Eurozone The investment meme of a synchronized global upturn has been undermined by the recent string of US and European economic data. The flash March eurozone composite reading fell to 55.3, the lowest reading since January 2017. Although Q4 17 US GDP may be revised higher (toward 2.8% from 2.5%) mostly due to greater inventory accumulation, the curse of weak Q1 GDP appears to be showing its hand again, with forecasts now coming in below 2%. It may be easier for the Federal Reserve to look past the disappointing US data than the European Central Bank. The fiscal stimulus, which is larger than the 2009 effort, is likely to underwrite US growth in the coming quarters. US core PCE deflator is expected to have ticked

Topics:

Marc Chandler considers the following as important: China, EMU, EUR, Featured, FX Trends, Japan, LIBOR, newsletter, SPY, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

EurozoneThe investment meme of a synchronized global upturn has been undermined by the recent string of US and European economic data. The flash March eurozone composite reading fell to 55.3, the lowest reading since January 2017. Although Q4 17 US GDP may be revised higher (toward 2.8% from 2.5%) mostly due to greater inventory accumulation, the curse of weak Q1 GDP appears to be showing its hand again, with forecasts now coming in below 2%. It may be easier for the Federal Reserve to look past the disappointing US data than the European Central Bank. The fiscal stimulus, which is larger than the 2009 effort, is likely to underwrite US growth in the coming quarters. US core PCE deflator is expected to have ticked up in March. For the past two years, the eurozone expansion has produced minimal price pressures. The two cycles, activity and prices, are not in sync. In the face of the loss of economic momentum, price pressures may be bolstered as the early Easter distorts. Preliminary March CPI will be reported in days ahead. The sharp equity loss and increased volatility seen in recent days are arguably more important than the high-frequency data in shaping the investment climate as the first quarter draws to a close. With the sharp drop in the US markets before the weekend and the poor close, the risk of gap lower opening in Asian markets is likely. Calendar considerations may discourage asset managers and other investors from viewing the pullback as a new buying opportunity quite yet. Testing chart-based support or technical retracement objectives may not be sufficient in themselves to provide a new low-risk opportunity. As we did last month, we suggest waiting for a reversal pattern, which is likely to be characterized by a recovery and strong close after new lows are recorded. At the same time, we note that ahead of the Q1 earnings reports, the largest buyers of US shares, corporations themselves, may also be sidelined. There are two proximate triggers of the renewed slide in equity prices. However, the perhaps the triggers were not needed. Many investors were skeptical of the recovery in equity markets after the February air pocket. The fact that the NASDAQ made new record highs, albeit marginal, is not an exception to the rule but illustrates the lack of breadth that characterized the bounce. Most bourses in Europe and Asia barely registered the minimum of technical retracements before the news selling pressure emerged. |

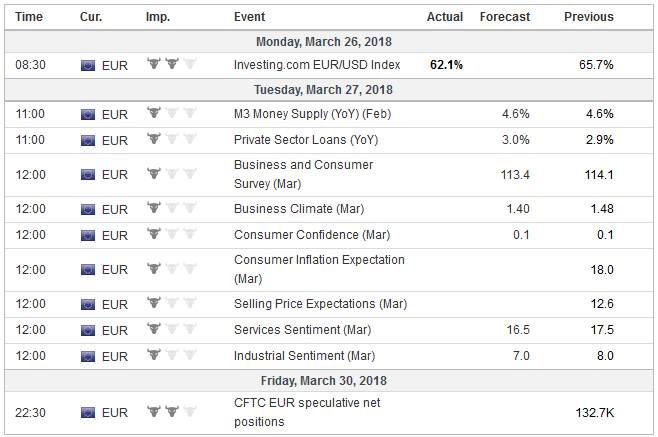

Economic Events: Eurozone, Week March 26 |

United KingdomNeeded or not, one proximate cause of new investor anxiety is the increase in LIBOR and the widening of spreads between it and other benchmarks like OIS, T-bills, and Fed funds. There seems to be a general consensus that the widening spread is not being spurred by tensions within the financial system, as was the case in the Great Financial Crisis and the EMU crisis. The main impetus appears to be coming from technical factors, the essence of which is reducing offshore dollars and boosting the supply of onshore dollars. It is different but shares some parallels with the CNH and CNY issue in China but is considerably more significant given the extensive use of dollar-funding (compared to yuan-funding). There are three different considerations at work. First, the lifting of the US debt ceiling as spurred large-scale T-bill auctions. These sales serve to attract and mop up dollar liquidity. Second, the new tax changes are encouraging US corporation to repatriate offshore funds. Corporate offshore savings, largely kept in dollar-denominated instruments, are now increasingly available onshore. Third, the tax and regulatory changes appear to be forcing foreign financial institutions to substitute fx swaps with unsecured funding, which may help explain why cross-currency basis swaps are tighter while LIBOR-OIS is wider. Many financial contracts still remain tied to LIBOR and the increase in dollar LIBOR raises the cost of funding. There are alternatives for some participants, like cross-currency swaps, which often are used for pricing of fx forwards, when available, rather than LIBOR. The Federal Reserve offers swap lines to other several central banks, including the ECB and BOJ, that can make dollars available for member banks (at a premium), but the minimal usage suggests the situation is no extreme and the disruption remains contained. Dollar LIBOR is not only rising relative to other short-term rates but also relative to interbank offered rates elsewhere. This has increased the pressure on some currencies that are pegged to the dollar, including the Hong Kong dollar and the Saudi riyal, for example. However, the broader impact on the dollar exchange rate seems minimal. Against the majors, the US dollar has pullback after making new highs for the year at the start of last week against the Canadian and Australian dollars. The greenback also slumped to new lows against the yen since late 2016. For its part, the euro remains range-bound as it has for the better part of the past two months. Sterling has been aided by progress on Brexit and economic data, including stronger retail sales and stronger wage growth, which fanned expectations for a rate hike later in the middle of Q2. There seems little in the way of technical or fundamental considerations that may prevent sterling from making new highs. Cross-rate demand against the euro helped propel sterling higher, but the momentum eased at the end of last week. |

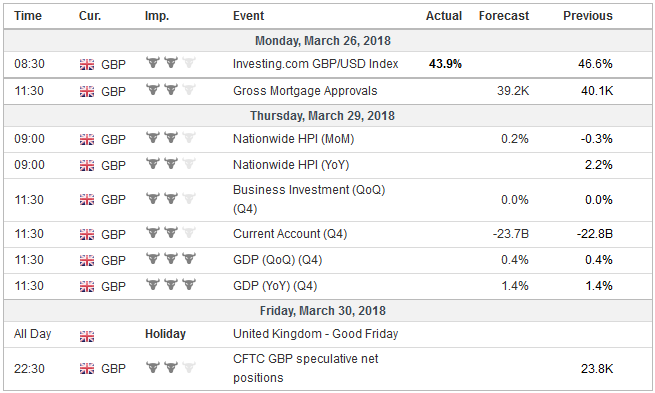

Economic Events: United Kingdom, Week March 26 |

United StatesThe second proximate cause of investor anxiety is the prospect of a trade war. The US is perceived to be defecting from the multilateral trading system that it was instrumental in creating. The media and some other observers seem to be too ready to project the worst-case scenario and insist offering militaristic imagery as it did repeatedly with the foreign exchange market and so-called currency wars. The fact of the matter is that there are nearly always low-grade tensions between trade partners. The US and Canada are among the largest trading partners in the world, and there is a constant tension, which incidentally pre-date the Trump’s presidency. Lumber and dairy, for example, are nearly perennial areas of dispute. In the middle of NAFTA negotiations, Canada has filed an omnibus case against the US at the WTO. Moreover, as coverage of the exchange between Trudeau and Trump illustrate, there is a disagreement on the size of the bilateral trade balance (as there is with China). The US provocations and the initial response by China (and other US trading partners) is relatively benign. A relatively small part of trade is being impacted, and the retaliatory steps seem symbolic. The counter-measures are the bare minimum of what should have been expected, given past experience (precedent) and what we think is the strategic response to the ostensible threat posed by Trump. Specifically, limiting the damage of US actions while at the same time strengthening the multilateral system requires avoiding a downward spiral of recriminations and allowing the conflict resolution mechanism at the World Trade Organization. In the 1980s, Japan was the rising Asian power that challenged that US economic prowess. Several of the senior trade officials in the Trump Administration got critical experience in the Reagan Administration. The WTO organization, however, prohibits some of the policies the US pursued then, such as Voluntary Export Restrictions and Orderly Market Agreements. China has a wider range of options available, and unlike Japan, is not dependent on the US for security. At the same time, Japan found, as the US did in the post-WWII environment, other countries protectionism may spur short-term challenges but offers strategic opportunities. In response to US protectionism, Japan moved auto plant and production to the US. Car parts followed shortly after. Japanese domestic producers moved up the value-added chain. US provocations may spur Chinese reforms, which ultimately will likely be beneficial for China and President Xi’s agenda. A more robust defense of intellectual property rights is necessary for a modern dynamic economy. The US and other countries have been haranguing China on this issue for nearly twenty years. China’s tariff schedule can also be reduced to the benefit of its own economy. China’s leadership seems prepared to respond to the US provocations in part by objecting, playing up the risks of a trade war, defending the multilateral trade system, making some low-scale expressions of displeasure, and seizing the opportunity to pursue long-awaited reforms. |

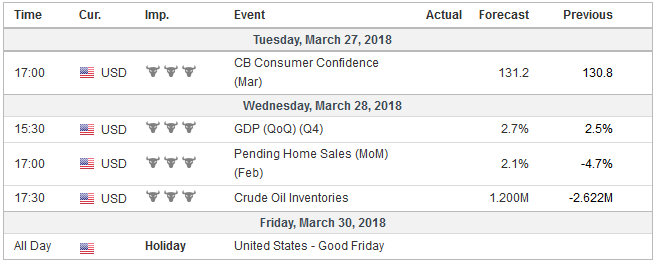

Economic Events: United States, Week March 26 |

Switzerland |

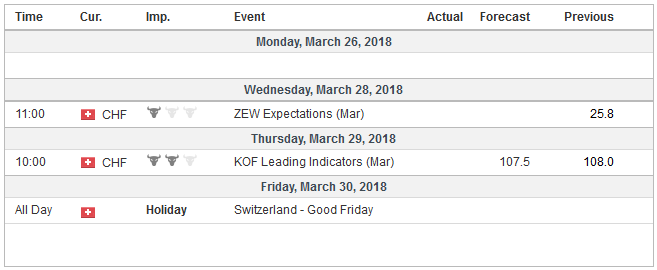

Economic Events: Switzerland, Week March 26 |

Tags: #USD,$EUR,China,EMU,Featured,Japan,Libor,newsletter,SPY,Trade