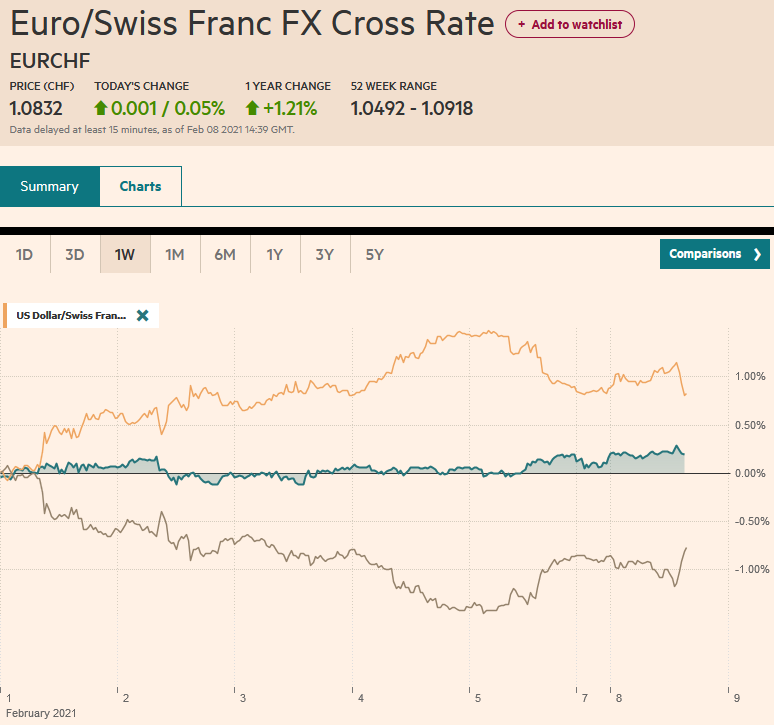

Swiss Franc The Euro has risen by 0.05% to 1.0832 EUR/CHF and USD/CHF, February 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar has drifted higher against the major currencies and most of the freely accessible emerging market currencies, paring the losses seen before the weekend in response to the disappointing employment report. Easing pressure from the pandemic as the surge in cases after the holidays may also be encouraging risk-taking to extend the global equity rally. Several markets in the Asia Pacific region, including Japan, China, India, and Thailand, rose by more than 1%. That was sufficient to lift the Nikkei and the Topix to their best levels since the early 1990s. Led by materials

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movement, Featured, Fiscal policy, newsletter, Oil, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.05% to 1.0832 |

EUR/CHF and USD/CHF, February 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar has drifted higher against the major currencies and most of the freely accessible emerging market currencies, paring the losses seen before the weekend in response to the disappointing employment report. Easing pressure from the pandemic as the surge in cases after the holidays may also be encouraging risk-taking to extend the global equity rally. Several markets in the Asia Pacific region, including Japan, China, India, and Thailand, rose by more than 1%. That was sufficient to lift the Nikkei and the Topix to their best levels since the early 1990s. Led by materials and financials, Europe’s Dow Jones Stoxx 600 is extending last week’s nearly 3.5% advance. US shares are enjoying a firmer tone, as well. Benchmark 10-year bond yields are 2-3 bp higher in the US and most of Europe. Italian bonds are a bit more resilient, and the premium over Germany is near 95 bp, a new 11-year lows. The US 10-year reached almost 1.20%, its highest since the chaos last March. Gold marginally extended its recovery off last week’s two-month low, near $1785. A move above $1820 could spur another $10 rally. Meanwhile, oil continues to march higher. March WTI is up for the sixth consecutive session to build on last week’s nearly 9% advance. It has reached about $57.70, and there is little resistance ahead of $60. |

FX Performance, February 8 |

Asia Pacific

China reported that its reserves unexpectedly slipped last month. A small increase from the year-end valuation of $3.216 was anticipated. Instead, reserves fell to $3.210, the first decline since October, but are $95 bln higher than a year ago. The decline may be a function of valuation adjustments. Major reserve currencies, outside the dollar, fell, and main investments, bonds, fell. The PBOC estimates the value of its gold holdings fell by about $1.5 bln. Nevertheless, the yuan remains a heavily-managed currency. The large trade surplus and portfolio capital inflows are associated with an appreciating currency. Many suspect the yuan would be rising faster if it were not being checked. Pressing for greater transparency is the first step.

Japan’s December current account surplus eased to JPY1.17 trillion ($11 bln) from JPY1.19 trillion last November. The decline contrasts with the JPY350 bln increase in the trade surplus (JPY965 bln from JPY616 bln). Japanese investors stepped up their purchases of French and Italian bonds in December. Its French bond purchases of almost JPY450 bln was the most in more than a year. They also bought JPY424 bln of Italian bonds, the most in four months. For the year as a whole, Japanese investors bought JPY3.75 trillion of Australian bonds and JPY1.48 trillion Canadian bonds. Both appear to be the highest on record. On the other hand, Japanese investors for net sellers of foreign equities for the first time since 2013. In 2020, foreign investors sold JPY2.79 trillion of Japanese bonds, the first annual net sales since at least 2014, but bought a record JPY21.4 trillion T-bills.

Taiwan reported record exports and imports last month to drive the trade surplus to $6.19 bln, about 20% more than economists forecast. Exports rose 36.8% year-over-year (12% in December), while imports jumped almost 30% (less than 1% in December). Exports to Hong Kong and China rose 57.0% year-over-year. Exports to the US and Japan rose 21.9% and 21.5%, respectively. Shipments to Vietnam increased by nearly 82%. On the import side, China and Hong Kong rose by almost 47%, almost 77% from South Korea and 66% from Thailand. Intra-Asian trade is impressive.

The dollar held above JPY105.30 support and continue to flirt with the 200-day moving average (~JPY105.60). The pre-jobs data high was a little above JPY105.75. Rising yields and rising equities are often seen as negative for the yen. The Australian dollar briefly and marginally rose above last week’s high but stalled a little above $0.7680. An option for A$1 bln at $0.7650 expires today and may attract prices. The PBOC set the dollar’s reference rate at CNY6.4678, a touch softer than expected. The yuan has traded broadly sideways so far this year. The offshore yuan has also been rangebound, mostly between CNH6.44 and CNH6.50.

Europe

Following last week’s disappointing factory orders (the 1.9% decline in December was nearly twice what was expected), Germany reported no change in industrial output. The median forecast in the Blomberg survey was for a 0.3% gain. The disappointment was mitigated by the revision in the November series to 1.5% from 0.9%. In contrast, Spain reported a 1.1% jump in industrial output in December. Economists had expected a 0.3% increase after a 0.9% decline in November. Italy reports its figures tomorrow, and the aggregate report for the euro area is due in a week.

Italy’s Draghi is holding the second round of talks, but it is increasingly likely that he will lead the next government. A cabinet could be named later this week, and confidence votes held in parliament next week. The Five Star Movement, the largest party in the lower house, initially seemed opposed, but going to the polls now would have dealt a blow to the party that grew out of the crisis a decade ago. The (Northern) League, on Italy’s political right, has also indicated support after initial hostility. Several small and moderate parties also support Draghi. The far-right Brothers of Italy appears to be the notable holdout. A poll over the weekend found more than half of Italy wants Draghi to be prime minister until 2023, when the next parliament election is due.

The euro initially extended the pre-weekend recovery but stalled near $1.2055 before pulling back toward $1.2020 in the European morning. There are two option expirations of note today. One is at $1.20 for 1.1 bln euros, and the other is at $1.2050 for a little more than 625 mln euros. The limited follow-through buying after the key upside reversal after the US jobs data is somewhat disappointing. However, so far, the price action is consolidative in nature, confining the euro to a relatively narrow range near the pre-weekend high. Sterling saw the least possible follow-through (it was worth 1/100 of a cent) and struggled to sustain a foothold above $1.3700. The pre-weekend low was a little under $1.3665, and a break of $1.3635-$1.3655 would weaken the technical tone. Of note, the euro is gaining on sterling for the second consecutive session. It does not sound like much, but it is the first time this year that the euro could post back-to-back gains.

America

While the rise in long-term US yields has captured market participants’ imagination, less noticed has been the slippage of short-term rates. The two-year yield fell to a marginal new record low ahead of the weekend, just above 10 bp. The Eurodollar benchmark rate is also at record lows. Other money market rates are lower, The system is awash with cash. The Treasury is drawing its cash balances at the Fed down, and this is expected to be a trend in the coming months. Partly this is to pay for the stimulus, and partly it is a function of the budget process and the pending debt ceiling, which requires the cash holdings be reduced to a little less than $120 bln from over $1 trillion. One implication is that the US 2-year premium over Germany has fallen to almost 80 bp, the lowest level since last August. In contrast, the US 10-year premium over Germany has edged up to 1.61%. A 10-month high was set last month near 1.68% before falling to around 1.56% at the end of January. Another implication is that US T-bill yields may dip below zero.

Separately, the US quarterly refunding kicks off tomorrow. It will sell $126 bln in coupons. The backing up of yields offers a concession to investors. Demand at the long-end will be closely monitored, but recall that demand last month was robust. Assuming that these sales go off without a hitch, some post-auction bounce cannot be ruled out.

The US 10-year yield is higher for the eighth consecutive session. The yield has risen around 17 bp during this run. Most explanations focus on inflation expectations driven by the $1.9 trillion stimulus proposal that follows on the heels of the $900 bln packaged at the end of last year. Noted economists Summers and Blanchard seemed to play up the inflationary risks, even though inflation spurred by overheating of the economy has not been seen in more than 30 years, the link between deficits and inflation is far from clear, and that is before a discussion about modern monetary theory. Meanwhile, oil prices are higher for the sixth session and have risen by about 10% during this run. It looks like it has been driven primarily by supply considerations, which will wane. Indeed, that is what the backwardation in the oil market means (higher prices near-term, lower prices medium-term).

The economic calendar of North America is light today. The week’s highlights include the US and Mexico’s January CPI and Mexico’s central bank meeting (February 11). The market expects a 25 bp rate cut that will bring the overnight target to 4%. The Fed’s Mester speaks today and Bullard tomorrow, but the highlight is Chair Powell on Wednesday at the Economic Club of New York.

The US dollar is pinned near the pre-weekend low against the Canadian dollar. It has not been able to distance itself much from the CAD1.2755 low, which is slightly above the 20-day moving average (~CAD1.2745). Initial resistance is seen around CAD1.28. Similarly, the greenback has held above the MXN20.08 area seen after the US jobs disappointment (and the 20-day moving average is around MXN20.02). Initial resistance is seen in the MXN20.20-MXN20.25 area, but only a move above MXN20.50 is noteworthy.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,Currency Movement,Featured,fiscal policy,newsletter,OIL