Two years ago, China was gripped by what was described as an epic pig problem. For most Chinese people, pork is a main staple so rapidly rising pig prices could have presented a serious challenge to an economy already at that time besieged by massive negative forces. It was another headache officials in that country really didn’t need. For economists and the media, however, China’s possible porcine nightmare was written about in the most glowing of terms (scrubbed, of course, of any mentions of livestock). The mainstream was looking for any small bit of confirmation that “transitory” was a real factor and not just something Janet Yellen dreamed up out of desperation. A spark of ignition in Chinese inflation would

Topics:

Jeffrey P. Snider considers the following as important: China, China Industrial Production, Consumer Prices, cost-push inflation, CPI, currencies, economic growth, economy, Featured, Federal Reserve/Monetary Policy, food prices, inflation, Markets, newsletter, PBOC, pig populations, PPI

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Two years ago, China was gripped by what was described as an epic pig problem. For most Chinese people, pork is a main staple so rapidly rising pig prices could have presented a serious challenge to an economy already at that time besieged by massive negative forces. It was another headache officials in that country really didn’t need.

For economists and the media, however, China’s possible porcine nightmare was written about in the most glowing of terms (scrubbed, of course, of any mentions of livestock). The mainstream was looking for any small bit of confirmation that “transitory” was a real factor and not just something Janet Yellen dreamed up out of desperation. A spark of ignition in Chinese inflation would have been as good as, if not better than, a similar one for American or European inflation.

Why not pigs?

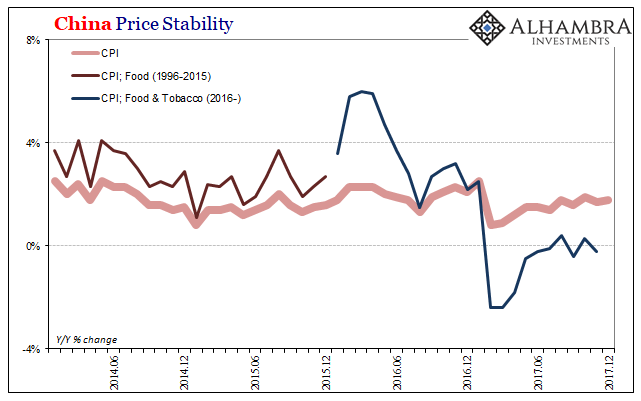

According to China’s National Bureau of Statistics, food inflation (including tobacco; the NBS changed its methodology to include it in the food index to begin 2016) spiked to 5.8% in February 2016. It was just in the nick of time given all the downturn negatives proliferating across the world, a technocratic reprieve from all that was going wrong especially by monetary indication.

Because it was only ever the pig population, however, it was Chinese food inflation that ultimately proved to be transitory. There really was never any reason to believe otherwise, as I wrote back in April 2016:

Despite that huge introduction of so-called cost-push inflation, China’s economy easily absorbed the pressure; or, another way to write that sentence, the moribund Chinese economy remained undisturbed by what economists were hoping could have resulted in more positive influence. |

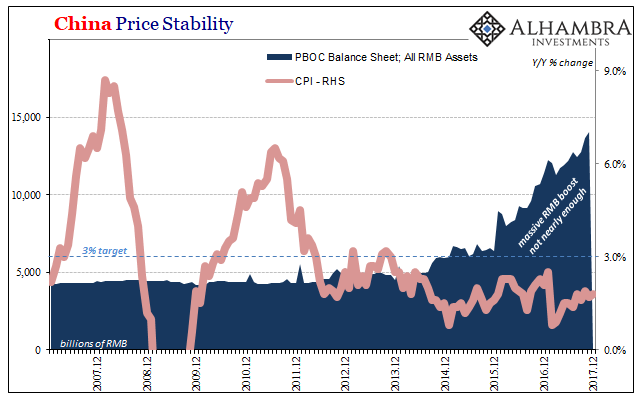

China Price Stability, Jun 2014 - Dec 2017 |

| Food prices throughout 2017 were instead for the most part falling again, dragging down the whole CPI index with them. Consumer prices in China continue to significantly undershoot the stated official target of 3%. The latest estimate for December 2017 was 1.8% year-over-year, the eleventh straight month below 2% let alone 3%.

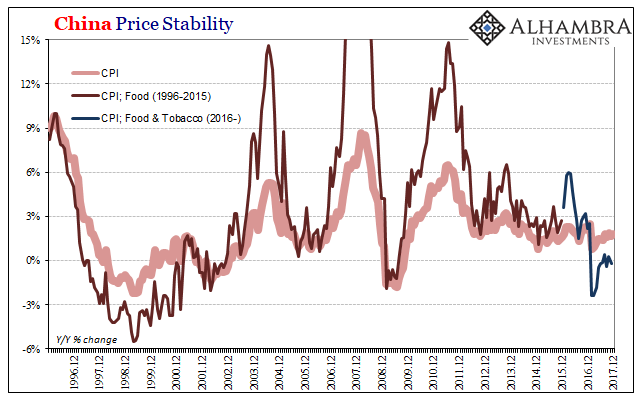

Just from the history of China’s food price index you can appreciate (to a limited degree) why economists are infatuated with rising inflation. Throughout the late nineties, for example, food prices were deeply deflationary, a large enough downward drag that the whole CPI index in China was for more than two years steadily negative. |

China Price Stability, Dec 1996 - 2017 |

| Contrast that with, say, 2007. Food prices were skyrocketing by as much as 18% at one point (not surprisingly, August 2007). On the surface, given the choice nobody would pick 18% food inflation versus prices falling by as much as -5.5% (April 1999). The latter would seem to be more than ideal, the former a disaster.

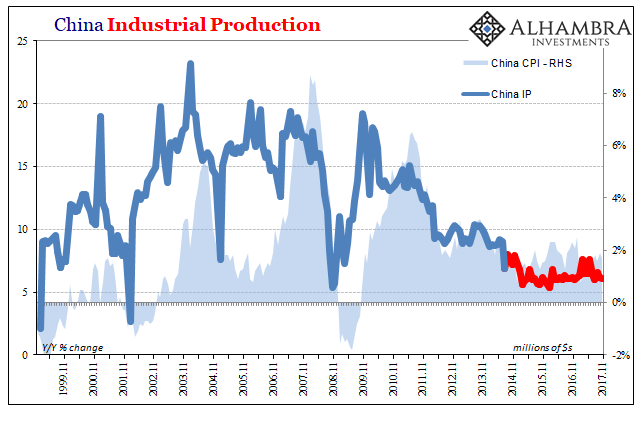

Yet, it was the opposite for most Chinese. When food and consumer prices were falling in the late nineties it was because of, what else, the “dollar’s” effects working through the aftermath of the Asian flu. China was spared the immediate monetary drafts unlike Thailand, Russia, and Japan, but not the economic downturn that gripped the whole of Asia (thus, Asian flu). In many ways, it turned out to be a wakeup call as well as affirmation to really buy wholeheartedly into the eurodollar and the opportunity it was presenting (giant sucking sound). The burst of inflation by 2007 occurred during the tail end of that rapid, paradigm shifting growth that had transformed China from its more agrarian, backwards economy of the end of the 20th century into the industrial and global powerhouse for the 21st century. You would much prefer the food inflation for drastically rising living standards that went along with the massive growth in between. For economists obsessed with regressions and therefore correlations, it becomes irresistible to see inflation and economic growth as one and the same. |

China Industrial Production, Nov 1999 - 2017(see more posts on China Industrial Production, ) |

| The trick is, they can be but aren’t always. There is a lot that goes on in any economy rendering straightforward analysis sometimes impossible. That’s especially the case when it comes to something like food prices, where basic supply and demand factors, such as pig populations, can mean more than economic growth and its monetary balance, or imbalance.

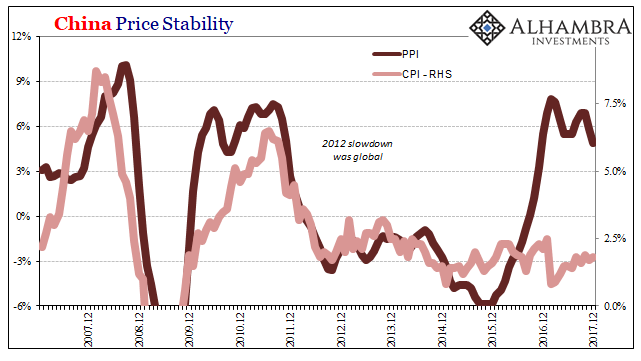

The same is true for producer prices, meaning that what businesses pay on commodity inputs may not immediately transfer into the prices they charge their customers. In a healthy and growing economy, that is much less of an issue or constraint; in a moribund economy, a rift between input costs and output revenue (growth) might more easily develop. |

China Price Stability, Dec 2007 - 2017 |

| At the very least, the focus on inflation is understandable but always incomplete. There does tend to be a correlation between changes in consumer prices and the state of economic progress. It’s not definitive, nor does it always imply causation, but in terms of China’s economy heading toward 2018 there are enough signs among inflation aggregates that it seems the system remains stuck in its slow or no-growth state.

It was only ever the pig population that briefly tickled Economists with excitement. Like Western central banks, no matter food (or commodity) prices China’s monetary officials have missed their explicit inflation target for quite a few years in a row. Including RMB activities, there’s nothing to suggest that’s about change. In fact, those RMB programs actually tell us that PBOC policymakers are increasingly frustrated by it, unable as they have been to change anything. |

China Price Stability, Dec 2007 - 2017 |

Tags: China Industrial Production,Consumer Prices,cost-push inflation,CPI,currencies,economic growth,economy,Featured,Federal Reserve/Monetary Policy,food prices,inflation,Markets,newsletter,PBOC,pig populations,PPI