Summary China State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. Korean officials warned that it will take stern steps to prevent one-sided currency moves. Bulgaria is talking “intensively” with the ECB and other EU representatives about entering the Exchange Rate Mechanism by mid-year. Hungary announced general elections on April 8. Poland’s government shuffled the cabinet. Romanian central bank unexpectedly hiked rates for the first time in almost a decade. Angola devalued the kwanza. S&P downgraded Brazil by a notch to BB- with a stable outlook. Stock Markets In the EM equity space as measured by MSCI, Qatar (+6.7%), Egypt

Topics:

Win Thin considers the following as important: Angola, Brazil, Bulgaria, China, emerging markets, Featured, Hungary, Korea, newsletter, Poland, Romania, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

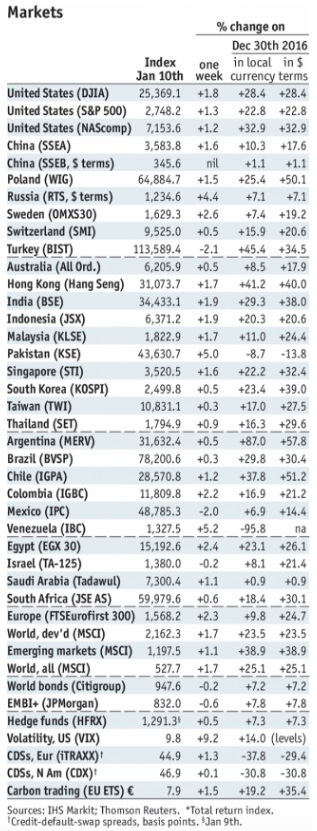

Stock MarketsIn the EM equity space as measured by MSCI, Qatar (+6.7%), Egypt (+3.8%), and Russia (+3.0%) have outperformed this week, while Turkey (-2.0%), Czech Republic (-1.4%), and South Africa (-1.0%) have underperformed. To put this in better context, MSCI EM rose 0.6% this week while MSCI DM rose 1.1%. In the EM local currency bond space, Brazil (10-year yield -9 bp), India (-6 bp), and Romania (-5 bp) have outperformed this week, while Argentina (10-year yield +26 bp), Mexico (+11 bp), and Korea (+9 bp) have underperformed. To put this in better context, the 10-year UST yield rose 9 bp to 2.57%. In the EM FX space, COP (+1.7% vs. USD), ARS (+1.0% vs. USD), and ILS (+0.9% vs. USD) have outperformed this week, while ZAR (-1.1% vs. USD), PHP (-1.0% vs. USD), and TRY (-0.6% vs. USD) have underperformed. |

Stock Markets Emerging Markets, January 10 Source: economist.com - Click to enlarge |

ChinaChina State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. SAFE official said that “We think the report might have cited wrong sources or may be fake news.” As the world’s largest holder of USTs, we do not think China would announce such a move even if it was considering it. KoreaKorean officials warned that it will take stern steps to prevent one-sided currency moves. Yet we do not think BOK can act aggressively now as Korea and the US are just starting trade talks. Both sides acknowledge that a trade deal will be difficult, and we think any whiff of potential currency manipulation would only make things more difficult. BulgariaBulgaria is talking “intensively” with the ECB and other EU representatives about entering ERM II by mid-year. This is the next step towards entering the eurozone. Under the rules, a country must remain in ERM II for two years without “severe tensions” before adopting the euro. Since the lev has been pegged to EUR (and first DEM) since 1999, this condition should be easily fulfilled. HungaryHungary announced general elections on April 8. This is the anniversary of the 1990 vote, the first after the end of communist rule. Polls suggest Prime Minister Orban is on track to easily win a third consecutive term and fourth overall. PolandPoland’s government shuffled the cabinet. Prime Minister Morawiecki announced ten new ministers, a group that included the Finance, Defense, and Foreign Affairs portfolios. Yet Morawiecki said afterward that the government will not back down over the controversial judicial reforms. RomaniaRomanian central bank unexpectedly hiked rates for the first time in almost a decade. The central bank hiked its benchmark interest rate 25 bp to 2.0%. After the hike, December CPI was reported at 3.3% y/y, the highest since 2013 and supporting the case for further tightening. AngolaAngola devalued the kwanza. The central bank has shifted to a trading band, with dollars now sold to commercial banks at regular auctions. However, more needs to be done as the rate established around 188 is not seen as market-clearing. Prior to the devaluation, the official rate was around 166 per USD while the black market rate was around 430.

BrazilS&P downgraded Brazil by a notch to BB- with a stable outlook. The move was not that surprising given the agency’s negative outlook. Brazil paid the price for delays to pension reform, S&P cited “slower-than-expected progress and lower support by the country’s political class to put in place meaningful legislation to correct structural fiscal slippage on a timely basis.” |

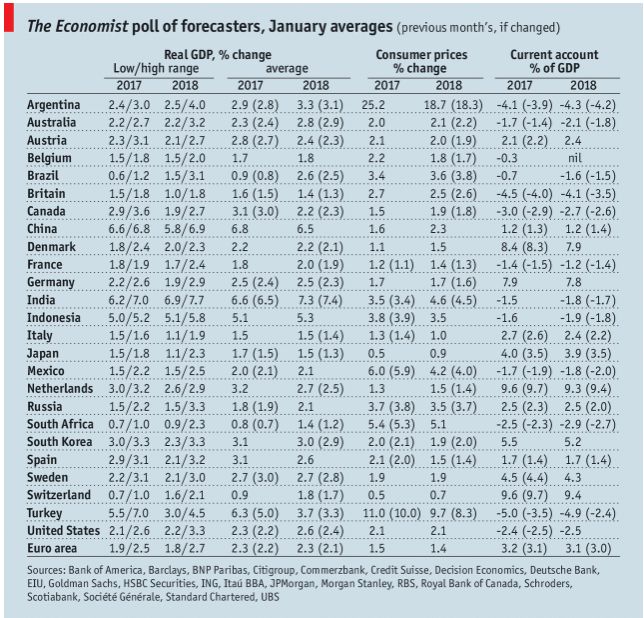

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2018 Source: economist.com - Click to enlarge |

Tags: Angola,Brazil,Bulgaria,China,Featured,Hungary,Korea,newsletter,Poland,Romania,win-thin