On November 4-5, the 10th Austrian Economics Conference took place at the Austrian Central Bank (Österreichische Nationalbank). The event was organized in collaboration with the Fundación Bases and the Hayek Institut and received more than 150 academics, researchers, think-tankers, entrepreneurs, and student advocates of the ideas of freedom from all over the world. #RestartVienna became a great motivation for the promoters of the ideas of the Austrian School to...

Read More »Weekly Market Pulse: Happy Anniversary!

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar. It wasn’t a true gold standard as only other countries that were party to the agreement could demand gold in exchange for their dollars, but it was at least a standard of some...

Read More »Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

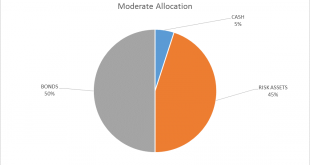

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average. That is about “as expected” as you can get for a stock...

Read More »Trump’s Biggest Deal

The Importance of Cabbages LONDON – A dear reader challenged us: “To create a perfect world what type of government would you propose?” Another put it a different way: “Again, I’m convinced more than ever, Trump is the only candidate that might have a chance to get us out of the financial and economic mess the United States is in. If Bonner & Partners is unable to recognize this, it tells me their agenda is not to fix America’s problems… but continue the agony…” Engraving by...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org