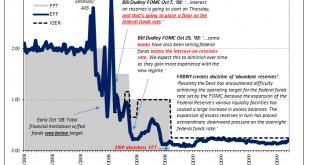

A momentous day, for sure, but one lost in what would turn out to be a seemingly endless sea of them. October 8, 2008, right in the thick of the world’s first global financial crisis (how could it have been global, surely not subprime mortgages?) the Federal Reserve took center stage; or tried to. Having bungled Lehman, botched AIG, and then surrendered to Treasury which then screwed up TARP, the world’s entire financial edifice was burning down while US...

Read More »The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations. If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility. There’s also the potential for the engine to overheat and maybe even...

Read More »Banks Or (euro)Dollars? That Is The (only) Question

It used to be that at each quarter’s end the repo rate would rise often quite far. You may recall the end of 2018, following a wave of global liquidations and curve collapsing when the GC rate (UST) skyrocketed to 5.149%, nearly 300 bps above the RRP “floor.” Chalked up to nothing more than 2a7 or “too many” Treasuries, it was to be ignored as the Fed at that point was still forecasting inflation and rate hikes. Total financial resilience otherwise. Yesterday was,...

Read More »Is GFC2 Over?

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either. Stocks rebounded because of “major helicopter stimulus” or because that’s just what stocks do during times like these. Some of the biggest up days have followed, and are often found in between, the greatest...

Read More »Das Einmaleins des neuen Leitzinses

Wie schon beim Libor teilt die Nationalbank mit dem Leitzins mit, wo sie die Kurzfristzinssätze haben will: SNB-Präsident Thomas Jordan. Foto: Anthony Anex (Keystone) Die Schweizerische Nationalbank (SNB) führt neu einen Leitzins ein. Hatte sie denn bis jetzt gar keinen? Doch, hatte sie, aber der hiess anders. Nutzen wir doch die Gelegenheit, um zu klären, was eigentlich ein Leitzins ist. Und was sich nun geändert hat. Eine Notenbank benutzt einen Leitzins, um das gesamte Zinsniveau in...

Read More »Das Einmaleins des neuen Leitzinses

Wie schon beim Libor teilt die Nationalbank mit dem Leitzins mit, wo sie die Kurzfristzinssätze haben will: SNB-Präsident Thomas Jordan. Foto: Anthony Anex (Keystone) Die Schweizerische Nationalbank (SNB) führt neu einen Leitzins ein. Hatte sie denn bis jetzt gar keinen? Doch, hatte sie, aber der hiess anders. Nutzen wir doch die Gelegenheit, um zu klären, was eigentlich ein Leitzins ist. Und was sich nun geändert hat....

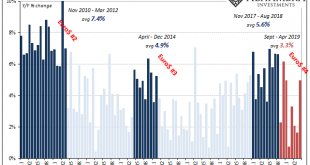

Read More »Global Doves Expire: Fed Pause Fizzles (US Retail Sales)

Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough. After the market slide through Christmas Eve, everything...

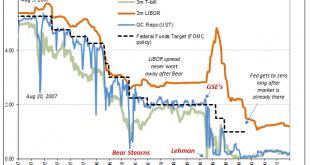

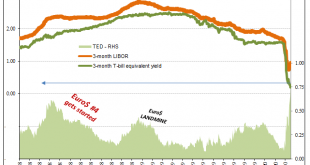

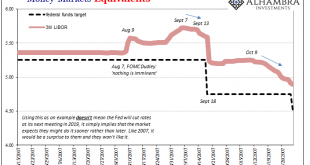

Read More »LIBOR Was Expected To Drop. It Dropped. What Might This Mean?

Everyone hates LIBOR, until it does something interesting. It used to be the most boring interest rate in the world. When it was that, it was also the most important. Though it followed along federal funds this was only because of the arb between onshore (NYC) and offshore (mainly London, sometimes Caymans) conducted by banks between themselves and their subs (whichever was located where). Unsecured markets used to be...

Read More »FX Daily, May 09: Oil Prices Surge and Dollar Gains Extended Post Withdrawal Announcement

Swiss Franc The Euro has risen by 0.29% to 1.1914 CHF. EUR/CHF and USD/CHF, May 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly higher as the 10-year yield probes above 3.0%. Disappointing French industrial production and manufacturing data for March provided additional incentive, as if it were needed, to extend the euro’s losses. The euro...

Read More »FX Daily, March 28: Three Developments Shaping Month-End

Swiss Franc The Euro has risen by 0.34% to 1.1779 CHF. EUR/CHF and USD/CHF, March 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Today may be the last day of full liquidity until next Tuesday, after the Easter holidays. We identify three developments that are characterizing the end of the month, quarter, and for some countries and companies, the fiscal year. Equity...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org