Despite the CNY’s recent fall, we believe the People’s Bank of China will refrain from competitive devaluation Following US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD. The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the deteriorating outlook for trade negotiations with the US and the resulting additional downward pressure on the Chinese economy. Consequently, we have decided to change our forecasts for the rmb against the US dollar to CNY7.10 per USD for the entire time horizon (three, six and twelve months) from

Topics:

Luc Luyet considers the following as important: 5.) China, 5) Global Macro, Chinese renminbi, Featured, Macroview, newsletter, People's Bank Of China, Trade War

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

Despite the CNY’s recent fall, we believe the People’s Bank of China will refrain from competitive devaluation Following US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD. The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the deteriorating outlook for trade negotiations with the US and the resulting additional downward pressure on the Chinese economy. Consequently, we have decided to change our forecasts for the rmb against the US dollar to CNY7.10 per USD for the entire time horizon (three, six and twelve months) from CNY6.95 per USD previously. However, we do not believe it is in China’s best interest to engineer a massive devaluation of its currency either, on concerns of triggering financial risks. |

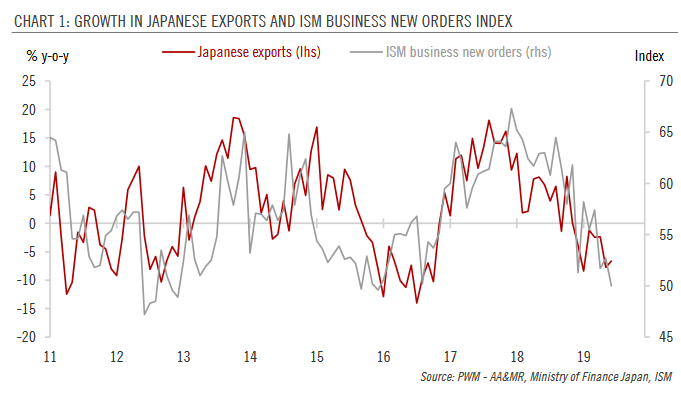

Growth in Japanese Exports and ISM Business New Orders Index, 2011-2019 |

Tags: Chinese renminbi,Featured,Macroview,newsletter,People's Bank of China,Trade War