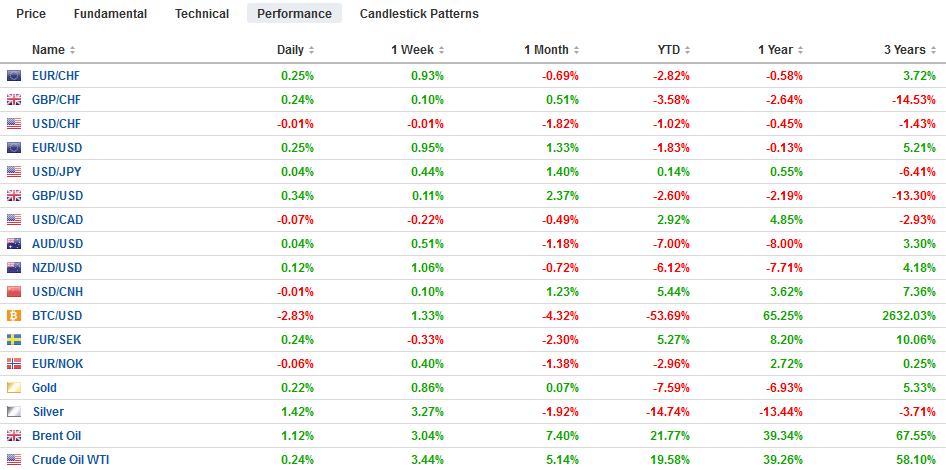

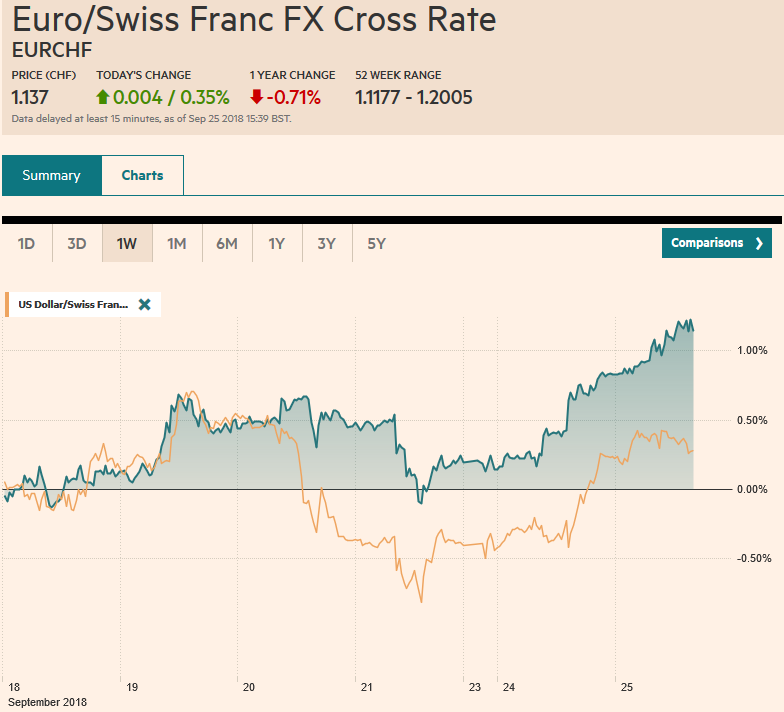

Swiss Franc The Euro has risen by 0.35% at 1.137 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The major currencies are mixed in quiet turnover. Most of the European currencies are firmer, while the dollar-bloc currencies, yen and Swiss franc are softer. Emerging market currencies are steady to higher, though there are a few exceptions in Asia, where the Indonesian rupiah and the Chinese yuan are off about 0.3%, while the Indian rupee and Malaysian ringgit are around 0.2% lower. Asian equities were heavy, though the Nikkei rallied to its best level since February. European shares are mostly higher. Reports of a compromise that

Topics:

Marc Chandler considers the following as important: $INR, 4) FX Trends, AUD, CAD, EUR, EUR-GBP, EUR/CHF, Featured, JPY, newsletter, NZD, SPX, TLT, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.35% at 1.137 |

EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe major currencies are mixed in quiet turnover. Most of the European currencies are firmer, while the dollar-bloc currencies, yen and Swiss franc are softer. Emerging market currencies are steady to higher, though there are a few exceptions in Asia, where the Indonesian rupiah and the Chinese yuan are off about 0.3%, while the Indian rupee and Malaysian ringgit are around 0.2% lower. Asian equities were heavy, though the Nikkei rallied to its best level since February. European shares are mostly higher. Reports of a compromise that will produce a 1.9% deficit (of GDP) in Italy is helping its stocks and bonds outperform today. The US 10-year Treasury yield is consolidating around 3.10%. Oil prices are extending yesterday’s gain. The Australian dollar is trading lower for the third consecutive session. Support is seen in the $0.7200-$0.7220 range. The central bank meets next week and is widely expected to keep the cash rate steady. The Reserve Bank of New Zealand meets tomorrow, and it too will keep rates steady. Neither can match Federal Reserve, which is going to hike rates tomorrow and is expected to signal at least three rate hikes next year. The New Zealand dollar is flat after losing 0.6% yesterday. The Canadian dollar is softer. The US dollar traded at a four-day high near $1.2970. Resistance is pegged in the CAD1.2980-CAD1.3000 area. In trying to explain the dollar’s recent weakness, some have suggested that the US is simply not attracting sufficient capital at the current price (ostensibly a combination of the dollar’s exchange rate and yields). Under floating exchange rates and capital mobility, this seems intuitively true, except for one thing: The data. The recent TIC data shows foreign investors have put nearly $670 bln of their savings in US assets in the first seven months of the year. This compares with almost $290 bln in the same period last year and $29 bln in Jan-July 2016. What about direct investment, you ask? In H1 18, the US experienced direct investment inflows of $91.55 bln. In H1 17, direct investment was about $81.3 bln and $75.4 in H1 16. |

FX Performance, September 25 |

Eurozone

The euro had fallen after the each of the ECB meetings between last October through the July 2018 meeting. The pattern broke at the September 13 meeting when the euro appreciated. Draghi spoke yesterday and two words got market participants excited. He said that the staff forecast (1.7% CPI this year and the next two) concealed what he described as “relatively vigorous” improvement in underlying inflation. ECB’s Praet played down the significance of Draghi’s comments, suggesting that no new ground was broke and that policy would remain accommodative.

Ahead of the weekend, the preliminary EMU September CPI will be reported. The headline is expected to rise from 2.0% to 2.1%, while the core is forecast to increase to 1.1% from 1.0%. The former will match the five-year high seen earlier this year, while the core rate would match this year’s high, last year’s high was a touch higher (1.25). Underlying inflation does refer to the impact of higher oil prices (Brent recorded a new multi-year high near $81.80). Labor market dynamics are behind Draghi’s optimism, where he is putting faith in the return of the Phillip’s Curve. He noted in yesterday’s speech to the European Parliament that negotiated wages rose 1.5% in 2017 and 1.7% in Q1 17 and 2.2% in Q2 17. The implied December 2019 Euribor futures contract is minus 8.5 bp compared with minus 12.5 bp at the end of August.

Sweden

Prime Minister Lofven lost of a vote of confidence today, ending the four-year rule by the Social Democrats. The center-right joined forces with the nationalist forces to turn the government out in a vote of confidence. The election a couple of weeks ago gave Lofven’s coalition a narrow one-seat majority. The nationalist Democrats hold the balance of power with 62 of the 349-seats. The center-right is undecided whether to form an alliance with the Democrats, but without it, they do not have the votes to pass a budget. The political situation is very fluid, but the krona itself has mostly shrugged off the political developments. The euro is steady against the krona after it lost about 1.8% last week to cap a nearly 4% decline since the end of last month. The technical indicators warn that euro has approached what may prove to be a near-term bottom. Swedish stocks are underperforming today, slipping almost 0.2%, while the Dow Jones Stoxx 600 is up about 0.25% near midday. The Stockholm 30 Index is up 4.8% this year, making it one of the better performing G10 equity markets this year.

Japan

Minutes from the BOJ meeting in which the range for the 10-year JGB yield was widened to 20 bp. The forward guidance introduced was meant to address speculation that it was tapering and withdrawing stimulus. The 10-year yield was steady near 12 bp. Japan’s markets re-opened after yesterday’s holiday, and the Nikkei extended its rally for a seventh consecutive session. It is knocking on 24,000 while the high set in January was near 24,129.35. The dollar reached almost JPY113 in Tokyo before consolidating. Initial support is seen near JPY112.70. In January, the dollar peaked near JPY113.40.

United Kingdom

Merkel and Macron are taking two different tacts. Merkel is concerned that an excessive harsh stance toward the UK could be counter-productive. The fear has been that if May is toppled, she would likely be replaced a harsher skeptic of the EU. Macron, whose support in the latest polls rival Hollande below 20%, has taken a harsher line. He is demanding an agreement be struck next month rather than wait until November’s special summit. Sterling is trading in the upper end of yesterday’s ranges against the dollar and is slightly softer against the euro.

United States

The US reports house prices and the September Richmond Fed manufacturing survey today ahead of the new home sales and the FOMC meeting tomorrow. The Fed’s forecasts tomorrow will include forecasts for 2021 for the first time. Many observers have expressed concern for a fiscal cliff or an economic downturn in 2020. Will the Fed project its current cycle to continue in 2021 and will it lift long-term target are key questions that will be answered tomorrow. Meanwhile, the S&P 500 is caught between two gaps. On the downside is a small gap remains from last week. It is found between about 2912.35 and 2912.60. On the upside, there is a gap between 2923.80 and 2927.10. The Dollar Index is stuck between 93.80 and 94.40.

Tags: #USD,$AUD,$CAD,$EUR,$INR,$JPY,$TLT,EUR/CHF,EUR/GBP,Featured,newsletter,NZD,SPX,USD/CHF