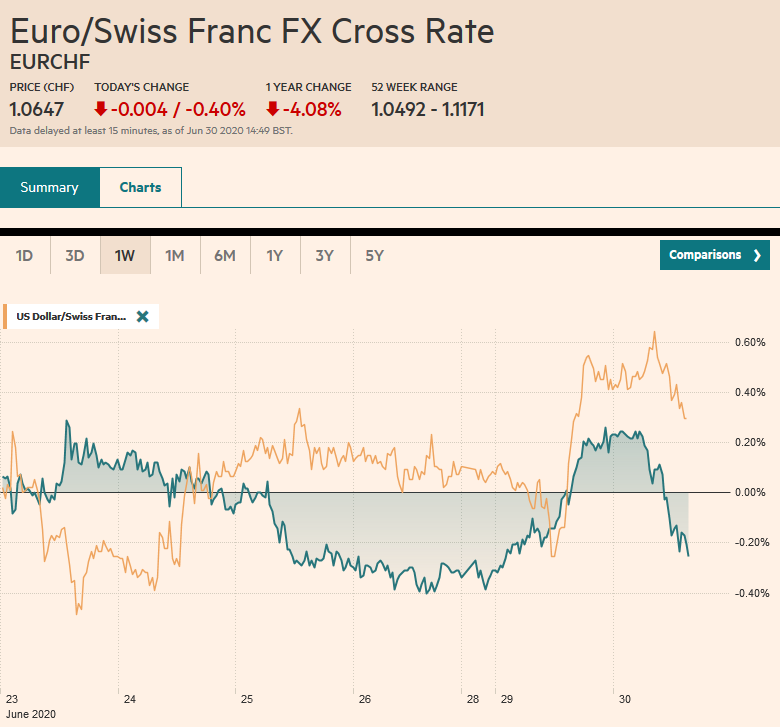

Swiss Franc The Euro has fallen by 0.40% to 1.0647 EUR/CHF and USD/CHF, June 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The gains in US equities yesterday carried into Asia Pacific trading today, but the European investors did not get the memo. The Dow Jones Stoxx 600 is succumbing to selling pressure and giving back yesterday’s gain. Energy and financials are the biggest drags, while real estate and information technology sectors are firm. All the markets had rallied in the Asia Pacific region, with the Nikkei and Australian equities leading with around 1.3% gains. US shares are trading lower. Bond markets remain quiet, and yields are little changed. The US 10-year benchmark is near 63 bp. The US

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, China Manufacturing PMI, China Non-Manufacturing PMI, ECB, EUR/CHF, Eurozone Consumer Price Index, Featured, Federal Reserve, FX Daily, HK, Japan, newsletter, South Korea, Spain Gross Domestic Product, U.S. Chicago Purchasing Managers Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.40% to 1.0647 |

EUR/CHF and USD/CHF, June 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

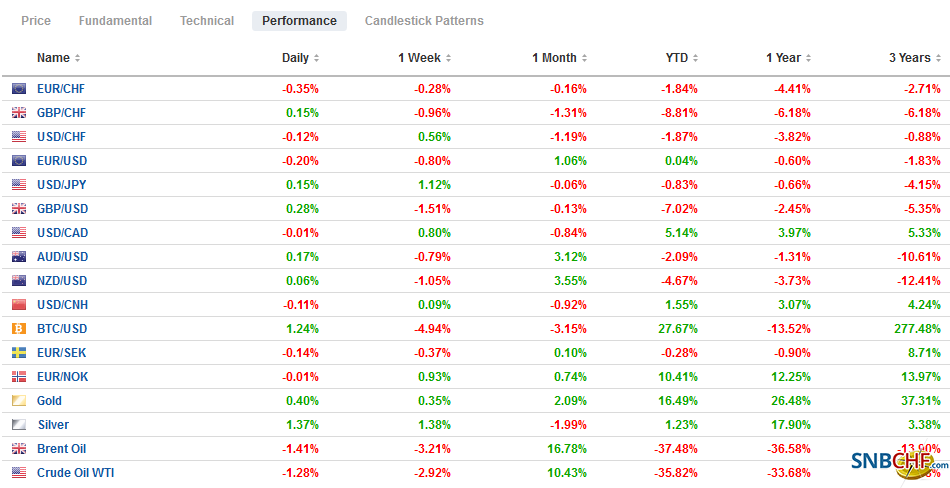

FX RatesOverview: The gains in US equities yesterday carried into Asia Pacific trading today, but the European investors did not get the memo. The Dow Jones Stoxx 600 is succumbing to selling pressure and giving back yesterday’s gain. Energy and financials are the biggest drags, while real estate and information technology sectors are firm. All the markets had rallied in the Asia Pacific region, with the Nikkei and Australian equities leading with around 1.3% gains. US shares are trading lower. Bond markets remain quiet, and yields are little changed. The US 10-year benchmark is near 63 bp. The US dollar is stronger against all the major currencies, with the dollar bloc and Scandis down the most, while the yen and Swiss franc are resilient. Emerging market currencies are mostly lower, though both the Chinese yuan and Indian rupee are firmer. Gold is straddling the $1770 area and is sticking close to the recent highs. August WTI posted an outside up day yesterday but continues to be stymied near $40. |

FX Performance, June 30 |

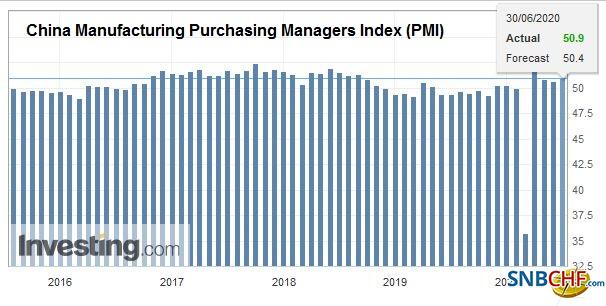

Asia PacificChina’s PMI was stronger than expected, but many observers are not convinced a robust recovery is underway. The manufacturing PMI rose to 50.9 from 50.6, |

China Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on China Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| and the non-manufacturing PMI rose to 54.4 from 53.6. This lifted the composite to 54.2 from 53.4. Export orders rose. |

China Non-Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on China Non-Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Japan reported a deterioration in its lower market and continued weakness in the industrial sector. The unemployment rate rose to 2.9%, its highest in three years, from 2.6% in April. The job-to-applicant ratio fell to 1.2 from 1.3. Industrial output slid 8.4% in May (month-over-month) after falling 9.8% in April. Separately, the BOJ boosted its bond-buying in July but did not increase the buying of the very long maturities, which seems to signal acceptance of a steeper curve. The 10-30 year spread was already at three-month highs.

South Korea’s industrial output fell 6.7% in May, matching the April decline. The weakness in Japan and South Korea’s industrial sector may also be impinging on China’s recovery. The central bank is preparing to buy US Treasuries on a repo basis from banks to boost liquidity.

As China approved the new security law in Hong Kong, the US announced export restrictions on sensitive technology and halting the export of defense equipment. Even if the US were levy tariffs on Hong Kong imports as it does the mainland, the impact might be modest–more symbolic than substantive. Hong Kong specializes in financial and logistic services, not manufactured good exports. The US ran a $26 bln trade surplus with Hong Kong last year, among the biggest bilateral surpluses. Estimates suggest that around 1300 US companies are represented in Hong Kong, 800 of which have regional headquarters.

The dollar is trading in the upper end of yesterday’s range against the Japanese yen when it peaked just shy of JPY107.90. It is in about a quarter of a yen range so far today. It has not traded above JPY108 since June 9. It has held above JPY107.50. There are $1.6 bln in options that will expire today struck between JPY107.35 and JPY107.50. For the fourth session, the Australian dollar has been capped in front of $0.6900. There is a A$1.4 bln option there that expires today. The lower end of the consolidative range it has been stuck in for the last couple of weeks is about $0.6770-$0.6800. A break could signal another cent decline. The PBOC set the dollar’s reference rate a little stronger than the models implied and announced a 25 bp cut in the rediscount rate.

EuropeLast month the German Constitutional Court cast doubt on the legitimacy of the ECB’s Public Sector Purchase Program, the bond-buying operation that preceded the pandemic. It claimed that the European Court of Justice ruling exceeded its mandate. European and German officials have sought to address the former while ignoring the latter. It is not a small matter as no fewer than three German ECB officials, including a Weidmann’s predecessor at the hall of the Bundesbank, resigned in recent years over asset purchases. The ECB forwarded the documents to the Bundesbank, which gave them to the President of the Bundestag, providing evidence of its ongoing discussion over the proportionality of its response. A bill that broadly supported by the two main parties that make up the governing coalition, the Greens, and the FDP will be debated in the coming days. Its passage is virtually certain, which clears the way for the Bundesbank to continue to participate in the PSPP. |

Eurozone Consumer Price Index (CPI) YoY, June 2020(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

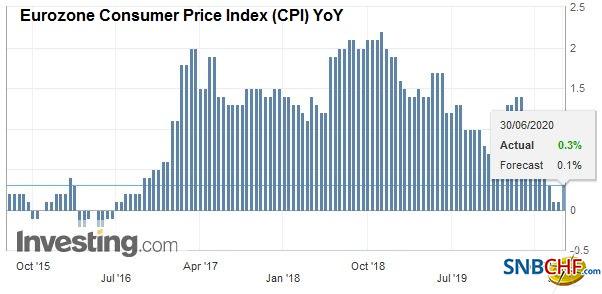

| After Germany reported a larger than expected rise in May CPI, it was clear that deflation was going to be avoided for the euro area as a whole. This was born out in today’s report. Eurozone CPI rose by 0.3% in May and on a year-over-year basis. In April, it has fallen by 0.1% and was up 0.1% year-over-year. The core rate slipped to 0.8% from 0.9%. |

Spain Gross Domestic Product (GDP) QoQ, Q1 2020(see more posts on Spain Gross Domestic Product, ) Source: investing.com - Click to enlarge |

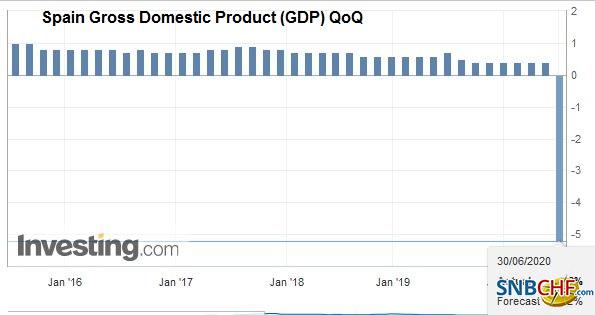

UK Prime Minister Johnson is endorsing a “New Deal” for Britain. Extracts from his speech reflect the call to accelerate spending on roads, schools, and hospitals. Meanwhile, as the UK is accelerating its efforts re-open the economy, Leicester has had to re-close schools and non-essential shops after a flare-up in cases. Separately, it reported that Q1 GDP contracted by 2.2% rather than 2.0% of the earlier estimate. Consumption was the main culprit. It contracted by 2.9% instead of 1.7%. The external account was a larger drag, and government spending fell more than expected.

The euro stalled near $1.1290 yesterday and is testing the $1.12 area today. There is an option for 1.6 bln euros at $1.1185 that expires today and an option for 1.5 bln euros at $1.1250 that also rolls off today. Last week’s low was a touch below $1.1170, and below there, the $1.1150 area corresponds to the halfway point of the leg up from the dip below $1.09 on May 25. Sterling is holding barely above yesterday’s low (~$1.2255) in the European morning, which is also the low for the month. The next big target on the downside is a little above $1.21, where the (50%) retracement objective of the rally off the March lows. However, the intraday technical indicators warn that a bounce is likely first. The $1.2300-$1.2320 area offers initial resistance now.

America

A few weeks after making its Secondary Market Corporate Credit Facility operational by purchasing first ETFs of corporate bonds, and then individual issues, the Federal Reserve announced yesterday that its Primary Market Corporate Credit Facility was now open. The primary facility allows the SPV the Fed has established to be the sole investor in a bond issuance or portions of bond issued or syndicated loans. The Treasury Department seeded both of these facilities with a combined $75 bln from the CARES Act (initial allocation is $50 bln for the Primary facility and $25 bln for the secondary). The combined size of both facilities is initially capped at $750 bln. That means that the Primary facility will lever the Treasury’s money 10x while the Secondary facility will be levered 7x.

These facilities, like the others launched by the Fed, are temporary, and the purchases currently stop at the end of Q3. Through June 24, the Fed had bought a little less than $9 bln of corporate bonds and corporate bond ETFs. That said, as we have noted previously, many of the Fed’s emergency facilities have considerably greater capacity than has been tapped. Initiatives, like the repo operations and swap lines with foreign central banks, are being unwound as they are no longer needed. The Fed has re-embraced the ample reserve regime, and the dollar-funding markets are functioning again.

Among the efforts that have been pulled back, the Federal Reserve has slowed its Treasury purchases to $4 bln a day from a peak of $75 bln. Some observers worry that this means that it is only buying a quarter of the new issuance. That could be an issue at some juncture, but it is not now. The US five-year yield fell to new record lows yesterday (~26.5 bp) The 10-year yield is below 65 bp, its lowest level since mid-May. The 10-year break-even (difference been the convention yield and the inflation-protected security) has crept higher from about 115 bp at the end of May to 133 bp now. It had finished January near 165 bp. The 2-10 year yield curve is virtually flat on the month a little below 15 bp.

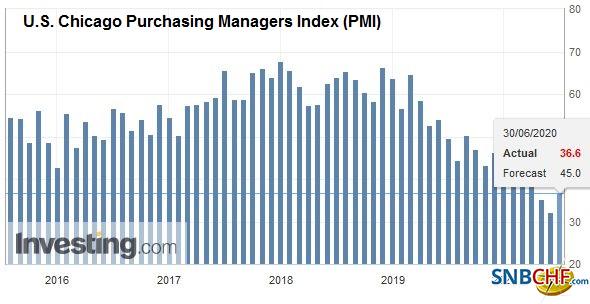

| The US reports house prices, the Chicago PMI, and the Conference Board’s consumer confidence. None are typically market-moving, even in the best of times. Quarter-end portfolio rebalancing and adjustments may dominate. Powell and Mnuchin testify before Congress. Powell’s prepared remarks have been published. In addition to recognizing the “extraordinary uncertainty,” the Fed Chief encourages Congress not to withdraw support prematurely. Note that at the end of business today, the SBA will stop approving new Payroll Protection Program loans/grants. Reports suggest that nearly $135 bln is unused. Separately, Canada reports April GDP. It may be too historic to have much impact. Still, it is expected to have declined by more than 12% after the March contraction of 7.2%. |

U.S. Chicago Purchasing Managers Index (PMI), June 2020(see more posts on U.S. Chicago Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

The US dollar is firm near CAD1.37. The high from last week is near CAD1.3715, and assuming this is surmounted, the next target is near CAD1.3770 and then CAD1.3830. Initial support is seen around CAD1.3650. The greenback is finishing the month with new highs against the Mexican peso (~MXN23.20). It had closed May near MXN22.1760. The next resistance area is near MXN23.30-MXN23.35. Initial support is expected in front of MXN22.90.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,China Manufacturing PMI,China Non-Manufacturing PMI,ECB,EUR/CHF,Eurozone Consumer Price Index,Featured,federal-reserve,FX Daily,HK,Japan,newsletter,South Korea,Spain Gross Domestic Product,U.S. Chicago Purchasing Managers Index,USD/CHF