Stock Markets EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6. We remain cautious on EM FX, and do not think it can decouple from the majors if dollar strength continues. Stock Markets Emerging Markets, April 2 Source: economist.com - Click to enlarge China Caixin reports March China manufacturing PMI Monday, which is expected at 51.7 vs. 51.6 in February. The economic outlook remains solid, with

Topics:

Win Thin considers the following as important: Brazil, Chile, China, Colombia, Czech Republic, emerging markets, Featured, Hungary, India, Indonesia, Korea, newsletter, Philippines, Thailand, Turkey, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock Markets

EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6. We remain cautious on EM FX, and do not think it can decouple from the majors if dollar strength continues. |

Stock Markets Emerging Markets, April 2 Source: economist.com - Click to enlarge |

ChinaCaixin reports March China manufacturing PMI Monday, which is expected at 51.7 vs. 51.6 in February. The economic outlook remains solid, with growth likely to remain stable at around 6.5% this year. ThailandThailand reports March CPI Monday, which is expected to rise 0.97% y/y vs. 0.42% in February. If so, it would be the highest rate since November but still below the 1-4% target range. Low inflation should allow the central bank to remain on hold for much of this year. Next policy meeting is May 16, rates are likely to be kept at 1.5% then. IndonesiaIndonesia reports March CPI Monday, which is expected to rise 3.35% y/y vs. 3.18% in February. If so, it would still be near the bottom of the 3-5% target range. Low inflation should allow the central bank to remain on hold for much of this year. Next policy meeting is April 19, rates are likely to be kept at 4.25% then. KoreaKorea reports March CPI Tuesday, which is expected to remain steady at 1.4% y/y. If so, it would remain well below the 2% target. Low inflation should allow the central bank to hike rates slowly this year. Next policy meeting is April 12, rates are likely to be kept at 1.5% then. Korea reports February current account Thursday. TurkeyTurkey reports March CPI Tuesday, which is expected to rise 10.0% y/y vs. 10.3% in February. If so, it would be the lowest rate since July 2017 but still well above the 3-7% target range. Falling inflation should keep the central bank on hold for much of this year. Easing is most likely a 2019 story. Next policy meeting is April 25, rates are likely to be kept steady then. BrazilBrazil reports February IP Tuesday. The economy continues to recover, while price pressures remain low. Central bank minutes suggest risks of persistent below-target inflation as well as room for further easing. Markets are pricing in another 25 bp cut to 6.25% at the next COPOM meeting May 16. PhilippinesPhilippines reports March CPI Thursday, which is expected to rise 4.7% y/y vs. 4.5% in February. If so, it would be the highest rate since August 2014 and further above the 2-4% target range. Rising inflation and a strong economy should force the central bank to start a tightening cycle soon. Next policy meeting is May 10, and we think a 25 bp hike then is becoming more likely. HungaryHungary reports February retail sales Thursday, which are expected to rise 7.4% y/y vs. 7.8% in January. It reports February IP Friday, which is expected to rise 4.3% y/y WDA vs. 6.7% in January. The economy remains robust, but CPI rose only 1.9% y/y in February. This is below the 2-4% target range and likely to keep the central bank in dovish mode. ColombiaColombia reports March CPI Thursday, which is expected to rise 3.3% y/y vs. 3.4% in February. If so, it would be the lowest rate since October 2014 but still below the 1-4% target range. The central bank releases its minutes Friday. At that March meeting, the bank kept rates steady at 4.5%. However, we think it will cut rates further by 25-50 bp this year before ending the easing cycle. Next policy meetings are April 27 and June 29, and a 25 bp cut is likely at one of those meetings. IndiaReserve Bank of India meets Thursday and is expected to keep rates steady. CPI rose 4.4% y/y in February, which is in the top half of the 2-6% target range. This should keep the RBI in hawkish mode, though markets are not pricing in a hike until 2019. Czech RepublicCzech Republic reports February industrial and construction output and retail sales Friday. The economy remains robust, but CPI rose only 1.8% y/y in February. This is in the bottom half of the 1-3% target range and should allow the central bank to hike rates modestly this year. Next policy meeting is May 3, rates are likely to be kept at 0.75% then in favor of a Q3 move. ChileChile reports March CPI Friday, which is expected to rise 1.9% y/y vs. 2.0% in February. If so, it would be back below the 2-4% target range. Low inflation should allow the central bank to remain on hold for most of this year. Markets are starting to price in a hike late this year. Next policy meeting is May 3, rates are likely to be kept at 2.5% then. |

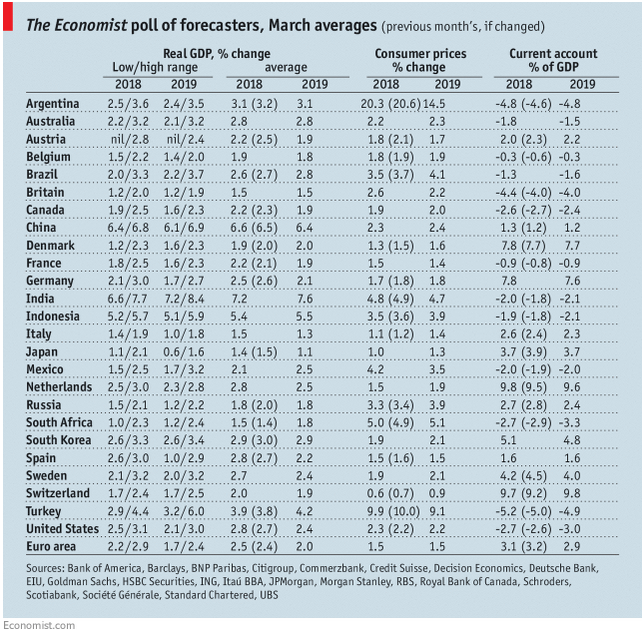

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: Brazil,Chile,China,Colombia,Czech Republic,Emerging Markets,Featured,Hungary,India,Indonesia,Korea,newsletter,Philippines,Thailand,Turkey,win-thin