The step away from the edge of the abyss may have stirred the animal spirits, but it remains precarious at best. The formal withdrawal of the extradition bill in Hong Kong is too late and too little at this juncture. The ambitions of the protests have evolved well beyond that. Italy has a new government, but a prolonged honeymoon is unlikely for this unlikely union. Face-to-face talks between the US and China are better than no talks but hardly indicates an end to...

Read More »FX Daily, August 30: US Dollar Finishing August on Firm Note as Euro nears Two-Year Lows

Swiss Franc The Euro has fallen by 0.03% to 1.0903 EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are advancing at least in part on ideas that trade tensions are easing. China announced it would not take immediate action on the five percentage point increase in levies that the US announced strictly in response to China’s retaliatory tariffs. A lull between...

Read More »FX Daily, March 26: Semblance of Stability Re-Emerging

Swiss Franc The Euro has risen by 0.06% at 1.1231 EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sell-off in equities seemed to peak yesterday, and US indices were narrowly mixed. Traders found comfort in that performance, even though the S&P 500 finished a little below 2800, and took the markets in the Asia-Pacific region...

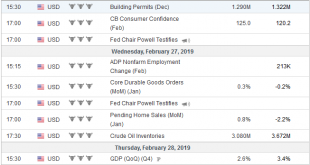

Read More »FX Daily, February 26: Brexit Dilution Lifts Sterling, while Yesterday’s Equity Rally Fades, Powell Awaited

Swiss Franc The Euro has fallen by 0.02% at 1.1363 EUR/CHF and USD/CHF, February 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The increased likelihood that Brexit is delayed and the possibility of a second referendum is helping lift sterling. As has been the case for most of the time since the June 2016 referendum, the prospects of a softer and/or later...

Read More »FX Weekly Preview: The Week Ahead

After a dismal end of 2018, investors are faring better through the first two- thirds of the Q1 19. Equity markets have recouped a good part of the late-2018 decline. Bond yields, however, have not returned to where they previously were. The tightening of financial conditions, which was both cause and effect of heightened anxiety among investors, and spooked some central bank have eased considerably. The volatility of...

Read More »FX Daily, February 05: Greenback Remains Firm

Swiss Franc The Euro has fallen by 0.04% at 1.1407 EUR/CHF and USD/CHF, February 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is little firmer against most of the major currencies. Despite some disappointing data (retail sales, trade, PMI), the Australian dollar has recovered from initial losses below $0.7200 on the back of the central bank’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org