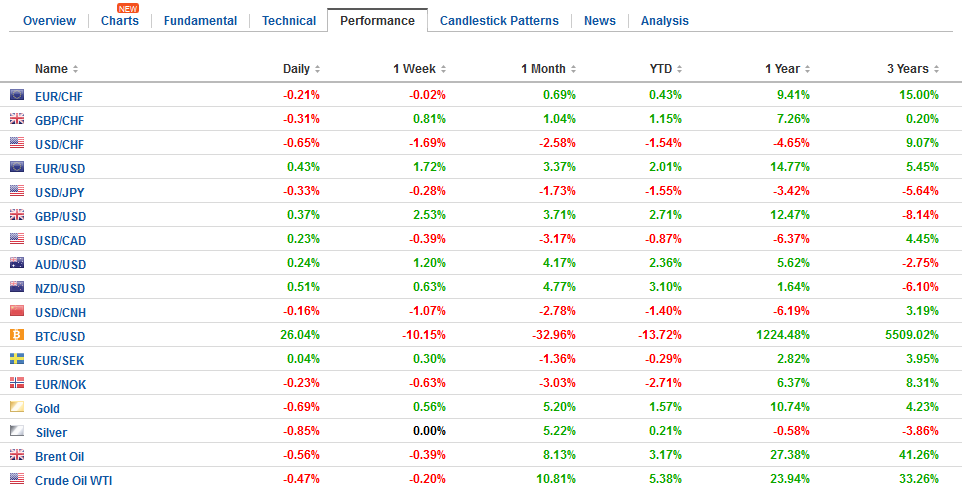

Swiss Franc The Euro has fallen by 0.20% to 1.174 CHF. EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed’s Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%, and helped by speculation that as US companies repatriate earnings kept abroad that they may have to liquidate the investments, some of which are thought to be in Treasuries. The greenback is trading with a modest downside bias today after yesterday’s late bounce was extended. The euro fell to .2165 in

Topics:

Marc Chandler considers the following as important: $CNY, AUD, CAD, China Fixed Asset Investment, China Gross Domestic Product, China House Prices, China Industrial Production, China Retail Sales, EUR, EUR/CHF, Featured, FX Trends, GBP, JPY, newslettersent, TLT, U.S. Housing Starts, U.S. Initial Jobless Claims, U.S. Philadelphia Fed Manufacturing Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.20% to 1.174 CHF. |

EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

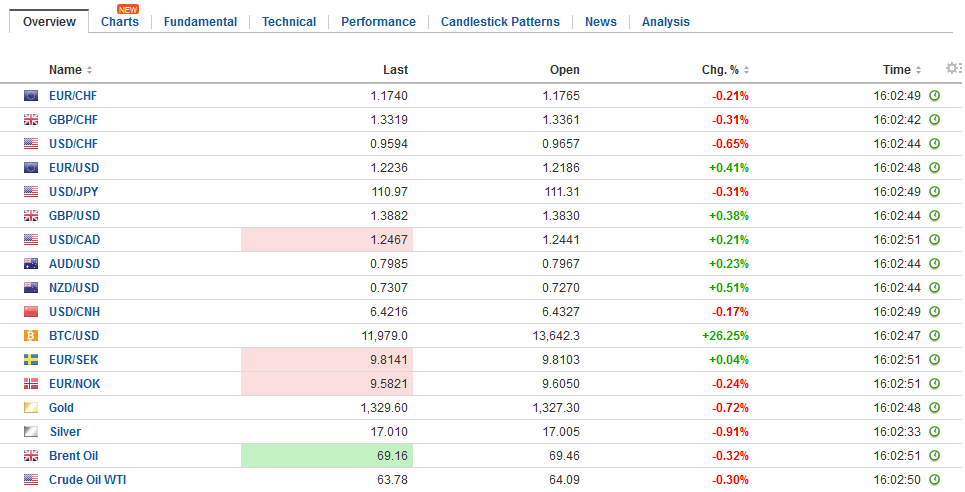

FX RatesThe US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed’s Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%, and helped by speculation that as US companies repatriate earnings kept abroad that they may have to liquidate the investments, some of which are thought to be in Treasuries. The greenback is trading with a modest downside bias today after yesterday’s late bounce was extended. The euro fell to $1.2165 in early Asia, the lows for the week, but the dip was bought and by in the European morning, the euro was back testing $1.2220. There are roughly 1.3 bln euro in options struck at $1.2200-$1.2220 that expire today. |

FX Daily Rates, January 18 |

| The dollar is faring somewhat better against the yen. It pushed above JPY111.00 yesterday and has held above it today, reaching almost JPY111.50 in Asia before consolidating in the European morning. Thee is a $1.5 bln option struck at JPY111.00 that will be cut today. There is another option of the same size struck at JPY110.80 that expires today as well.

Sterling spiked a little through $1.3940 yesterday, a post-referendum high, but closed the North American session nearly a cent lower from the peak. It is consolidating so far today in narrow ranges in nearly a quarter cent range on either side of $1.3825. |

FX Performance, January 18 |

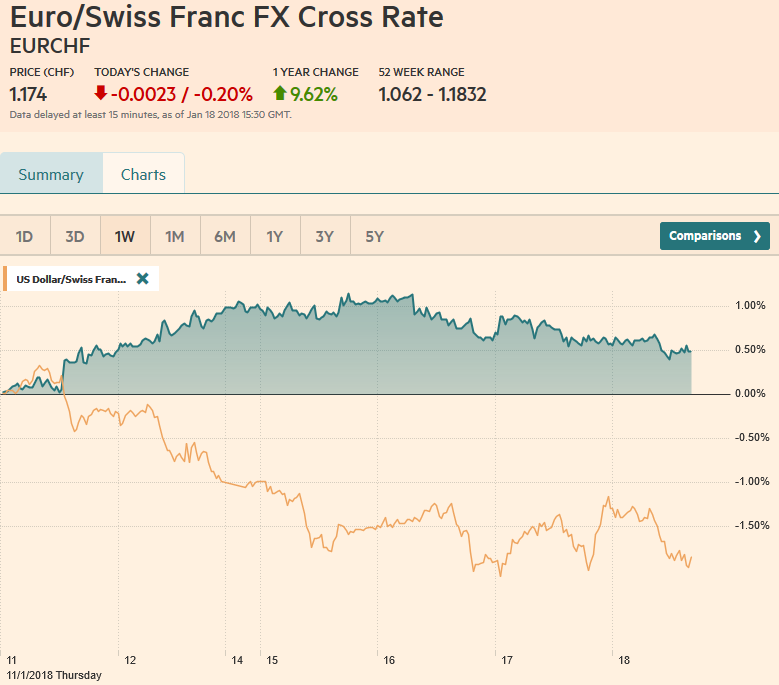

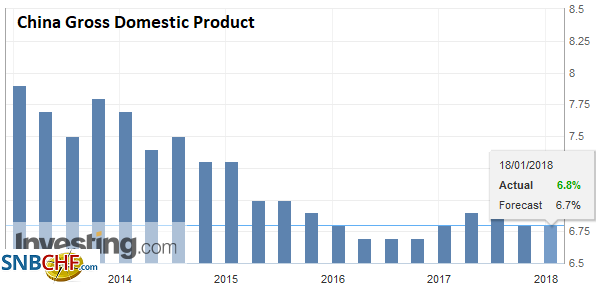

ChinaChina reported Q4 GDP rose 6.8% year-over-year in Q4 the same as in Q3, though the quarterly pace slowed to 1.6% from 1.8%. |

China Gross Domestic Product (GDP) YoY, Q4 2017(see more posts on China Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

| The incredible stability of China’s GDP is off-putting and breeds doubts even if it is broadly consistent with other data. |

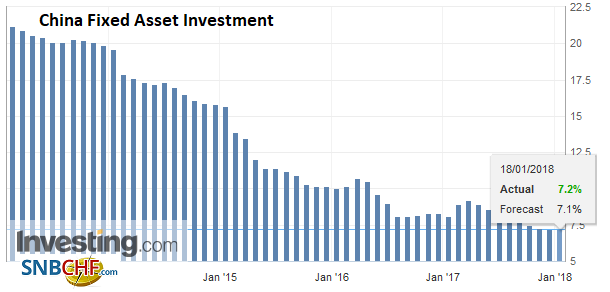

China Fixed Asset Investment YoY, Dec 2017(see more posts on China Fixed Asset Investment, ) Source: Investing.com - Click to enlarge |

| The world’s second largest economy grow 6.8% in the fourth quarter of not only last year but the previous two years as well. |

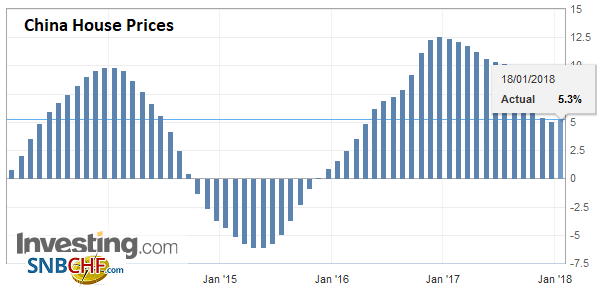

China House Prices YoY, Dec 2017(see more posts on China House Prices, ) Source: Investing.com - Click to enlarge |

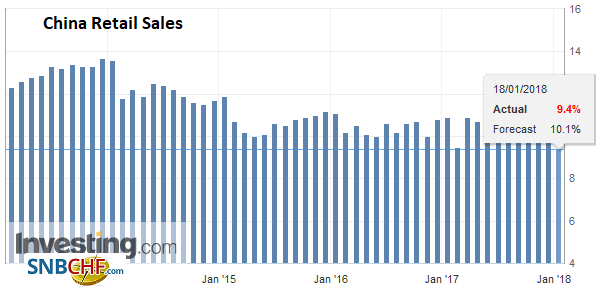

| Last year, the quarterly average pace of 1.67% matched the 2016 average and compares with 1.68% in 2015. China reported other data as well. Retail sales slowed into the year end, with December sales rising 9.4% year-over-year, down from 10.2% and the weakest since 2006. |

China Retail Sales YoY, Dec 2017(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

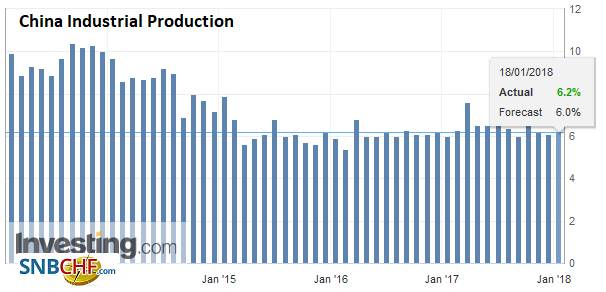

| Industrial output was a bit firmer than expected at 6.2% year-over-year and fixed increased rose 7.2%, the same year-over-year pace as in November. |

China Industrial Production YoY, Dec 2017(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

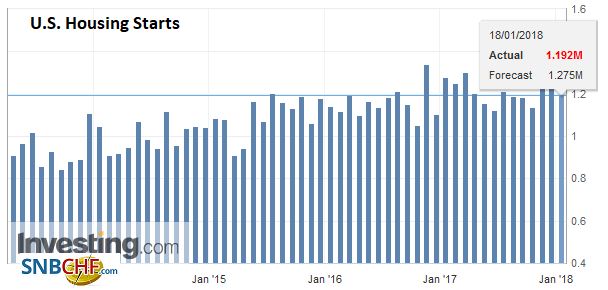

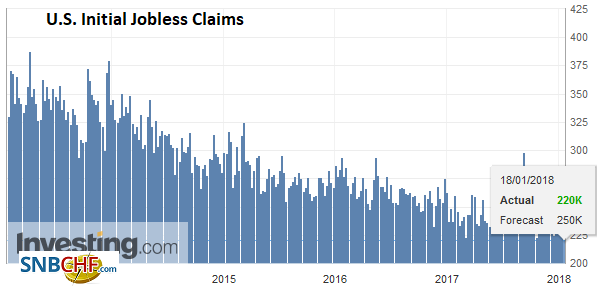

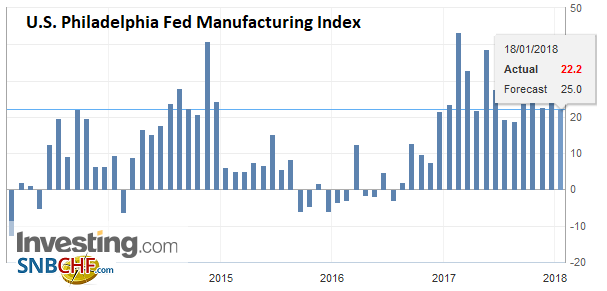

United StatesThe US reports housing starts and permits, weekly initial jobless claims (which cover the week that the January non-farm payroll survey is conducted) and the Philly Fed survey (January). Yesterday’s report showing a surge in industrial production (0.9% and 8.2% annualized pace in Q4) was fueled by utilities (5.6%) and mining/drilling (1.6%). Manufacturing edged up by 0.1%. It is unreasonable to expect the overall pace of industrial output to be sustained at its best level since Q2 2010. If the pace slows by half that would still be consistent with above trend growth in Q1 18. |

U.S. Housing Starts, Dec 2017(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

U.S. Initial Jobless Claims, January 18 Source: Investing.com - Click to enlarge |

|

U.S. Philadelphia Fed Manufacturing Index, Jan 2018(see more posts on U.S. Philadelphia Fed Manufacturing Index, ) Source: Investing.com - Click to enlarge |

The news stream is light in Europe after Australia and China provided the highlights earlier. Australia reported the December jobs data. Employment rose 34.7k, which is in line with the year’s average through November (~33.5k). Full-time employment rose 15.1k, which comes on the back of 75k increase over the past two months. The participation rate rose to 65.7% from 65.5%, while the unemployment rate ticked up to 5.5% from 5.4%. It is understood as a favorable report, but probably not enough to bring forward an RBA rate hike. The Australian dollar popped above $0.8000 for the first time in four months yesterday and is consolidating in a have cent range below it today.

China is also the subject of two other talking points today. First, the US Treasury data shows that China’s holdings of Treasuries slipped 1.1% in November to stand at a four-month low of $1.18 trillion. Recall the recent Bloomberg report that people were advising the PBOC to take a more cautious approach to US bonds. Recall that the dollar value of China’s reserves rose by $10 bln in November. However, as we noted at the time, the November increase could be explained by the valuation rather than the accumulation of more reserves. The euro rose 2.2% against the dollar in November. Making conservative assumptions about the amount of euros, China holds can easily explain a $10 bln increase.

The other talking point is President Trump’s interview in which he warned of coming action against China for violation of intellectual property rights. He suggested a big fine would be set shortly, though other observers suspect several measures, which could include tariffs, and actions in areas that the WTO does not cover. It looks like some announcement may be forthcoming shortly, and it will also appear prominently in the State of the Union address at the end of the month.

Separately, but not totally unrelated, the US auctions $13 bln of inflation-protected 10-year notes today. With market-based measures of inflation on the rise, the anecdotal Beige Book, and data suggesting that the tax cuts come as the US economy appears to be accelerating, makes demand for the TIPS a window into market psychology.

The rally in US equities yesterday failed to carry over into Asia, and the MSCI Asia Pacific Index shed 0.4%. It is the first back-to-back drop since early December. However, Japan was the main drag (Nikkei off 0.45% and the Topix off 0.75%). Excluding Japan, the MSCI Asia Pacific Index rose 0.15% and extended its winning streak to a fifth session. European shares slightly firmer and the Down Jones Stoxx 600 is up fractionally on balance as information technology, energy, materials and financials have offset the losses in telecom, utilities, real estate and consumer sectors.

Bond markets are heavy. Australia and New Zealand 10-year yields rose two and four basis points respectively, while yields are up one-three basis points in Europe and the US 10-year Treasury yield is trying to get a foothold above 2.60%.

The Bank of Canada seemed to have tried to deliver a dovish hike yesterday, but the market views have not changed. The two-year yield eased a single basis point and the OIS curve was unchanged. The market favors another hike in April/May. The Bank of Canada expressed concerns about risks associated with a breakdown of NAFTA. The second to last round of negotiations are to be held in Montreal next week. Yesterday, reports quoted Trump threatening to abandon NAFTA, and even if this materializes, it most likely would not be until the negotiations are completed.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,$TLT,China Fixed Asset Investment,China Gross Domestic Product,China House Prices,China Industrial Production,China Retail Sales,EUR/CHF,Featured,newslettersent,U.S. Housing Starts,U.S. Initial Jobless Claims,U.S. Philadelphia Fed Manufacturing Index,USD/CHF