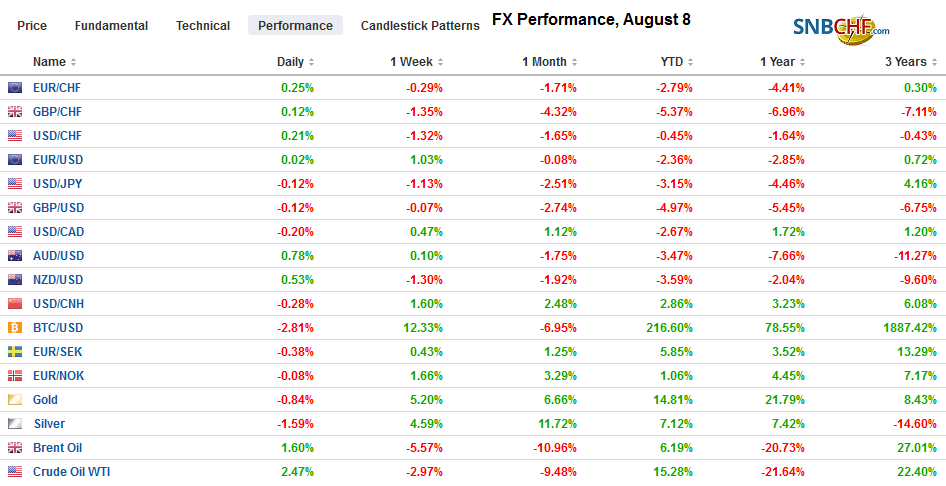

Swiss Franc The Euro has risen by 0.27% to 1.0948 EUR/CHF and USD/CHF, August 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The challenges for investors have not gone away, but a combination of factors has helped stabilize the capital markets. The PBOC set the dollar’s reference rate above CNY7.0, but not as high as anticipated, and this has seen the yuan strengthen modestly today. Meanwhile, the strong recovery in the S&P 500 has spilled over and helped lift global equities. Asia Pacific equities were led higher by a 13% gain China’s CSI300; ending a six-day decline with its biggest advance in a month. Europe’s Dow Jones Stoxx 600 is posting gains for the

Topics:

Marc Chandler considers the following as important: $CNY, $PHP, 4.) Marc to Market, 4) FX Trends, Currency Movements, EUR/CHF, Featured, FX Daily, Italy, Japan Current Account n.s.a., MXN, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.27% to 1.0948 |

EUR/CHF and USD/CHF, August 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

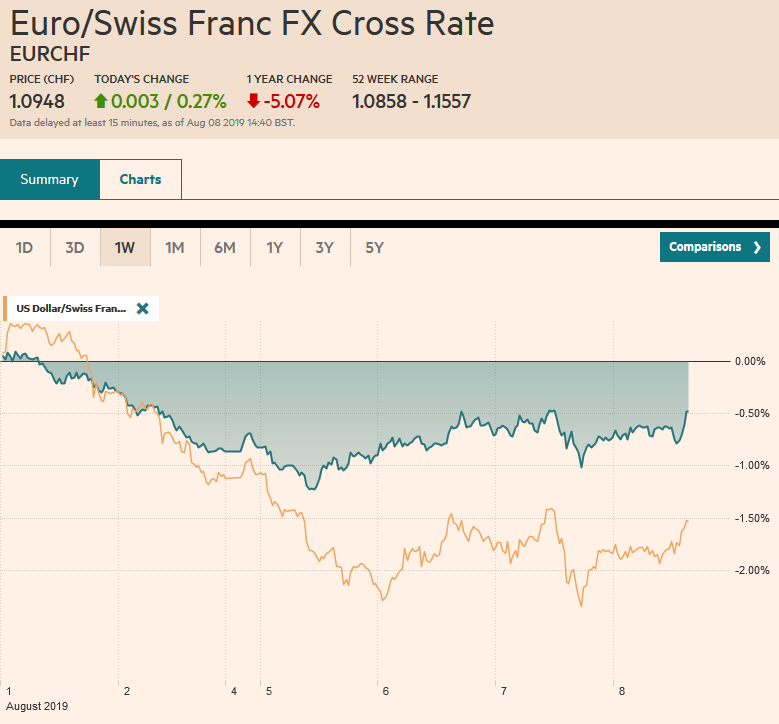

FX RatesOverview: The challenges for investors have not gone away, but a combination of factors has helped stabilize the capital markets. The PBOC set the dollar’s reference rate above CNY7.0, but not as high as anticipated, and this has seen the yuan strengthen modestly today. Meanwhile, the strong recovery in the S&P 500 has spilled over and helped lift global equities. Asia Pacific equities were led higher by a 13% gain China’s CSI300; ending a six-day decline with its biggest advance in a month. Europe’s Dow Jones Stoxx 600 is posting gains for the second session. The 0.8% gain in the morning has been led by information technology and health care. US shares are also trading higher, extending yesterday’s recovery. The gap created by Monday’s sharply lower opening (~2898.1-2914.1) is important for the near-term outlook. The dollar is weaker against most of the major and emerging market currencies in relatively quiet turnover. Among the majors, the recently beaten-up Australian and New Zealand dollars are leading the way. The Philippines became the latest emerging market central bank to cut rates, but the peso is poised to end its six-day slide. Gold is slipping back below $1500 and oil is firm following reports Saudi Arabia is seeking to strengthen efforts to stabilize prices. |

FX Performance, August 8 |

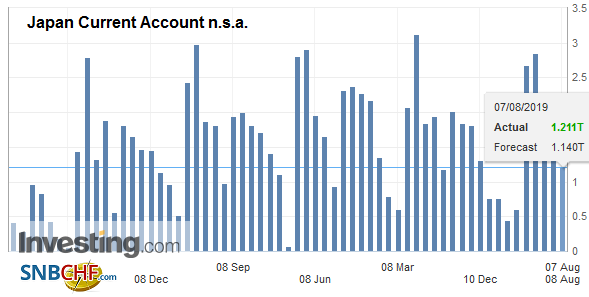

Asia PacificThe PBOC set the dollar’s reference rate above CNY7.0 for the first time in over a decade. However, analysts estimating were it should be based on their models were surprised that it was not set even stronger. The fix was at CNY7.0039, but it was projected to be a little above CNY7.0150. The signal was that the PBOC was stabilizing the yuan. The yuan strengthened by about 0.2% against the dollar. Yesterday China reported that its reserves edged slightly lower in July to about $3.104 trillion from $3.119 trillion. The small change can be explained through shifts in valuation, and it confirms what many suspected, namely, minimal intervention. Today, China reported a narrower trade surplus of $45.1 bln in July vs. $51.0 bln in June, but the details were constructive. Exports rose 3.3% year-over-year. Economists had expected another decline after June’s 1.3% fall. Imports slid 5.6% in July, less than the 7.4% drop in June and the 9% decline economists expected. Of note, exports to the US fell 6.5% year-over-year, while its bilateral surplus is 11% larger in the first seven months of 2019 compared with the same period last year. China appears to be re-orienting its trade, as one would expect given the US tariffs. Exports to Europe rose 6.5% and 15.6% to ASEAN. Japan reported a larger than expected June current account surplus of JPY1.21 trillion. It was smaller than the May surplus of JPY1.59 trillion, but this was primarily due to seasonal factors, and on an adjusted basis, the surplus is the largest since October 2017. However, the news that captured the attention of investors today was Japan’s decision to resume exports to South Korea of some materials needed to make semiconductor chips. This seemed to be the first thaw in a few weeks. Japanese chip material companies and South Korean firms rallied on the news. |

Japan Current Account n.s.a. June 2019(see more posts on Japan Current Account n.s.a., ) Source: investing.com - Click to enlarge |

The Philippines first reported a disappointing Q2 GDP of 5.5%. It is the slowest in five years and was below the median forecasts. This solidified expectations for a quarter-rate cut that was quickly delivered. The rate corridor is now 3.75%-4.25%. Rate cuts were delivered in April and June, and with 2.4% inflation, the economists expect another reduction in Q4.

The dollar has been confined to a narrow JPY106.00-JPY106.30 range through the European morning as it consolidates. Until the dollar resurfaces above JPY107, it will remain on the defensive. There is a nearly $925 mln option at JPY106 that expires today, and the JPY106.20 for almost $530 mln also expires. Another option at JPY106.50 for around $470 mln will be cut too. The Australian dollar is more than a cent above yesterday’s lows (~$0.6675) but is running into resistance near $0.6800. Above there a move above $0.6820-$0.6830 would suggest a correction rather than just consolidation.

Europe

Political pressures in Italy are on the rise. League leader Salvini has been teasing his supporter about flexing party’s muscles. Even though the League is ostensibly the junior partner in the coalition, Salvini’s sheer will and bullying appear to have given the League the upper hand. It did better in the European Parliament election than the Five Star Movement. Often the extreme parties do well in the EP elections and Salvini has been pushing it to his advantage. He is reportedly demanding more seats for the League in the government. Salvini appears to have targeted the Transportation Minister Toninelli and wants to replace Finance Minister Tria. Salvini apparently has given Prime Minister Conte until Monday. The polls suggest a center-right government is likely if Italy has national elections now Salvini may see the Five Star Movement as his main obstacle to becoming Prime Minister himself. This is leading to Italian bonds underperforming today.

The ECB’s monthly bulletin is sobering and paves the way to action next month. The central bank worried about the “prolonged uncertainty dampening economic sentiment.” This is especially true in manufacturing, but the drop in the global services PMI was noted as a potential signal of a more broad-based erosion of the global outlook. German industrial output drop of 1.5% in June (the average decline of 1.1% in the April-June period is the worst three month average since April 2009) underscores expectations that the German economy contracted in Q2. The data will be reported next week.

The euro is trading inside yesterday’s range, which was inside Tuesday’s. This consolidative pattern is often seen as a continuation pattern, and that would point higher. However, the market seems tentative and the expiration of 2.6 bln euros of options today in the $1.1230-$1.1240 may be a sufficient check today, barring new developments. Initial support is pegged near $1.1180. Sterling is also consolidating with a slightly firmer tone. It appears comfortable in the $1.21-$1.22 range or so pending fresh incentives. The euro is up about almost 0.9% against the sterling this week, which, if sustained, would be the 14th consecutive weekly advance. It is trading sideways today in a narrow range above GBP0.9200.

America

The main feature of the North American economic calendar today is Mexico’s June CPI. It is expected to push a little more into the 2%-4% range. The Mexican peso slide has extended now for eight of the past nine sessions coming into today, and it is a bit firmer now. A break below MXN19.50 would suggest a near-term dollar top may be in place. Two forces are weighing on the peso: domestic and foreign. Domestically, the AMLO government has not won over the confidence of the business community, and this has cramped investment. Figures out earlier today showed fixed-asset investment fell 6.9% year-over-year in May. It was the fourth consecutive monthly decline, and it is the largest contraction in six years. The economy barely escaped its second consecutive quarterly decline in Q2. When adjusted for inflation, Mexico has the highest real rates in the world next to Ukraine. However, pressure is building on Mexico to cut rates. Speculation is mounting that it could cut as early as next week, August 15. At the end of July, there was a 3% chance of a cut in August discounted by the derivatives markets. Now the odds are better than 1-in-4. There is about a 52% chance of a cut at the next meeting (September 26).

The international pressure on the peso has to do with its role as a liquid proxy for emerging markets more broadly. It is a levered bet, if you will, on global growth and risk-taking in general. The prospects of escalating conflict between the US and China does not set well. Consider that the MSCI Emerging Market equity index has fallen in 11 of the past 12 sessions through yesterday. Another channel of contagion is the peso’s role in structured carry-trades. The peso is the long-leg of the trade that is often financed with low-yielding currencies, such as the yen, Swiss franc, or euro. As these currencies have strengthened, the funding leg is repurchased and the peso liquidated.

The US reports weekly jobless claims and June wholesale trade and inventory data. Canada releases a house price index. These are not the reports that typically move the capital markets. Speculation is also increasing that Canada will be forced to cut interest rates later this year, even though the central bank has a firmly neutral stance presently. Canada’s 2-10 yr yield curve is inverted (2 yr yield is about 1.35% today, and the 10 yr yield is near 1.25%. Moreover, the entire curve is below the overnight target of 1.75%. The US dollar shot up to CAD1.3345 yesterday, its highest level since mid-June. It is consolidating in the lower half of yesterday’s range. A break of CAD.13265 maybe a preliminary signal that a near-term high is in place. The Dollar Index is also consolidating inside yesterday’s range. A break of the 97.30-97.70 range will likely signal the direction of the next move.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,$PHP,Currency Movements,EUR/CHF,Featured,FX Daily,Italy,Japan Current Account n.s.a.,MXN,newsletter,USD/CHF