In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn. This view had been punctuated by Fed Vice Chairman Richard Clarida, among many others, who in early January...

Read More »Writing Rebound in Italian

As the calendar turned to September, the US Centers for Disease Control and Prevention (CDC) issued new guidelines expanding and extending existing moratoriums previously put in place to stop evictions during the pandemic. Families affected by COVID either through the disease or as a result of job loss due to the coronavirus have been protected from landowner actions including eviction as a final means to reclaim rental properties from non-conforming tenants. There...

Read More »What Did Everyone Think Was Going To Happen?

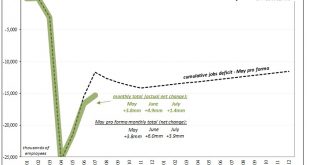

Honestly, what did everyone think was going to happen? I know, I’ve seen the analyst estimates. They were talking like another six or seven perhaps eight million job losses on top of the twenty-plus already gone. Instead, the payroll report (Establishment Survey) blew everything away, coming in both at two and a half million but also sporting a plus sign. The Household Survey was even better, +3.8mm during May 2020. But, again, why wasn’t this expected? All this...

Read More »Financial markets looking for a second wind

Published: 17th March 2016 Download issue: Financial markets search for a second wind Equity markets in developed economies rebounded in February, after spending December and January in an attitude of crisis. We think that this is just a tactical rebound, rather than a return to the bull market that prevailed on equity markets from 2009 to 2014. The fundamentals that limit the upside for equities have not changed; meanwhile, the limits of central bank policy are becoming increasingly...

Read More »2016 off to a turbulent start

Published: 12th February 2016 Download issue: A turbulent start to a volatile year Global markets had a very difficult start to 2016, with equity markets experiencing one of the largest January falls in history, currency markets also seeing major disruption, and a sharp widening of spreads on high yield corporate bonds. By the end of the month, though, there were signs that a rebound was underway. Although the magnitude of the sell-off was clearly a concern, these developments are not out...

Read More »The recent decline in equity markets and the rationale for a bounce-back

The decline in equity markets since the start of the year stands out as one of the largest in history in January, not only in its magnitude but also its suddenness. One has to go back to 1897 to find such a bad start for equity markets. This note will analyse the situation on the markets and the prospects for a rebound. As often in a large correction, one can find many causes. We think the following are the most significant: Monetary policy running out of steam. The fall in commodities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org