Swiss Franc The Euro has risen by 0.08% to 1.0837 EUR/CHF and USD/CHF, July 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Strong inflation prints this week have not prevented the long-term US interest rates from tumbling. The 10-year yield is about 10 bp lower than where it closed on Tuesday after the lackluster 30-year auction. The 30-year yield itself is 11 bp lower. Fed Chair Powell did not break new ground yesterday and insisted that the bar of “significant further progress” has not been met to begin reducing its bond purchases. A possible deal in OPEC saw a sharp drop in crude oil prices, and there is some follow-through selling today. European yields are lower, though hawkish comments are

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Australia, Canada, Chile, China, Currency Movement, EU, Featured, Federal Reserve, jobs, newsletter, Poland, U.K., USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

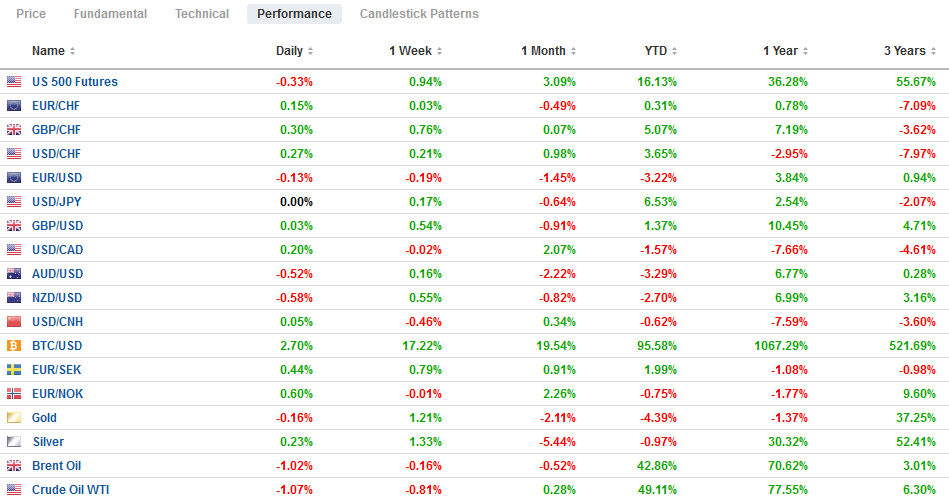

Swiss FrancThe Euro has risen by 0.08% to 1.0837 |

EUR/CHF and USD/CHF, July 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Strong inflation prints this week have not prevented the long-term US interest rates from tumbling. The 10-year yield is about 10 bp lower than where it closed on Tuesday after the lackluster 30-year auction. The 30-year yield itself is 11 bp lower. Fed Chair Powell did not break new ground yesterday and insisted that the bar of “significant further progress” has not been met to begin reducing its bond purchases. A possible deal in OPEC saw a sharp drop in crude oil prices, and there is some follow-through selling today. European yields are lower, though hawkish comments are weighing on UK Gilt prices. Australia’s jobs data were also better than expected, and the 10-year Aussie bond yield fell five basis points and is again at a discount to the US. The dollar is mixed against the majors. The Swiss franc, sterling, and the yen are faring best. The Antipodeans and Scandis are off by 0.2%-0.3%. Advancing emerging market currencies are being led by South Korea (no change in policy rates at today’s meeting) and Taiwan, while the beleaguered rand is leading the losers. The JP Morgan Emerging Markets Currency Index is slightly firmer, trying to post back-to-back gains for the first time in a few weeks. The MSCI Asia Pacific Index rose for the third session this week, despite Japanese and Australian shares not participating. Europe’s Dow Jones Stoxx 600 is threatening to post its second consecutive loss for the first time since mid-June. NASDAQ futures are higher, but the S&P 500 is slightly heavier. Lower yields seem to be aiding gold, which is seeing follow-through buying after taking out the 200-day moving average (~$1825) yesterday. Gold has advanced in nine of the past 11 sessions. It is oscillating around unchanged levels near midday in Europe. The next upside target is seen near $1845. Copper is snapping a three-day slide with a 1% gain. September lumber was at $737 at the end of June and settled yesterday near $612. The CRB Index fell yesterday (-0.35%) to end a four-day advance. |

FX Performance, July 15 |

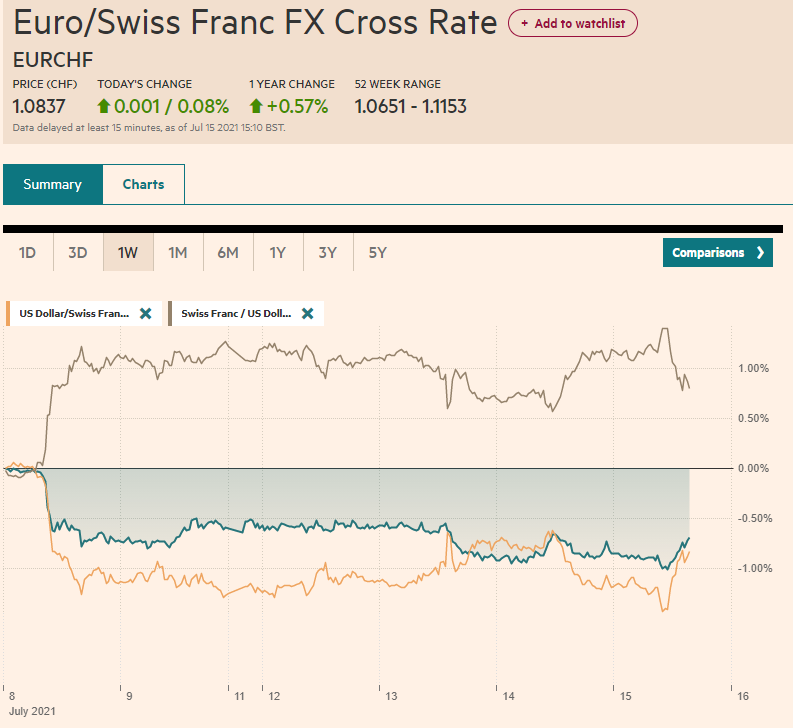

ChinaChina’s Q2 GDP is not a game-changer. For a country where the data is often opaque and whose credibility is frequently questioned by outside observers, the market’s forecasts tend to be fairly good. The median forecast in Bloomberg’s survey was for the world’s second-largest economy to have expanded by 1.0% in Q2, and instead, the government showed a 1.3% expansion. On the other hand, Q1 GDP was revised to 0.4% from 0.6%. |

China Gross Domestic Product (GDP) YoY, Q2 2021(see more posts on China Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

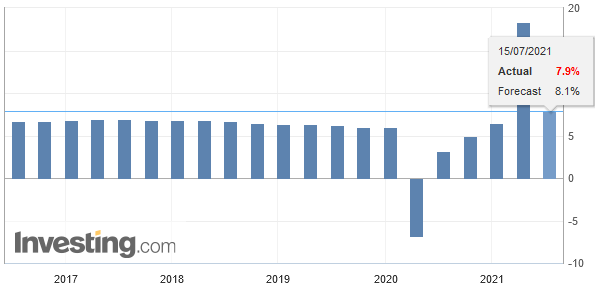

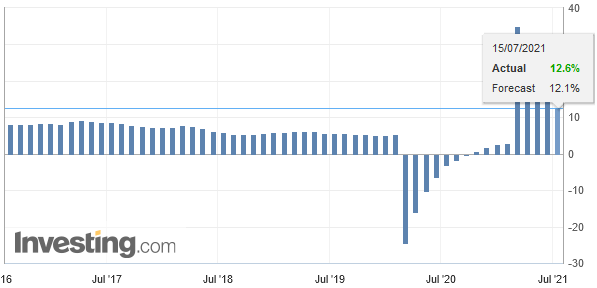

| June retail sales and industrial output year-over-year were stronger than expected, but the base effect means slower sequentially. Retail sales were 12.1% above year-ago levels (12.4% in May and 10.8% expected). |

China Retail Sales YoY, June 2021(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

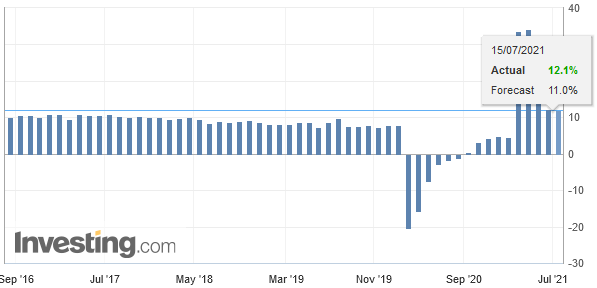

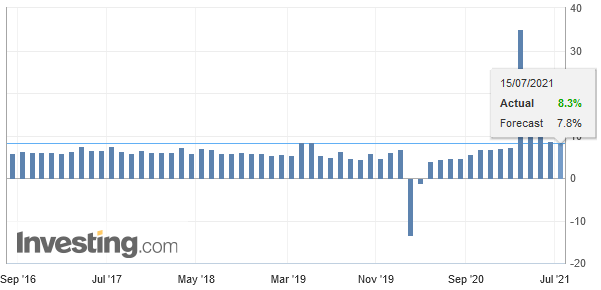

| Industrial output rose 8.3% year-over-year, off from 8.8% in May, but better than the 7.9% forecast. |

China Industrial Production YoY, June 2021(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

| While fixed-asset investment was consistent with the pattern, property investment missed expectations for a 16% increase and rose 15% (down from 18.3% in May). The surveyed joblessness remained at 5%, as anticipated. The takeaway is that there is no strong urgency for Chinese officials to change macro policy. |

China Fixed Asset Investment YoY, June 2021(see more posts on China Fixed Asset Investment, ) Source: Investing.com - Click to enlarge |

Australia’s immigration limits appear to be helping the labor market. Australia reported a 29k increase in employment in June, while the Bloomberg median was for 20k. This understates the strength of today’s report. Full-time positions rose by 51.6k after 97.5k in May. Although the participation rate was unchanged at 66.2%, the unemployment rate unexpectedly fell to 4.9% from 5.1%. It is the lowest unemployment rate since 2011. Separately, note that the July consumer inflation expectations eased to 3.7% from 4.4%. It was at 4% at the end of 2019 and 3.5% at the end of last year.

The pullback in US yields appears to be the main driver of the Japanese yen. Yesterday’s drop in US rates saw the greenback post a bearish outside down day against the yen, and follow-through selling today has brought it to nearly JPY109.70. Last week’s low was near JPY109.55, and a break of it would target the JPY109.00-JPY109.10 area. The BOJ’s meeting concludes tomorrow. It is likely to reduce its growth forecast and provide more details about how it will incorporate climate change into the conduct of monetary policy.

The Australian dollar remains within the range seen on Tuesday (~$0.7425-$0.7505). It still does not appear to be going anywhere quickly, though it has the feel of building a base.

The Chinese yuan is firm, advancing for the fourth session in the past five. The greenback finished the mainland session below the 20-day moving average (~CNY6.4690) for the first time in a month. If CNY6.49-CNY6.50 marks the upper end of the dollar’s range, the market may be fishing for the lower end. Maybe it is CNY6.45 or CNY6.42. The PBOC set the dollar’s reference rate at CNY6.4640. The median projection was for CNY6.4626.

Europe

The UK’s June employment report seemed to capture a labor market in transition. Still, a clear read may not be possible until after the furlough program that subsidizes wages concludes at the end of September. Those claiming jobless benefits fell by 115k after falling by a revised 151k in May (initially reported at almost -93k). Employment (three-month over three-month) in May rose by 25k after 113k in April. The unemployment rate measured by ILO ticked up to 4.8% from 4.7%. Average weekly earnings jumped 7.3% (three-months year-over-year) as the composition of the workforce seems to be shifting with a loss of low-paid jobs.

The Bank of England’s chief economy Haldane stepped down last month, but his voice as the resident hawk may be replaced by Deputy Governor Ramsden. He warned that monetary policy may have to tighten earlier than previously anticipated and warned that CPI may peak near 4% (yesterday, it was reported at 2.4%). MPC member Saunders also echoed these remarks, warning that stimulus may have to be withdrawn soon. However, BOE Governor Bailey was explicit earlier this week that the rise in prices will be temporary. The market is not pricing in any change in the base rate before H2 22.

Tensions between the EU and Poland are escalating. Poland’s Constitutional Court ruled yesterday that injunctions by the European Court of Justice about the country’s judiciary are violating Poland’s constitution and therefore are not binding. When Poland joined the EU in 2004, it accepted that the European law was paramount. Some observers argue that is a step toward Poland leaving the EU. Yet, when the German high court second-guessed the European Court of Justice, there was no talk of a German exit for the EU. Still, the ECJ reaffirmed its judgment that the new disciplinary chamber set up by the Polish government violates the commitment toward impartiality and independence. Separately, the EC initially placed legal measures against Poland and Hungary for violating LGBT rights.

The euro is firm, and although it is extending yesterday’s gains, it remains below the recent highs in the $1.1875-$1.1880 area. It has not traded above $1.19 here in July so far. Initial support is seen near $1.1820, and there are options struck at $1.18 that expire today (~653 mln euros) and tomorrow (~777 mln euros). Sterling remains confined to the range it saw on Tuesday (~$1.38-$1.39). The daily momentum indicators look supportive, but quiet consolidative turnover is the most likely scenario.

United StatesNeither the first leg of Powell’s testimony nor the Beige Book generated much fresh light on the trajectory of the US economy or Fed policy. The takeaway is that the uneven recovery continues, and the tapering is still some ways off. Powell reiterated that it seeks to avoid a taper tantrum by giving investors ample warning of when it decides to reduce bond-buying. |

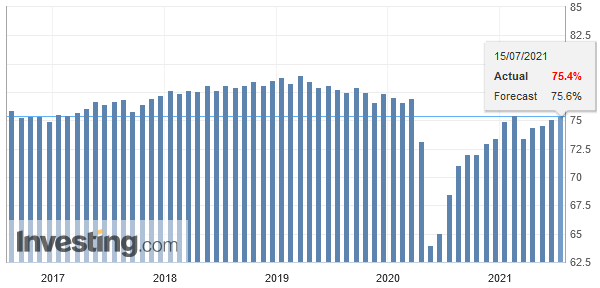

U.S. Capacity Utilization Rate, June 2021(see more posts on U.S. Capacity Utilization Rate, ) Source: Investing.com - Click to enlarge |

| The Fed chief also played down the direct role of the MBS purchases in lifting house prices. He seems more sympathetic to slowing both Treasury and MBS purchases when tapering does begin. Powell vigorously defended the official judgment that price pressures are largely transitory, even while acknowledging the increase is more than expected. Today, Powell testifies before a Senate panel. The questions may differ, but the answers are likely the same. Typically, the market “corrects” the move from the first day of testimony. Today’s high-frequency data includes the weekly jobless claims, the Empire and Philly Fed manufacturing surveys (July) and June import/export prices, and industrial output. Note that Q2 GDP will be reported on July 29, the day after the FOMC meeting concludes. |

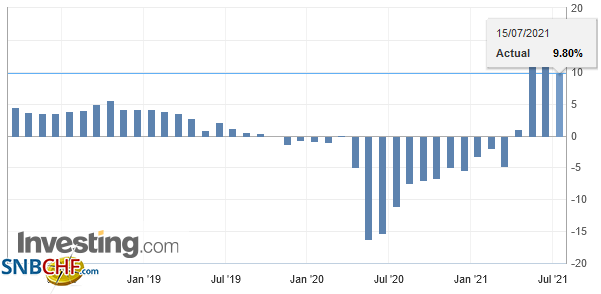

U.S. Industrial Production YoY, June 2021(see more posts on U.S. Industrial Production, ) Source: Investing.com - Click to enlarge |

The Bank of Canada did not surprise yesterday. It reduced its bond-buying to C$2 a week and maintained its view that the output gap would close in H2 22. Still, it shaved this year’s growth forecast but lifted next year’s. At the same time, the central bank was more confident in its economic outlook. Like, the Fed, ECB, and BOE, the Bank of Canada see upward pressure on prices as transitory. The derivatives market appears to have four hikes priced over the next two years. Canada reports existing home sales today, and housing starts, and international portfolio flows tomorrow. The highlight for next week is the May retail sales report.

Despite the Bank of Canada’s continued tapering, the Canadian dollar was unable to draw much succor. The greenback closed firmly above CAD1.25 after a knee-jerk move after the central bank’s decision saw it spike to a low slightly below CAD1.2430. Follow-through buying lifted the US dollar to almost CAD1.2550 earlier today, but it is better offered in the European morning. A break of CAD1.2500 would re-target yesterday’s lows.

The greenback remains within the range set on Tuesday against the Mexican peso (~MXN19.8150-MXN20.0820). It has not traded above MXN20.00 so far today, and if sustained, it would be the first time in nearly two weeks. Intraday support is seen near MXN19.85. As widely anticipated, Chile hiked its cash target rate by 25 bp to 0.75% and signaled that it was the start of the tightening cycle. The peso rose around 0.6% yesterday ahead of the announcement, which took place after the markets closed. The central bank meets again at the end of August. Before that, though, Brazil (August 4) and Mexico (August 12) are likely to raise rates again.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Canada,Chile,China,Currency Movement,EU,Featured,federal-reserve,jobs,newsletter,Poland,U.K.