Overview: The US dollar is stabilizing a bit but only after extending its gains initially It reached almost JPY149.20, while the euro slipped to $1.0570 before recovering to straddle $1.06 in the European morning. Sterling sank a little through $1.2170 but stabilized to return to almost $1.2200. The Australian dollar tested last week's low slightly below $0.6390 before resurfacing above $0.6400. The US dollar toyed with CAD1.3500, where there is a large option...

Read More »Markets Catch Breath as Politics Trumps Economics

Overview: The dollar is mostly consolidating last week's gains. The big news has been on the political front. Thailand's opposition parties dealt the military-led government a powerful blow. But in Turkey, Erdogan staved off a serious challenge and a run-off later this month looks likely, while his party maintained its parliamentary majority. Tensions over arms shipments to Russia have eased between the US and South Africa, giving the rand a boost. The greenback's...

Read More »Macro: Tell Us Something We Don’t Already Know

As September winds down, three sets of economic reports will draw the most attention. We will review them and then offer a snapshot of the emerging market central bank meetings. As we have seen in the UK and Norway, several emerging market countries raised rates early (beginning in the middle of last year) but still experienced an acceleration of inflation. It obviously begs the unanswerable question about the impact on US inflation if the Fed had taken its foot off...

Read More »Emerging Markets: Preview of the Week Ahead

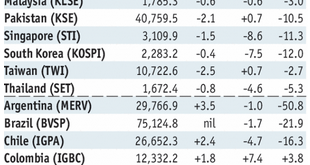

Stock Markets EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned. With US rates pushing higher, we think the...

Read More »Emerging Markets: Preview of the Week Ahead

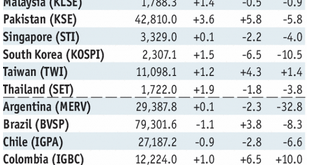

Stock Markets EM FX stabilized last week as the situation in Turkey calmed somewhat. Reports Friday that the US and China are hoping to resolve the trade dispute also helped EM FX ahead of the weekend. However, TRY remains vulnerable as the US threatens more sanctions due to the pastor. Both S&P and Moody’s downgraded it ahead of the weekend and our own ratings model points to further downgrades ahead. Turkish...

Read More »Emerging Markets: Preview of the Week Ahead

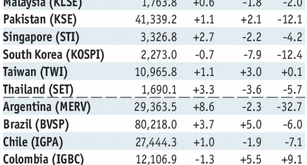

Stock Markets EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW. Stock Markets Emerging Markets, August 01 - Click...

Read More »Emerging Markets: Week Ahead Preview

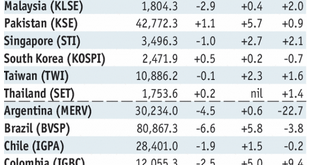

Stock Markets EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX. Stock Markets Emerging Markets, July 25 - Click to enlarge South Africa South Africa reports June money, loan, and budget data Monday. June...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term. Stock Markets Emerging Markets, June 13 - Click to enlarge Singapore Singapore reports May...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX has started the week mixed. Some relief was seen as US rates stalled out last week, but this Friday’s jobs number could be key for the next leg of this dollar rally. On Wednesday, the Fed releases its Beige book for the upcoming June 13 FOMC meeting, where a 25 bp hike is widely expected. We believe EM FX remains vulnerable to further losses. Stock Markets Emerging Markets, May 23 Source:...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX ended Friday on a week note and capped of another generally negative week. Worst performers last week were ARS, BRL, and TRY while the best were ZAR, RUB, and KRW. We remain negative on EM FX and look for losses to continue. US retail sales data Tuesday pose further downside risks to EM FX. Stock Markets Emerging Markets, May 08 - Click to enlarge India India reports April WPI and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org