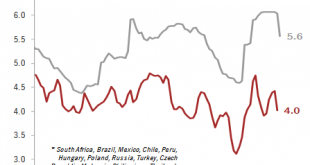

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward.Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a lower oil price and less...

Read More »Emerging market sovereign debt update: yields are falling

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward. Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a...

Read More »EM storm is subsiding, but clouds remain

We are waiting for trade-war clouds to become less threatening before adopting a more positive stance on EM debt.In a Flash Note in May, we argued that the rise in yields of emerging market (EM) debt could offer compelling opportunities for investors who had the patience to ride out the storm. EM credit spreads and yields have indeed recently being shown some signs of stabilising after a period of rising yields. The faltering rise in US Treasuries yields, some effective EM rate hikes and the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org