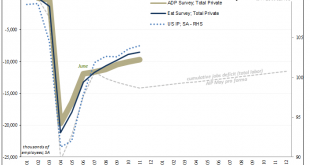

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data. It is the jobs market where much of the official “inflation” jawboning is centered, all that Phillips Curve stuff. So, whatever might seriously undermine Phillips would put the end to the rate hikes in sight. Short-term Treasuries therefore ignored...

Read More »What Really ‘Raises’ The Rising ‘Dollar’

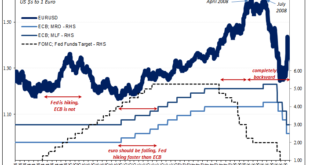

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials. A relatively more “hawkish” US policy therefore the wind in the sails of a “strong” dollar exchange regime. How else would we explain, for example, the euro’s absolute plunge since around May last year?...

Read More »We Can Only Hope For Another (bond) Massacre

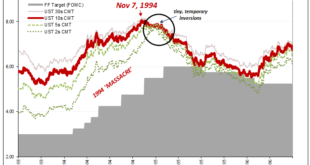

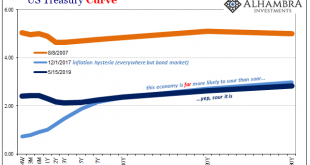

To begin with, the economy today is absolutely nothing like it had been almost thirty years ago. That fact in and of itself should end the discussion right here. However, comparisons will be made and it does no harm to review them. I’m talking about 1994, or, more specifically, the eleven months between late February 1994 and early February 1995. Fearing inflation (the only time in its history, including much of the Great Depression, the Fed didn’t fear inflation...

Read More »Another One Inverts, The Retching Cat Reaches Treasuries

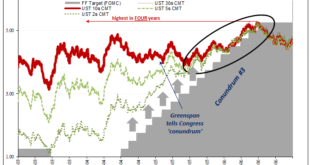

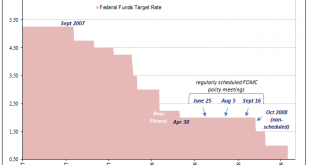

As Alan Greenspan’s rate hikes closed in, longer-term Treasury yields were forced upward as the flattening yield curve left no more room for their blatant defiance. By mid-2005, though, the market wasn’t ready to fully price the downside risks which had already led to that worrisome curve shape (very flat). While all sorts of bad potential could be reasonably surmised, none of it seemed imminent or definite. Thus, between July 2005 and June 2006, the entire curve...

Read More »The ‘Fed Put’ – Gone Until There’s Blood in the Streets

The ‘Fed put’ – gone until there’s blood in the streets Well, it’s happening. Bitcoin (and other cryptocurrencies are sharply down, along with equity markets in many advanced economies. And the Federal Reserve (the U.S. Central Bank) statement and press conference on Wednesday didn’t indicate any backing down from raising interest rates, maybe as soon as the March meeting. The Fed’s stance pivot from ‘the economy needs additional stimulus’ to ‘it is time to start...

Read More »Taper Discretion Means Not Loving Payrolls Anymore

When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money. The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97. As Emil Kalinowski and I had...

Read More »One Shock Case For ‘Irrational Exuberance’ Reaching A Quarter-Century

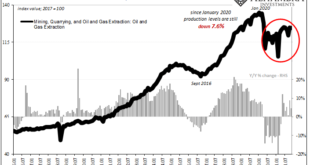

Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts. First up, yesterday the Federal Reserve published the November 2021 estimates for Industrial Production in the United States. As has been the...

Read More »Consumers, Too; (Un)Confident To Re-engage

There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend). Once the snowball of macro contraction begins rolling downhill, rational prudence dictates some degree of caution on all parts (pro-cyclicality). Bathed in the unearned glow of the Great “Moderation”,...

Read More »The Greenspan Moon Cult

Taking another look at what I wrote about repo and the latest developments yesterday, it may be worthwhile to spend some additional time on the “why” as it pertains to so much determined official blindness, an unshakeable devotion to otherwise easily explained lunar events. The short version: monetary authorities as well as the “experts” describe almost perfectly risk averse behavior among the central money dealing system in outbreaks like September’s repo – but...

Read More »History Shows You Should Infer Nothing From Powell’s Pause

Jay Powell says that three’s not a crowd, at least not for his rate cuts, but four would be. As usual, central bankers like him always hedge and say that “should conditions warrant” the FOMC will be more than happy to indulge (the NYSE). But what he means in his heart of hearts is that there probably won’t be any need. Three should do the trick nicely. And a lot of people, from what I can tell, believe him if not simply because he’s already stopped. The last two...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org