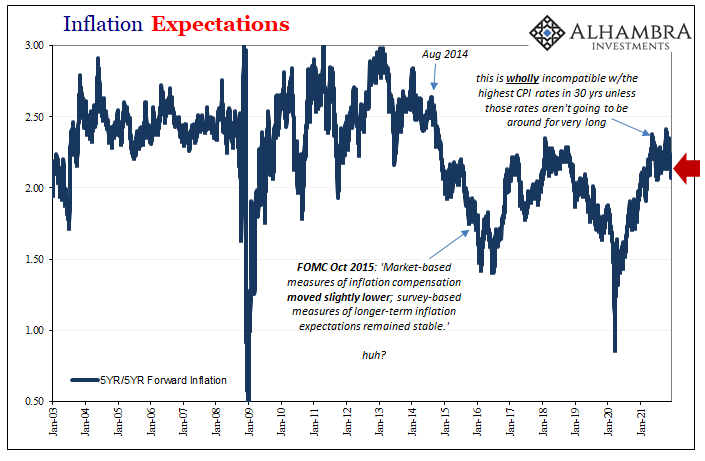

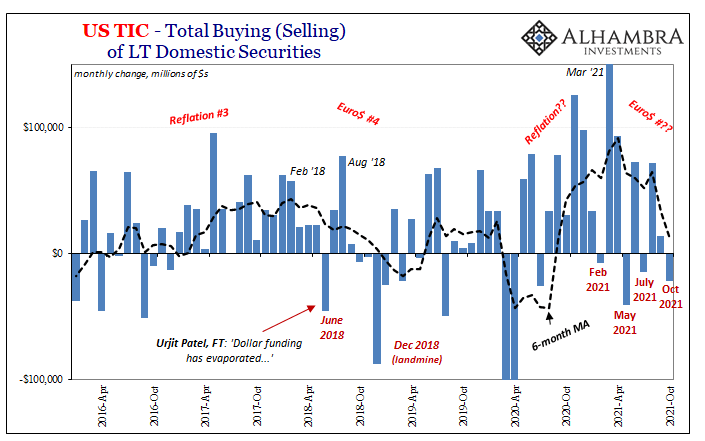

| One other fact is what happened on October 21. This is a date we’ve come back to frequently already, that one with several others nearby being displayed across a startling number of charts related to deflationary potential increasingly priced in many markets around the world.What was it on the 21st? A major reset as the Treasury Department auctioned 5-year TIPS. As a result, demand for it – in the face of rising oil prices, which bleed most directly into the CPI TIPS holders get reimbursed for – was out of this world.

As has occurred with the 5-year TIPS (some say because of how much the Fed buys of it conducting QE; I don’t buy the Fed buying excuse given how consistent the signals worldwide) auctions before, heavy bids for CPI-based protection reshuffled market-based inflation breakevens at that maturity. |

|

| This added an enormous 17 bps to the 5-year inflation expectation on just this one particular day, October 21:

The shorter breakeven had already been on the upswing, now given a huge boost that wasn’t replicated anywhere else like the 10-year breakeven (or the longer run 5-year/5-year forward rate). In fact, the 5s expectation would continue to rise while registering a high of 317 bps by November 15 even though the rest of the market would resist. During that same timeframe, the 10s breakeven wouldn’t move nearly that much while the longer run (5y5y) estimate would from then start to slide as the entire global bond market did, too. |

|

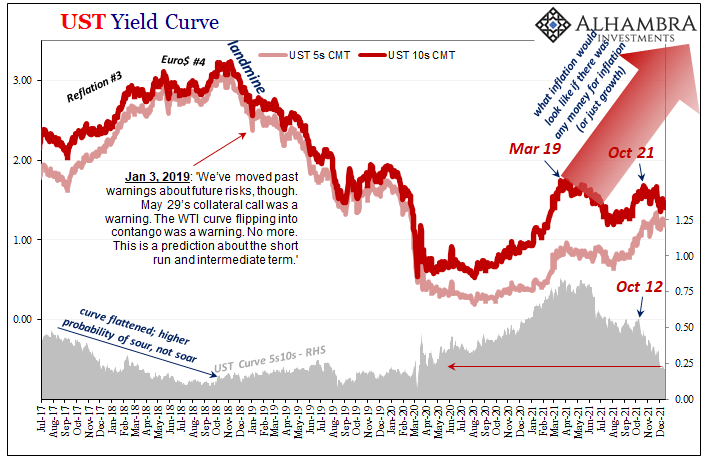

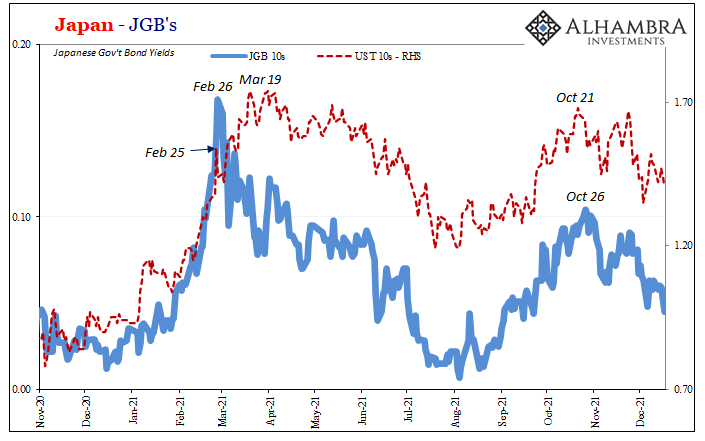

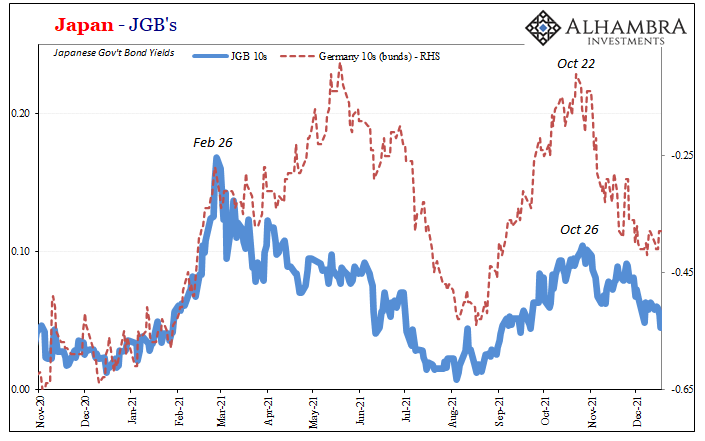

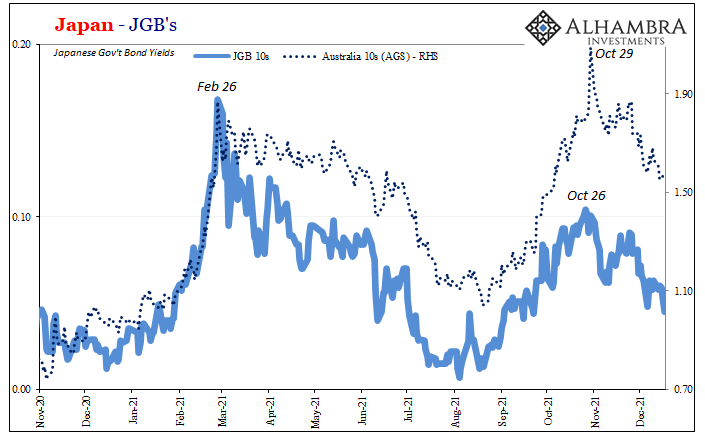

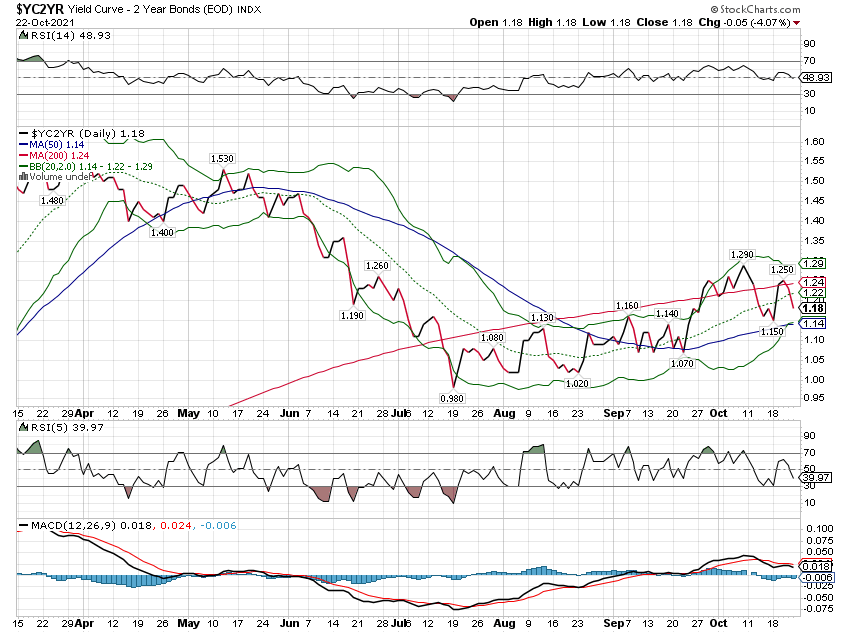

| Those count up as the rest of our facts; the coincidence of this change from modest, most likely seasonal reflation September and October that quickly became more extremely deflationary along global curves from eurodollar futures to JGB’s and German bunds. Even Bitcoin has struggled since October 21.

Given all these established specifics, let’s do some speculative interpreting. I did so in detail here first by reviewing two key relevant contributions to our knowledge-base from the 1990’s, beginning by recognizing the 25-year anniversary of Alan Greenspan’s infamous “irrational exuberance” speech and recounting the constructive substance of it. Those two words aren’t useful to our analysis, nor were they the “maestro’s” actual message.

M2, specifically, was no reliable monetary indicator and therefore the words irrational and exuberance placed side by side were an expression of serious doubts that could be applied to a number of potential situations even in the real economy, not just the specifics of the dot-com stock bubble. |

|

One of those he had witnessed close up a little more than six years earlier when Saddam Hussein foolishly tried to annex Kuwait. The result of that ill-fated adventure was, among other things:

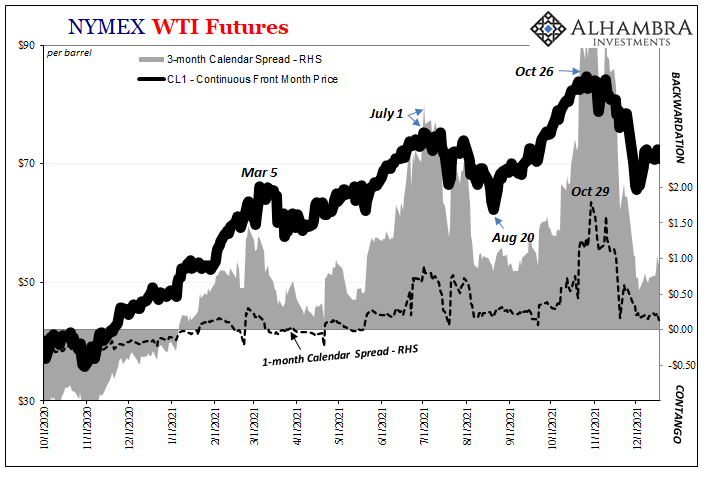

There was no runaway currency to produce sustained inflation, on the contrary the subsequent Iraq attack spasm in oil helped produce an outright and immediate recession; at the very least, made it worse. A classic oil supply shock case, one consistent with several periods in modern history. Are we now seeing something similar?

Did oil go too far? |

|

| It is at least possible – to the point the possibility needs to be serious considered – these growing deflationary fears are about just this kind of 1990 “inflation” only applied globally which then doesn’t actually lead to inflation (and therefore the rest of the TIPS market being upside-down).

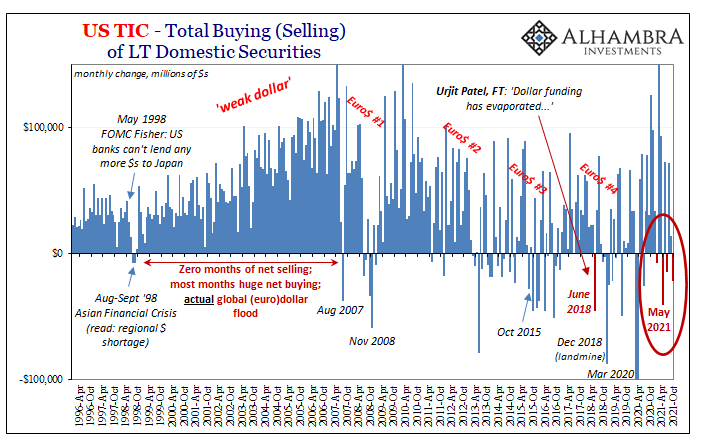

There are, as I already discussed earlier today, other potential suspects on these accounts. However, those indicated by eurodollar tightness might also be the mode by which these same oil supply shock uncertainties have been transmitted globally into markets and pretty likely the economy, too. |

|

| The higher oil went these last six months, the more deflationary the eurodollar money.

If so – and this is still a big “if” – then the oil producers really would have shot themselves in the foot by provoking higher oil prices that come right back on them in the form of global demand falling right back down again. Then again, maybe that’s what they’ve been thinking, perhaps expecting all along: a global economy which won’t be able to tolerate these oil prices still considerably less than a few years ago probably would never be one worth the effort to pump more oil in the first place. |

Tags: Alan Greenspan,Bonds,CPI,Crude Oil,currencies,Deflation,economy,Featured,Federal Reserve/Monetary Policy,inflation,inflation breakevens,inflation expectations,irrational exuberance,Markets,newsletter,TIPS,U.S. Treasuries,Yield Curve