Summary:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAlthough markets steadied as February progressed, volatility is unlikely to return to the low levels seen last year. Yet, after a good earnings season, and with strong, synchronised growth, we remain comfortable with our positive stance on developed-market equities. The potential for increased volatility opens the way for trading opportunities – but also calls for extra vigilance, especially if signs of economic overheating cause further nervousness in the fixed-income markets.The pro-cyclical increase in the US fiscal deficit after tax cuts and the agreement to increase federal spending are likely to lead to a rise in the term premium, further justifying our short-duration stance in

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAlthough markets steadied as February progressed, volatility is unlikely to return to the low levels seen last year. Yet, after a good earnings season, and with strong, synchronised growth, we remain comfortable with our positive stance on developed-market equities. The potential for increased volatility opens the way for trading opportunities – but also calls for extra vigilance, especially if signs of economic overheating cause further nervousness in the fixed-income markets.The pro-cyclical increase in the US fiscal deficit after tax cuts and the agreement to increase federal spending are likely to lead to a rise in the term premium, further justifying our short-duration stance in

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management's latest positioning across asset classes and investment themes.

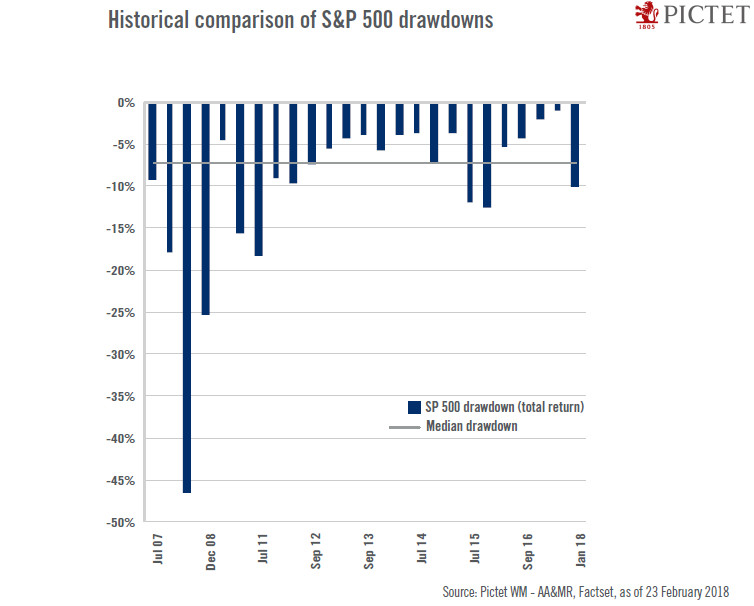

- Although markets steadied as February progressed, volatility is unlikely to return to the low levels seen last year. Yet, after a good earnings season, and with strong, synchronised growth, we remain comfortable with our positive stance on developed-market equities.

- The potential for increased volatility opens the way for trading opportunities – but also calls for extra vigilance, especially if signs of economic overheating cause further nervousness in the fixed-income markets.

- The pro-cyclical increase in the US fiscal deficit after tax cuts and the agreement to increase federal spending are likely to lead to a rise in the term premium, further justifying our short-duration stance in benchmark government bonds. We remain focused on the higher-quality end of high yield.

- Gradual monetary policy normalisation should result in the need for greater discrimination in capital allocation, and is liable to create a more favourable environment for active managers.

Commodities

- The oil price appears very close to its fundamental equilibrium level. For the foreseeable future, increased demand caused by strong global economic growth is likely to be compensated for by supply increases, notably from non-conventional US production.

Currencies

- Renewed concerns about the US budget deficit, on top of tax cuts and the potential two-year increase in federal spending limits, may have weighed on the US dollar.

- We believe that global risk appetite will remain healthy during 2018, suggesting that the recent outperformance of other funding currencies such as the Swiss franc and Japanese yen may not be sustainable.

Equities

- 2018 earnings growth for the S&P 500 is showing signs of stabilising around 19%, far higher than for the Stoxx Europe 600 and Topix.

- We are keeping our positive stance on equities, but volatility will take more time to adjust to changing growth and inflation metrics.

- The 10-year yield has been moving up as the Fed hikes rates and economic growth strengthens. The risk that yields overshoot comforts us in our short-duration exposure in government bonds.

- We cautiously believe that the current environment of good economic growth and moderate inflation is leading to opportunities in the quality segments of the credit universe.

Alternatives

- After strong returns in January, many hedge fund strategies fared well during the spike in volatility in February, providing downside protection to balanced portfolios.

- We aim to maintain our long/ short equity exposure as opportunities arise on the short side of managers’ books. Our CTA under-allocation will be rebuilt progressively according to momentum / trends. We also continue to monitor crowding risk.

- Neither high valuations nor lingering uncertainty over the impact of US tax reforms seems to be deterring private equity investors. Capital continues to flow into the asset class as never before.