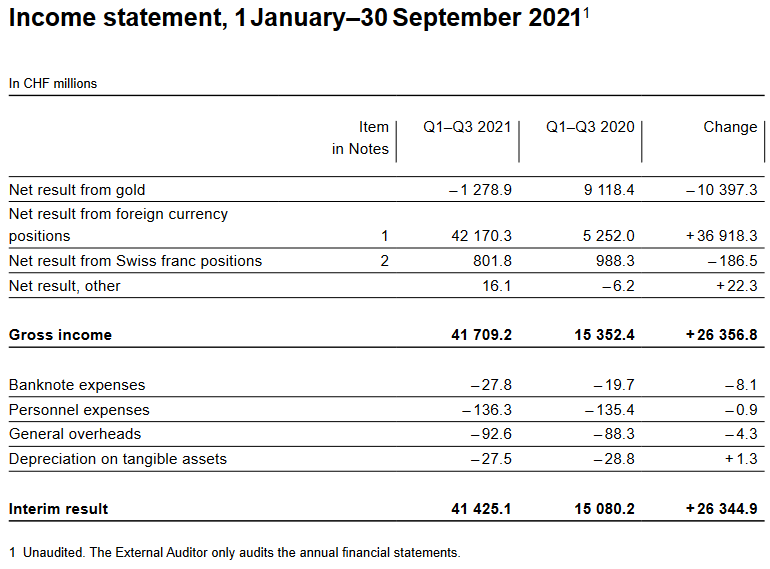

In the third quarter of 2021, the current account surplus amounted to CHF 24 billion, CHF 10 billion more than in the same quarter of 2020. The increase was mainly attributable to the significantly higher receipts surplus in goods trade. This surplus was due to traditional goods trade (foreign trade total 1), non-monetary gold trading, as well as to merchanting. Primary income counteracted the rise in the current account balance. While a receipts surplus was recorded in the same quarter of 2020, primary income showed a high expenses surplus in the current quarter. This was largely due to developments in investment income from direct investments. The expenses surplus on primary income was, however, relatively low when compared with recent quarters. Current

Topics:

Swiss National Bank considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| In the third quarter of 2021, the current account surplus amounted to CHF 24 billion, CHF 10 billion more than in the same quarter of 2020. The increase was mainly attributable to the significantly higher receipts surplus in goods trade. This surplus was due to traditional goods trade (foreign trade total 1), non-monetary gold trading, as well as to merchanting. Primary income counteracted the rise in the current account balance. While a receipts surplus was recorded in the same quarter of 2020, primary income showed a high expenses surplus in the current quarter. This was largely due to developments in investment income from direct investments. The expenses surplus on primary income was, however, relatively low when compared with recent quarters. |

Current Account Q3 2019-Q3 2021(see more posts on Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

| In the financial account, reported transactions for the third quarter of 2021 showed a net acquisition of financial assets (CHF 40 billion) and a net incurrence of liabilities (CHF 17 billion). All components contributed to the net acquisition on the assets side – in particular other investment because resident banks increased their claims against non-resident banks (interbank business). Other investment accounted for the largest share of the net incurrence on the liabilities side too. Including derivatives, the financial account showed a balance of CHF 22 billion.

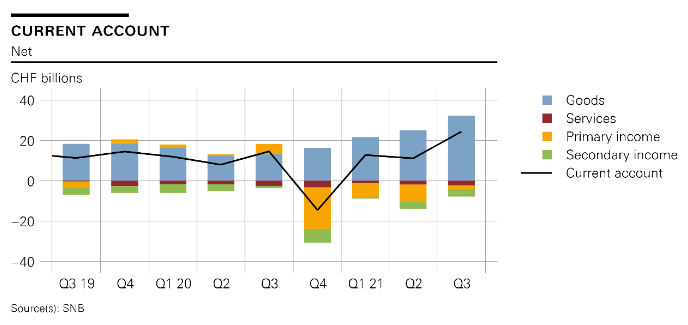

The net international investment position increased by CHF 27 billion quarter-on-quarter to CHF 847 billion in the third quarter of 2021, with the stocks of assets increasing more strongly than the stocks of liabilities. Assets rose by CHF 77 billion to CHF 5,659 billion and liabilities were CHF 50 billion higher at CHF 4,813 billion. On both the assets and liabilities sides, the increase was largely due to the transactions reported in the financial account. Price and exchange rate effects played only a minor role. |

Net international investment position, Q3 2019-Q3 2021 Source: snb.ch - Click to enlarge |

Data revisions

The data on the balance of payments and international investment position take into account revisions, some of which go back to 2008. These revisions have arisen as a result of newly available information from the reporting institutions. Direct investment and derivatives were primarily affected.

Backcasting financial account and international investment position data to 1985

The financial account and international investment position data have been backcast and are now available from the first quarter of 1985 (previously Q1 2000). More detailed information regarding the backcasting is available under Changes and revisions on the SNB’s data portal.

Tags: Featured,newsletter