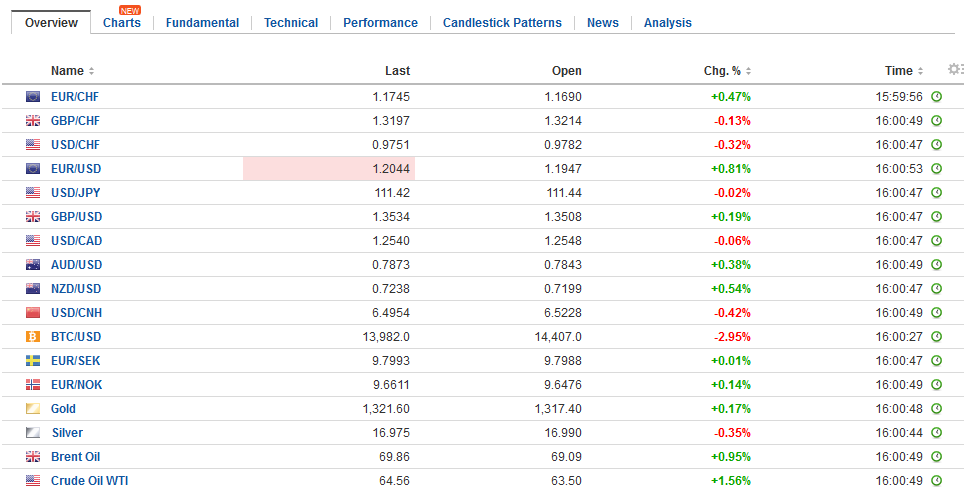

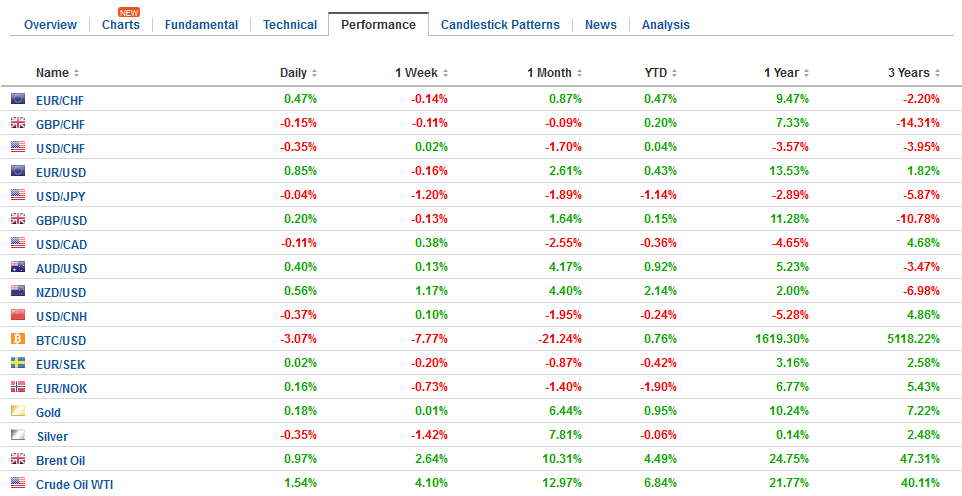

Swiss Franc The Euro has risen by 0.45% to 1.1735 CHF. EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury holdings. Then late yesterday, a news wire reported that Canada suspected the US was going to withdraw from NAFTA. Today, however, the markets have stabilized. First, in today’s operations, the BOJ maintained its purchases of short- and medium-term bonds today. This helped ease some fears and the

Topics:

Marc Chandler considers the following as important: $CNY, AUD, CAD, EUR, EUR/CHF, Eurozone Industrial Production, Featured, FX Trends, GBP, JPY, newslettersent, Spain Industrial Production, TLT, U.S. Core Producer Price Index, U.S. Initial Jobless Claims, U.S. Producer Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.45% to 1.1735 CHF. |

EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesAs market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury holdings. Then late yesterday, a news wire reported that Canada suspected the US was going to withdraw from NAFTA. Today, however, the markets have stabilized. First, in today’s operations, the BOJ maintained its purchases of short- and medium-term bonds today. This helped ease some fears and the 10-year benchmark yield slipped back. In our view, the purchases of fewer bonds by the BOJ was evident last year and is a consequence of the shift to “yield curve control” by targeting the 10-year yield rather than the quantity of purchases. Second, China’s State Administration of Foreign Exchange (SAFE) pushed back against yesterday’s news wire report about its wariness to buy Treasuries. The official suggested that “wrong sources” were used, and went on to say that China’s demand for Treasuries depends on market forces. That is exactly our point. China is not homogeneous even if it is a one-party state. There are natural difference of views and interests. For example, the PBOC often seems more open to market reforms than say the Commerce Ministry. From the news wire account, that some many other reporters and observers took at face value there was no way of telling how representative the view was or the gravitas of the officials cited. |

FX Daily Rates, January 11 |

| Also, our point is that if China wants to rebuild its reserves, like it has for the past 11 months after drawing them down by $1 trillion, it must buy foreign assets by definition. It can change the allocation of its reserves, of course, by this is not done by whim and there are many considerations, including alternatives. Some argue that China is trapped in Treasuries. That is not our point. China only faces the dilemma because it insists on amassing stock pile of reserves, in part because of its reluctance to embrace to fully embrace the best practices as defined by the G20 of letting market forces drive exchange rates.

Amid this concern about the shift in BOJ policy and China’s appetite for Treasuries, the reception to yesterday’s $20 bln US Treasuries was unexpectedly strong. The backing up of yields (2.579%) saw the bid-cover rise to 2.69, the highest since mid-2016. Indirect bidders (which includes asset managers) took down 71.4% of the new supply, the most since August 2016. This means the primary dealers absorbed a little more than a fifth, the least since March 2017. The US 10-year yield, which approached 2.60% yesterday is now back to 2.53%, down a couple of basis points today. |

FX Performance, January 11 |

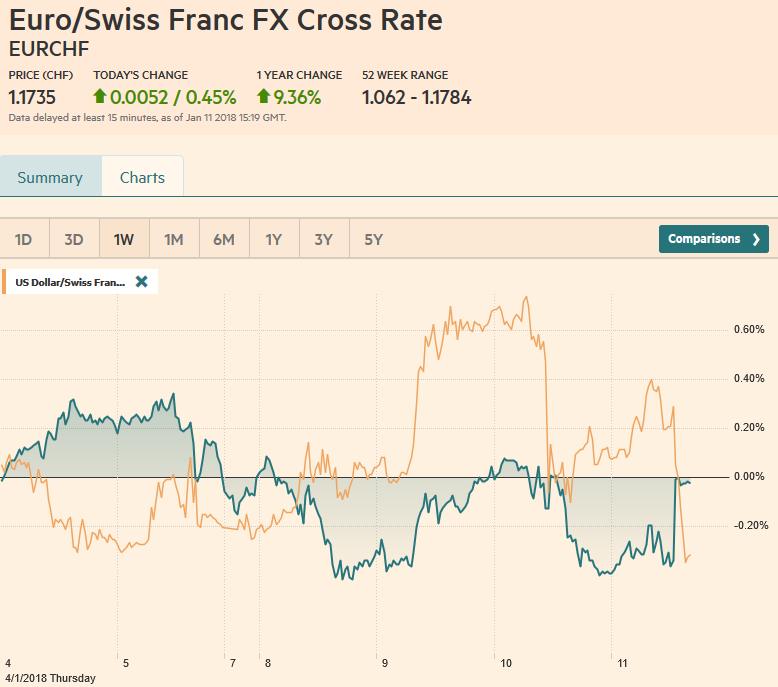

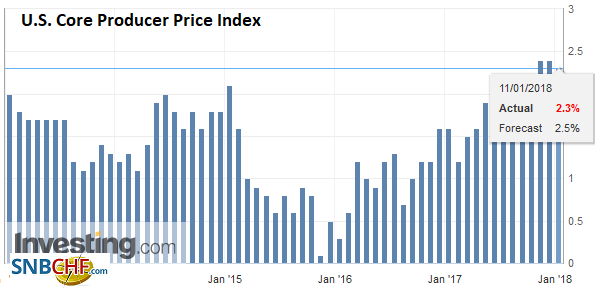

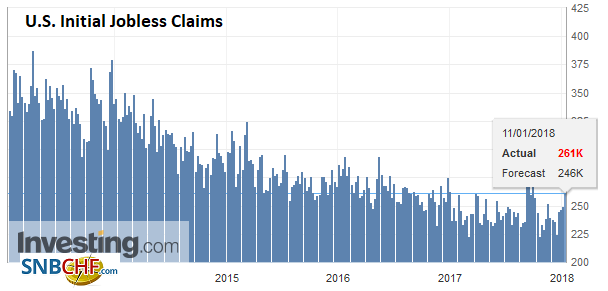

United StatesThe US reports PPI and weekly jobless claims. |

U.S. Producer Price Index (PPI) YoY, Dec 2017(see more posts on U.S. Producer Price Index, ) Source: Investing.com - Click to enlarge |

| These reports do not draw the interest as tomorrow’s CPI and retail sales will. |

U.S. Core Producer Price Index (PPI) YoY, Dec 2017(see more posts on U.S. Core Producer Price Index, ) Source: Investing.com - Click to enlarge |

| Near the close of the markets, NY Fed President Dudley speak on the outlook for the US economy. The market remains fairly confident of a March rate hike (~82%). |

U.S. Initial Jobless Claims, 11 January(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

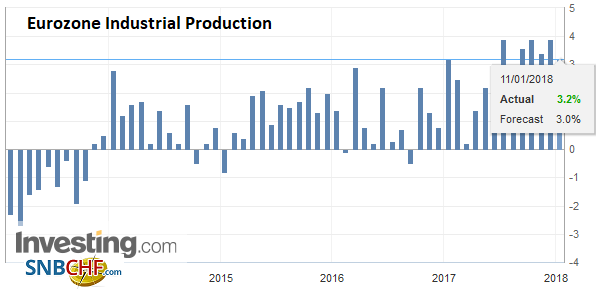

Eurozone |

Eurozone Industrial Production YoY, Nov 2017(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

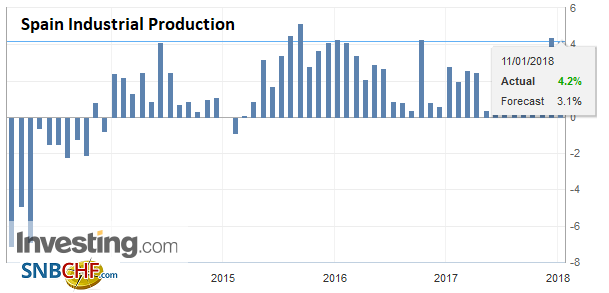

Spain |

Spain Industrial Production YoY, Nov 2017(see more posts on Spain Industrial Production, ) Source: Investing.com - Click to enlarge |

The White House says that the US position on NAFTA has not changed. While that sounds encouraging, the status quo may not have been particularly encouraging. The US has made substantive demands like curtailing the dispute resolution mechanism, and a sunset clause (that would end the treaty in five years unless the three parties explicitly endorse it) that some suspect is a poison pill. There is a negotiating round this month and next. Whatever low hanging fruit there might be, it is often picked at the start of the negotiations to show early success and create a good atmosphere of cooperation. The tougher issues come last.

The Canadian dollar is near yesterday’s lows. The US dollar has been trending lower since mid-December. The market anticipates the Bank of Canada to hike rates next week. However, even before yesterday, the US dollar began correcting higher. The CAD1.2570 area corresponds to some highs from last week and the 38.2% retracement of this last leg down. The 50% retracement is near CAD!.2640, which also is near the 20-day moving average (~CAD1.2630). The Mexican peso is little changed.

The Australian dollar is the best performing major currency today. It is up 0.4% and making new three-month highs. The driver was a sharp 1.2% jump in November retail sales, which was three-times more than economists expected. It is the strongest four and a half years. Household goods rose 4.5%, and these were fueled by a 9.3% rise in electrical and electronic products, which could prove to be one-off. The Australian dollar has approached a key (61.8%) retracement of the drop from mid-September. It is found near $0.7885.

The euro returned to where it was yesterday before the Chinese story broke. The euro continues to hold the 20-day moving average (now ~$1.1925). It takes a break of the $1.19 area, and probably $1.1865 to signal a proper correction as opposed to the consolidation. There is a 660 mln euro option struck at $1.20 that expires today. Another 2.0 bln euros expire with the same strike tomorrow. In contrast, sterling’s support near $1.35 is fraying.

Sterling has slipped through last week’s low briefly yesterday on the back of the disappointing trade figures, but snapped back on the broader dollar weakness. It has pushed a little lower today (~$1.3475), but the break is not clean or convincing yet.

The dollar reached a low near JPY11.25 yesterday. It has stabilized, but so far, the recovery is unimpressive. It has been up to almost JPY111.90 and we suspect that will not be the high of the day. The JPY112.10 area corresponds with a minimum retracement of this week’s slide and JPY112.35 is the 50% retracement and roughly the five-day moving average. There do not appear to be important option expiry today, but tomorrow there is $1.2 bln dollar on a JPY11.75 strike that expires.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Industrial Production,Featured,newslettersent,Spain Industrial Production,U.S. Core Producer Price Index,U.S. Initial Jobless Claims,U.S. Producer Price Index,USD/CHF