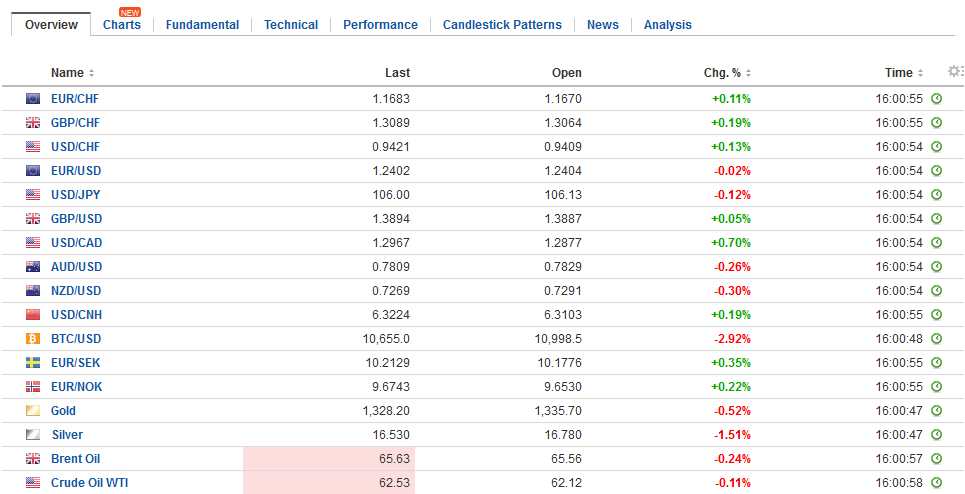

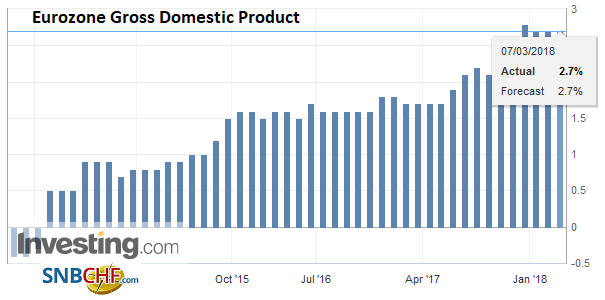

Swiss Franc The Euro has risen by 0.21% to 1.1688 CHF. EUR/CHF and USD/CHF, March 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates In response to the resignation of one of the few “globalist” advisers in the US Administration, the resignation Cohn has sent ripples through the capital markets. Stocks have been marked down across the world. The prospects of a trade war are also not good for growth and it may be adding to the pressure on yields. Cohn’s resignation has two immediate consequences. As Cohn goes so does the last-ditch effort of forces within the Administration seeking to deter the tariffs. Treasury Secretary Mnuchin seems more supportive, though probably

Topics:

Marc Chandler considers the following as important: $CNY, EUR, EUR/CHF, Featured, FX Trends, JPY, newslettersent, Norwegian Krone, SEK, TLT, U.S. Crude Oil Inventories, U.S. Nonfarm Productivity, U.S. Trade Balance, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.21% to 1.1688 CHF. |

EUR/CHF and USD/CHF, March 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesIn response to the resignation of one of the few “globalist” advisers in the US Administration, the resignation Cohn has sent ripples through the capital markets. Stocks have been marked down across the world. The prospects of a trade war are also not good for growth and it may be adding to the pressure on yields. Cohn’s resignation has two immediate consequences. As Cohn goes so does the last-ditch effort of forces within the Administration seeking to deter the tariffs. Treasury Secretary Mnuchin seems more supportive, though probably would have preferred a more targeted approach. The industry summit Cohn was trying to arrange has been canceled. That means that Congress is the next potential check on the unilateral trade power of the executive, which has largely been transferred from the legislative branch. |

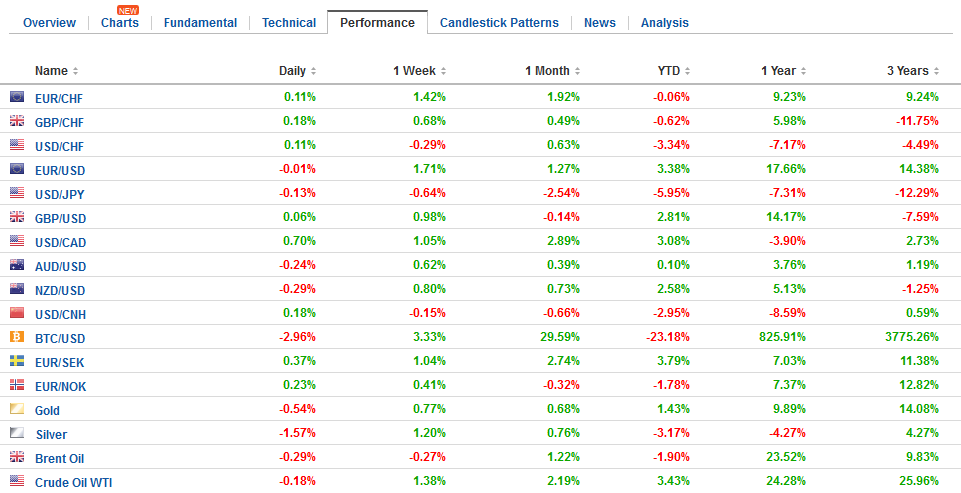

FX Daily Rates, March 07 |

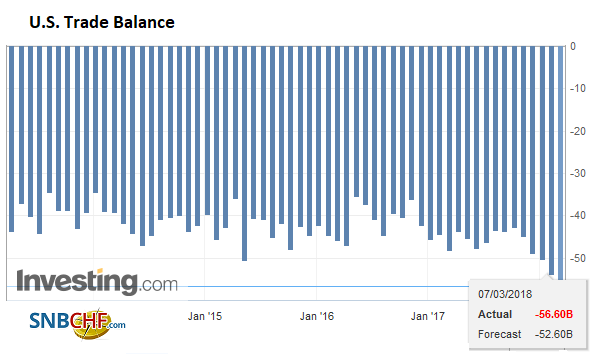

| Second, and we suspect that investors are also responding to the implications for future trade policy. It means that the Ross and Navarro wing will set the tone. This signals a more confrontational and aggressive trade policy The US reports the January trade balance today and it provides grist for their mill. The US is expected to report a $55 bln trade shortfall. The January 2017 deficit was $48.7 bln and in 2016 is was $43.4 bln. This illustrates the broad deterioration, even though we know that there has been dramatic improvement in the energy trade balance. Floating exchange rates and free-trade, they argue, should not result in the US have a significant and chronic trade deficit, unless 1) exchange rates are not really floating and/or 2) trade is not fair.

However, the response to the US actions arguably are the key to whether it turns into tit-for-tat spiral. This is surely one scenario, but is the most likely? First, we think about precedent. What was the response to Bush’s 30% tariff on steel. There were more exemptions then, including Canada and Mexico, and there was some protective action so that the sales were not simply deflected to a third party (e.g., Europe), and there were some symbolic gestures, and ultimately WTO challenges. |

FX Performance, March 07 |

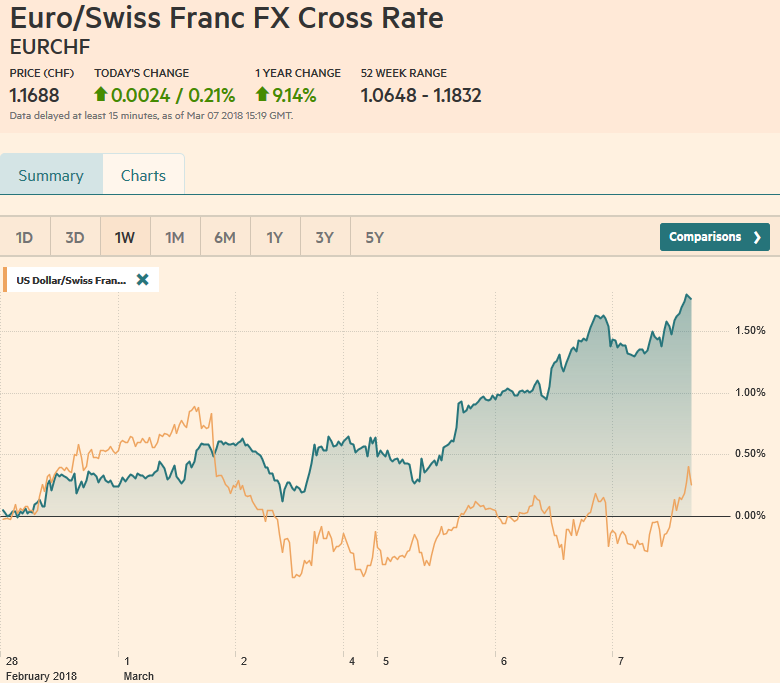

Eurozone |

Eurozone Gross Domestic Product (GDP) YoY, Nov 2013 - Mar 2018(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

United States |

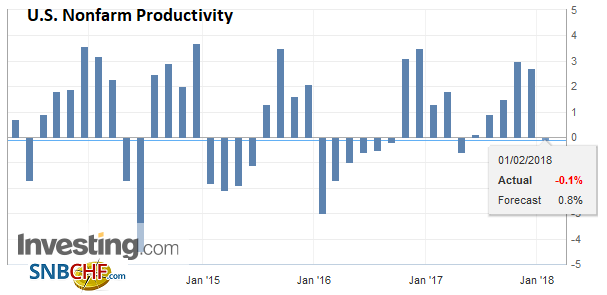

U.S. Nonfarm Productivity, Q4 2018(see more posts on U.S. Nonfarm Productivity, ) Source: Investing.com - Click to enlarge |

U.S. Trade Balance, Apr 2013 - Mar 2018(see more posts on U.S. Trade Balance, ) Source: Investing.com - Click to enlarge |

|

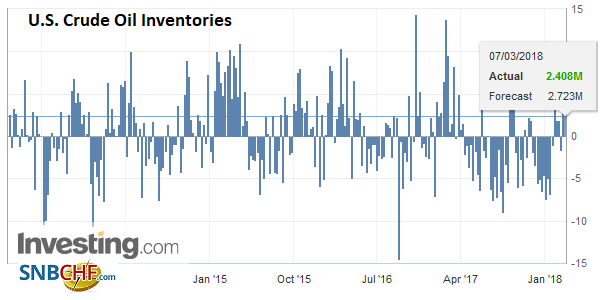

U.S. Crude Oil Inventories, Mar 2013 - 2018(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

Second, we think through the strategic values. By some measures, many high income and developing countries manage their trade and economies more than the US. However, there is a general acceptance of the multilateral free-trading system, and nearly all countries are members of the WTO. If the multilateral system is being challenged, it is incumbent on the other members to reinforce it. In this case, it means there may be some symbolic action, like on whiskey from Kentucky, but the best course is to challenge at the WTO. Some fear that if the case were to be decided against the US (may not for a year or more), the current administration would leave the WTO. It is possible, but unlikely. It would likely require Congressional approval, which would not be forthcoming.

The MSCI Asia Pacific Index fell almost 0.6%, while the Dow Jones Stoxx 600 is off only 0.2% in Europe. The S&P 500 is off a little more than 0.5%. The yield on ten-year benchmark yields are off mostly 2-4 bp. Of note, despite jitters at the start of the week, and not much more insight into what the next government will look like, Italian assets are not underperforming. The 10-year yield is off three basis points today and is now slightly lower since the election. The FTSE/Milan is flat today and is the only major European bourse still higher on the year.

There have been two economic reports to note today. Australia’s Q4 growth a little slower than expected and China reported a drop in its reserves. Recent data warned that softer capex and weaker net exports was a drag on Australia’s growth at the end of last year. Today’s Australia reported quarterly growth of 0.4% after a revised 0.7% pace in Q3 (initially 0.6%). The year-over-year pace slowed to 2.4% from 2.9%. The Reserve Bank of Australia is expected to be on hold for most of the year, if not into the next.

China reported a larger than expected $27 bln draw down in the value of its reserves in February. The last time China’s reserves fell was in January 2017. We suspect that while there were likely private capital outflows, the main drivers are innocuous, like distortions, including in trade, of the Lunar New Year, and there may have been some impact fromvaluation. The euro, likely the second largest currency in the PBOC reserves fell 1.8%. If 20% of China’s reserves are in euro-denominated assets, the euro’s decline alone would explain an $11 bln fall in China’s reserves. Of course, China’s reserves are held in some financial instruments. Yields rose in February. Lower bond prices could also impact valuation.

Today’s North American session features the Bank of Canada meeting. The Bank of Canada is widely expected stand fast after hiking rates at the start of the year. The probability of a rate cut has been trimmed but it is near 40% for April and more than 50% by May. Although Canada’s largest trading partner is enjoying above trend growth, and is providing additional fiscal support, the positive impulses are offset by the protectionist actions, steel, aluminum, and risks that NAFTA dissolves. The Canadian dollar has depreciated by nearly 5.5% on a trade-weighted basis since the end of January. Earlier in the week, we recommended looking Canada to soon outperform Mexico. A potentially important upside reversal (for Canada) appears to have taken place yesterday.

In addition to trade figures, the ADP private sector jobs estimate will be published. The market expects around a 200k increase after 234k in January. The Beige Book is out late in the session as is January consumer credit. Neither is typically a market-mover. The Fed’s Bostic and Dudley speak early in the session.

There is a large $1.7 bln option struck at JPY105.50 that expires in NY today. Between $1.3875 and $1.3900, there are about GBP800 mln in options that will also be cut today. There is also a large option in the New Zealand dollar (NZD760 mln) struck at $0.7300 that expires. The euro, yen, and Swiss franc are firm. Large external surpluses in Sweden and Norway have not protected the Scandis, which are the weakest majors after the Canadian dollar.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: $CNY,$EUR,$JPY,$TLT,EUR/CHF,Featured,newslettersent,Norwegian Krone,SEK,U.S. Crude Oil Inventories,U.S. Nonfarm Productivity,U.S. Trade Balance,USD/CHF