Monetary Metals CEO Keith Weiner was back on the Palisades Gold Radio podcast being interviewed by Tom Bodrovics. Keith revealed one key feature that gold has, which bitcoin does not. [embedded content] First, Keith discusses how economists and experts tend to say the strangest things and most of their statements don’t pass basic scrutiny, what Keith calls the “sniff test”. Gold has been accumulated for the last 5000 years. As a result physical scarcity is not possible. Gold is not consumed unlike other commodities like agriculture. Physical supply shortages are only possible at a particular price. Backwardation occurs in metals when people want to hold their gold more than dollars. Keith argues that because we don’t see backwardation often means the price cannot

Topics:

Benjamin Nadelstein considers the following as important: 6a.) Monetary Metals, 6a) Gold & Monetary Metals, blog, Featured, newsletter, video

This could be interesting, too:

Clemens Schneider writes Café Kyiv

Clemens Schneider writes Germaine de Stael

Clemens Schneider writes Museums-Empfehlung National Portrait Gallery

Clemens Schneider writes Entwicklungszusammenarbeit privatisieren

Monetary Metals CEO Keith Weiner was back on the Palisades Gold Radio podcast being interviewed by Tom Bodrovics. Keith revealed one key feature that gold has, which bitcoin does not.

Monetary Metals CEO Keith Weiner was back on the Palisades Gold Radio podcast being interviewed by Tom Bodrovics. Keith revealed one key feature that gold has, which bitcoin does not.

First, Keith discusses how economists and experts tend to say the strangest things and most of their statements don’t pass basic scrutiny, what Keith calls the “sniff test”.

Gold has been accumulated for the last 5000 years. As a result physical scarcity is not possible. Gold is not consumed unlike other commodities like agriculture. Physical supply shortages are only possible at a particular price. Backwardation occurs in metals when people want to hold their gold more than dollars. Keith argues that because we don’t see backwardation often means the price cannot be massively suppressed.

Then, Keith and Tom discuss the United States and Canada how they have the least understanding of gold markets in the world today. Most of the world understands the value of gold and silver because of their countries’ unstable currencies.

Next, Keith explains that dollars are illusory credits and are merely claims on wealth, not wealth itself. Fiat systems have become increasingly corrupted and this is why gold is the better option.

Tom and Keith discuss how global currencies are unsound and worsening. Bad behavior at a state level is trickling down to other parts of society. Keith argues that, eventually, there will be defaults but these may still be years away. Calculating the probability, severity, and consequences of a collapse is very difficult to predict due to the complexities of global systems.

Keith then discusses the importance of measuring assets in reference to a good standard. A dollar is a great unit of exchange but a terrible unit of measure. Investors should be calculating their assets against gold ounces to determine and compare their net worth.

Lastly, he explains the issues of unintended consequences due to government actions affecting everything from labor to logistics. The lobbyists are always encouraging the government and often the problems are magnified and exacerbated.

Time Stamp References:0:00 – Introduction 0:44 – The Sniff Test 3:55 – Basis & Futures 12:20 – Shortages & Price 14:04 – Why Buy Gold? 18:07 – Coinbase & Crypto 23:22 – Gold Backed Bonds 29:00 – Inflation & Green Energy 36:35 – Global Currency Health 42:51 – Valuing Gold 48:32 – Unintended Consequences 52:18 – Wrap Up |

Talking Points From This Episode

– The real reasons behind the current rise in price inflation.

– Keith’s article on the Gold vs. Bitcoin debate.

– Physical gold availability and debunking the “gold price suppression” talk.

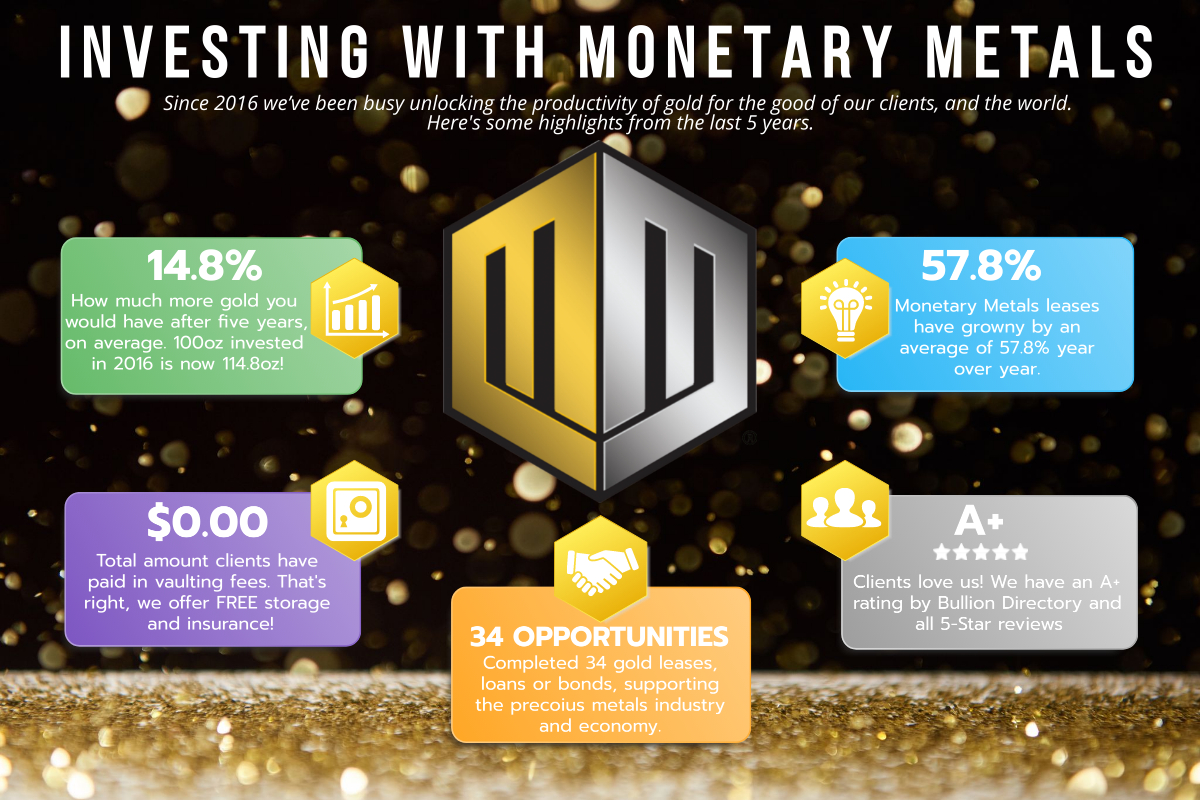

– Keith celebrates Monetary Metals’ first gold bond maturing.

– The reasons for holding gold and using it as a basis of measurement.

Make sure to subscribe to our YouTube channel and Palisades Gold Radio for future interviews like this one!

Tags: Blog,Featured,newsletter,Video