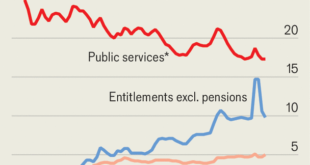

Says The Economist. The authors argue that falling state capacity, incompetence, corruption, and transfer/entitlement spending, which crowds out public investment and services, are to blame. Update: Related, in VoxEU, Martin Larch and Wouter van der Wielen argue that [g]overnments lamenting a stifling effect of fiscal rules on public investment are often those that have a poor compliance record and, as a result, high debt. They tend to deviate from rules not to increase public investment...

Read More »US Benchmark Payroll Revisions Over-Hyped? Dollar may Benefit from Buying on Fact after Being Sold on Rumors

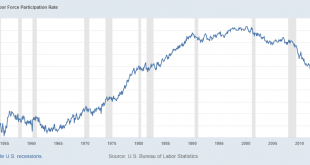

Overview: The preliminary annual revision to US jobs growth is front and center today. It has gotten more play that usual, amid speculation of a historically large revision. Yet, the direct impact on policy may be minimal. Federal Reserve officials, including Chair Powell, acknowledged that the payroll growth may have been overstated. Moreover, the Fed's judgment of the labor market is not based on one element of the multidimensional labor market. Indeed, given the...

Read More »Dollar Slips but Dip may Offer New Opportunity

Overview: The US dollar is offered today. It is trading softer against all the G10 currencies, with the yen the notable exception, and it is flat. The Antipodean are leading the way, taking out last week's highs, as has the euro. That said, the intraday momentum indicators are stretched as NY dealers return from the long holiday weekend. The Scandis are also trading above last week's highs. The yen, sterling, Canadian dollar, and Swiss franc are still inside last...

Read More »Calmer Capital Markets…for the Moment

Overview: The capital markets are quiet today. Equity markets and bond yields have a slight upside bias, while the dollar is little changed. Despite reports that the lockdown in Chengdu is easing, Chinese equities underperformed in the Asia Pacific region. Japan, Hong Kong, Taiwan, and Australia eked out modest gains. After sliding around 2.4% over the past two sessions, the Stoxx 600 is up fractionally. US futures have edged slightly higher. The US 10-year yield is...

Read More »Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large. George Carlin The quote from Dickens above is one that just about everyone knows even if they don’t know where it comes from or haven’t read the book. But, as the ellipsis at the end indicates, there is quite a bit more to the line than the part everyone remembers. It was the best of...

Read More »FX Daily, February 16: Greenback Remains Heavy

Swiss Franc The Euro has risen by 0.04% to 1.0799 EUR/CHF and USD/CHF, February 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equity rally appears undeterred by the rise in interest rates or the surge in oil prices. Led by Tokyo and Hong Kong, Asia Pacific equities advanced. China, Taiwan, and Vietnam markets remain closed. After gapping higher yesterday and extended the gains in early turnover today,...

Read More »FX Daily, February 9: Players are Not Buying Everything Today

Swiss Franc The Euro has fallen by 0.18% to 1.0807 EUR/CHF and USD/CHF, February 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally of US benchmarks to new record highs helped lift most Asia Pacific markets today, but the bulls are pausing in Europe, and there has been little follow-through buying of US shares. Australia, South Korea, and Indonesia did not participate in today’s regional advance led by...

Read More »FX Daily, February 8: Limited Follow-Through Dollar Selling to Start the Week

Swiss Franc The Euro has risen by 0.05% to 1.0832 EUR/CHF and USD/CHF, February 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar has drifted higher against the major currencies and most of the freely accessible emerging market currencies, paring the losses seen before the weekend in response to the disappointing employment report. Easing pressure from the pandemic as the surge in cases after the...

Read More »Comments on Geneva Report 23

Panel with Elga Bartsch, Agnès Bénassy-Quéré, Giancarlo Corsetti, Olivier Garnier, and Charles Wyplosz. Moderated by Tobias Broer. Elga Bartsch, Agnès Bénassy-Quéré, Giancarlo Corsetti, Xavier Debrun: Geneva Report 23 | It’s All in the Mix: How Monetary and Fiscal policies Can Work or Fail Together. Event at PSE. My comments on the report.

Read More »“Wirtschaftspolitik in Corona-Zeiten (Economic Policy in Times of Corona),” FuW, 2020

Finanz und Wirtschaft, December 9, 2020. PDF. Economic policy is not about GDP growth. It’s about welfare. Externalities are key. Infection externalities don’t go away by calling for responsible behavior. Infection externalities can turn positive. Keeping worthy companies or networks alive does not require government intervention, unless capital markets don’t work. To judge the right amount of burden sharing is beyond economics. But economics gives some clues: In an ideal world,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org