In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn. This view had been punctuated by Fed Vice Chairman Richard Clarida, among many others, who in early January 2020 said that, “’significant global headwinds and global disinflationary pressures … may be beginning to abate.” As usual, the Chinese and Chairman Xi, who presided over that Central Economic Work Conference, disagreed. In this December 2019 Chinese statement, it made mention of “contingency plans” to

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, China, currencies, economy, Europe, Featured, Federal Reserve/Monetary Policy, Germany, industrial production, Japan, Markets, Mexico, newsletter, PMI, re-recession, rebound, Recession, Reflation, Xi Jinping

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn.

This view had been punctuated by Fed Vice Chairman Richard Clarida, among many others, who in early January 2020 said that, “’significant global headwinds and global disinflationary pressures … may be beginning to abate.” As usual, the Chinese and Chairman Xi, who presided over that Central Economic Work Conference, disagreed.

In this December 2019 Chinese statement, it made mention of “contingency plans” to try gain control over China’s growing economic dangers.

Chalked up as nothing more than trade wars over here, over there they were rather more serious.

We need to be well prepared with contingency plans…The country faces rising downward economic pressure amid intertwined structural, institutional and cyclical problems.

Fast forward a year to December 2020. Last month the Work Conference convened again, with Xi chairing it as is customary, but notably dropped the whole bit about “downward economic pressure.”

Instead, the Communist Party Chairman, titular government leader, and de facto dictator made a point to highlight how China will be “the only major economy with positive growth this year.” The United States long thought the cleanest dirty shirt of the bunch which includes only dirty shirts, Xi Jinping has apparently claimed the title.

What does this mean?

Hard-pressed by the global recession in 2020, of which China’s COVID outbreak played a major role in providing the sparking shock for it, the Chinese economy isn’t dropping any longer. It is rebounding after having suffered less, purportedly, than anyone else.

This, however, isn’t quite the same standard for success.

Scouring the statement again for clues as to what the government and the Party (same thing) regard as the true state of economic affairs, the 2020 statement also states that, despite (because of?) Xi’s boasting, there will not be any “sharp turns” in the year ahead. This is a curious admission given that, again in the West, expectations have been primed for at least some big change in monetary and fiscal policy.

Though China’s system hasn’t, according to its figures, suffered nearly as much as everyone else it did suffer a severe blow. So sharp and sharply negative that Economists and observers have been waiting all year (that COVID blow came early on last January and February) for authorities to ramp up the rescue.

The PBOC and fiscal spending have been purportedly on tap – yet, they never materialized, at least not to any substantial scale, during 2020 despite the prior year’s notice from “contingency plans.” And with Xi now saying at last year’s end how China must be in relatively good shape, this plus the proscription against sharp turns means the same overarching view remains firmly in place.

Whatever happens in China, they’ll deal with the fallout as best as possible – thinking this was done through very modest means in 2020 – without (ever) going back to the standard Keynesian playbook everyone outside the country continues to expect for them to (re)use.

| Dual circulation, or something.

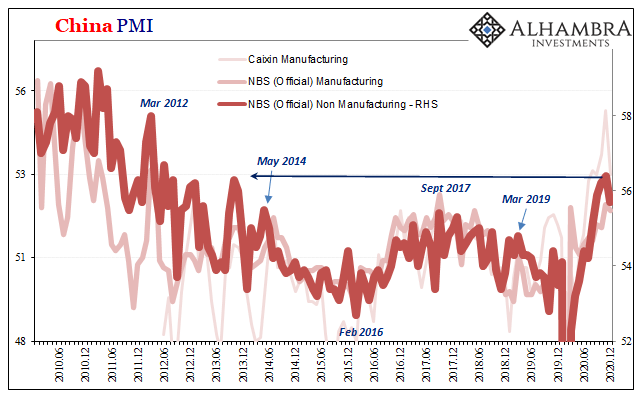

Whatever happens, this is the economy right here China’s governing minions are told to roll with. They got what they got. What that means entering 2021 is, rather abruptly, the same global economy which continues to rebound but fail to actually recover. This is no trivial distinction, a fact that Xi and his gang are obviously aware (it has been the entire premise since the 19th Party Congress). This is consistent with the actual data on the ground, in China as everywhere else. PMI’s have been consistently hyped up and having been so their actual indications have become lost in the noise over “strong” and “recovery” semantics. In fact, both sets (and both types) of China PMI’s stumbled for the month of December 2020, according to estimates released by the Chinese National Bureau of Statistics as well as Caixin. |

China PMI, 2010-2020 |

| Of the former, the official manufacturing PMI softened ever so slightly from November; down from 52.1 to 51.9. It’s not the gentle decline which matters, much more so from what low level.

The manufacturing sector just has never picked itself back up from the big contraction earlier in the year; a curious lack of symmetry no doubt influencing policy decisions. The official non-manufacturing PMI fell last month, too, and in much the same way. Like or not, China remains tied to the global economy in ways it won’t easily surmount. In fact, that’s really what the 14th 5-year Plan confessed; Xi’s government would really like to do something about this so long as it doesn’t depend upon massive doses of useless, textbook “stimulus” which for the last decade have proven futile (and then some). For the time being, the Chinese are going to ride with the global economy while biding their time creating new innovations no one in China can actually describe. It’s all futuristic and awesome. That’s just not for today (and may not happen until sometime closer to 2035). And the global economic data bears this out; the still-synchronized part, not the made-up technology pulled out from the 14th. You look around the world and you find exactly what China’s PMI’s signal – a global economy still rebounding (as indicated by PMI’s above 50) but curiously lacking the acceleration (as would be indicated by PMI’s way, way above 50) to make it into an actual recovery. |

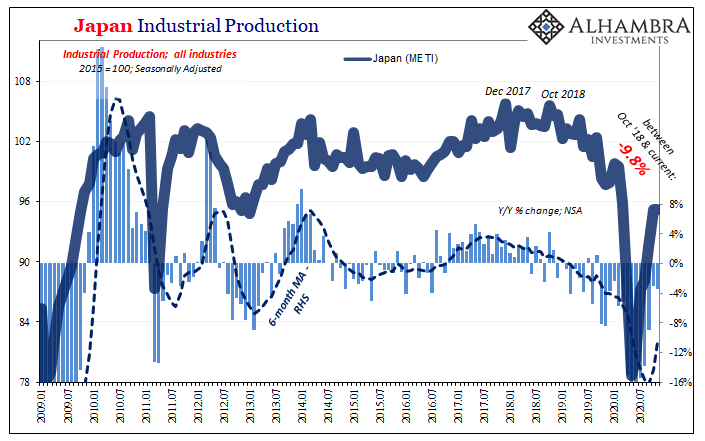

Japan Industrial Production, 2009-2020 |

| Approaching the end of 2020, why is everything still down so much?

Something (affecting global trade first) seems to be holding it back. But that something, if you believe it COVID, doesn’t apply in the erstwhile Middle Kingdom. They’ve vanquished their pandemic, so says Xi, and yet they are moving forward shirted anyway by a clearly soiled garment with no plans whatsoever to clean it. The slogan printed on its, only partly obscured by the dirt, says “at least China isn’t you.” To be clear about what I’ve been saying since the bottom, up through the era of gigantic positives in Q3, it is that there is a world of difference between rebound and recovery. Rebound falls short of even reflation; which is itself short of recovery. The world economy is not falling back into contraction, and doesn’t right now seem to be in danger of doing so – though parts of it probably will early this year (looking at you, Europe). That’s not the big problem and concern; and it sure isn’t what’s had Chinese authorities become more authoritarian over the past three plus years. Lack of recovery, even with a rebound, these relatively cleaner shirts, if you like, present challenges all their own that in many ways – especially in the long run – are more demanding than re-recession. And Xi is demanding so little, content with the global economy’s natural but so far very limited upswing: |

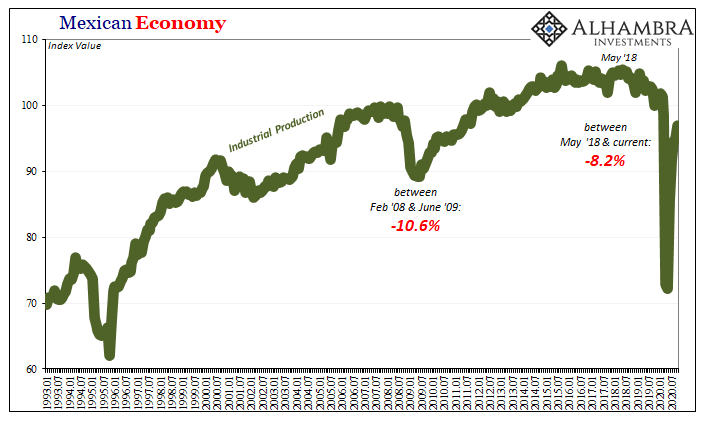

Mexican Economy, 1993-2020 |

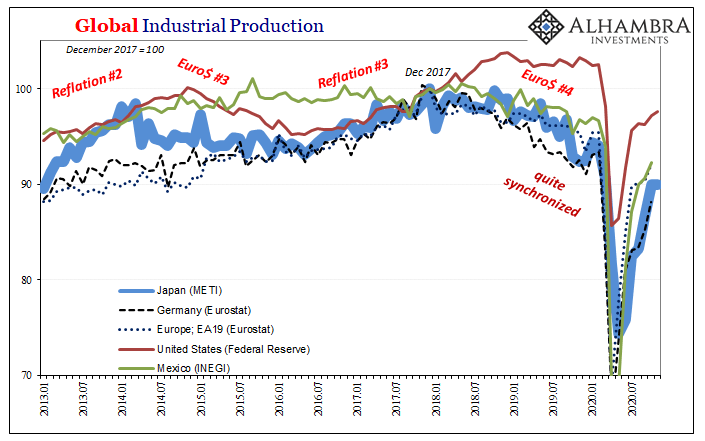

Global Industrial Production, 2013-2020 |

|

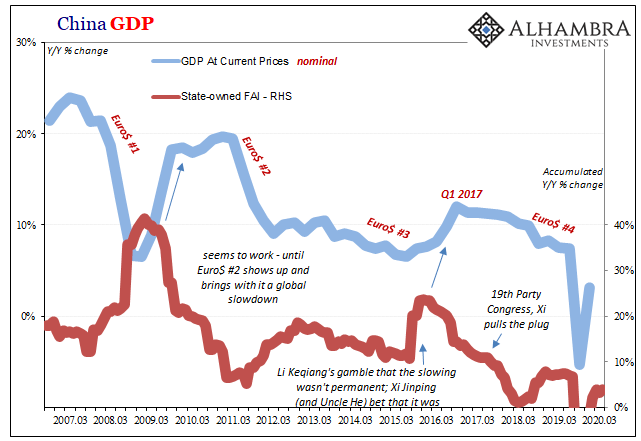

| This is what all the PMI’s around the world, including the US’s ISM which “surged” in December, actually indicate. Global industry, the global economy, is still down sharply from February let alone having made up so much lost ground, and time, from the Euro$ #4 peak which, depending upon the individual economy, topped out across the various months of 2018. Two lost years before the bigger lost year.

That’s a lot of years to be stuck going backward, and to be still doing so this late in 2020 and only marginally coming back out of it is, well, perfectly consistent with the “L”-shaped economy Xi’s people have been warning about since all the way back in 2016. |

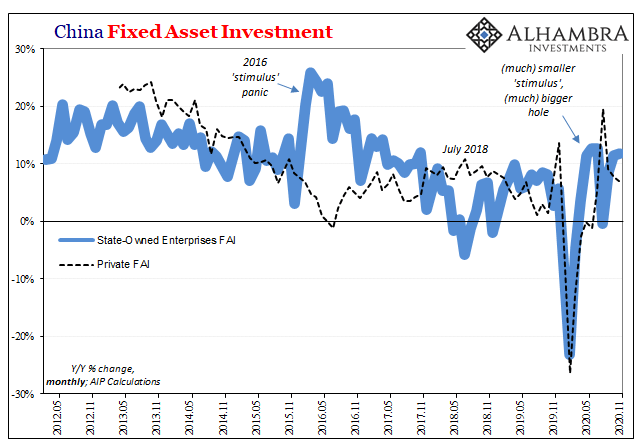

China Fixed Asset Investment, 2012-2020 |

| It’s a clear indication that something’s not right (and won’t be inflationary).

This doesn’t seem to have changed; at least the expectation, no matter what COVID, in China’s official policies. The Chinese economy is on its way back up, but, like everyone else, that only means it isn’t still falling. And if it isn’t coming back up very quickly, oh well, that’s just the way it is. People all across the globe seem to be, and continue to be, looking for China to bail the global economy out of this rebound-not-recovery-rut and furthermore are expecting Xi’s economic authorities to upsize the aid in order to get this started and moving again. Neither of those things are indicated here; in data, not even PMI’s, nor in government mandate. |

China GDP, 2007-2020 |

Tags: China,currencies,economy,Europe,Featured,Federal Reserve/Monetary Policy,Germany,industrial production,Japan,Markets,Mexico,newsletter,PMI,re-recession,rebound,recession,Reflation,Xi Jinping