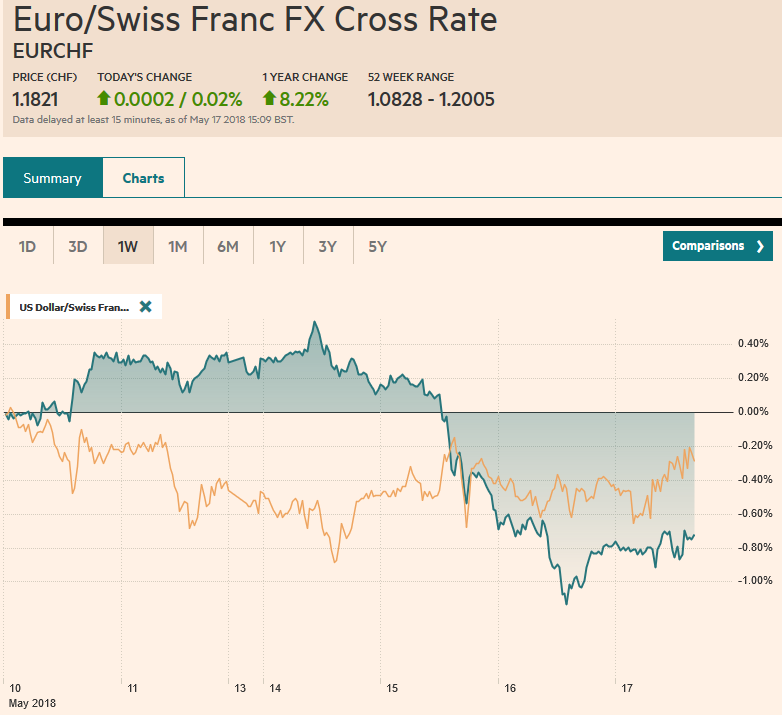

Swiss Franc The Euro has risen by 0.02% to 1.1821 CHF. GBP and CHF The Pound has remained fairly range bound against the Swiss Franc during the last couple of weeks as the markets appear to adopting a wait and see approach as to what might happen in the medium to long term. The Pound fell marginally during this time after the Bank of England once again decided to keep interest rates on hold at a split of 7-2 in favour of keeping the rates the same. Over the next couple of days there is limited data published both here and in Switzerland so the focus in terms of data is likely to come out from the Eurozone with the release of Construction Output data at 10am today. Data has been improving in this sector lately on

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, EUR/CHF, Featured, GBP, gbp-chf, MXN, newsletter, TLT, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.02% to 1.1821 CHF. GBP and CHFThe Pound has remained fairly range bound against the Swiss Franc during the last couple of weeks as the markets appear to adopting a wait and see approach as to what might happen in the medium to long term. The Pound fell marginally during this time after the Bank of England once again decided to keep interest rates on hold at a split of 7-2 in favour of keeping the rates the same. Over the next couple of days there is limited data published both here and in Switzerland so the focus in terms of data is likely to come out from the Eurozone with the release of Construction Output data at 10am today. Data has been improving in this sector lately on the continent and typically if we have some positive news in the Eurozone this will often result in some strength for the Swiss Franc. Arguably more important in terms of data will be the release of Eurozone Trade Balance data at 10am tomorrow morning. This will show how well the Eurozone economy is performing at the moment and if we see another positive release this could see the Swiss Franc have a strong end to the week against the Pound. The US Dollar has weakened marginally against the Swiss Franc overnight and this has helped the Franc vs the Pound as well. With the political landscape a little concerned with how the talks between the US and North Korea may go in the near future the Swiss Franc has seen the benefit of being a safe haven currency.

|

EUR/CHF and USD/CHF, May 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe Britsh pound was a cent from yesterday’s lows on a press report that claimed the UK cabinet had agreed on seeking to stay in the customs union with the EU beyond the two-year transition period. The report suggested that the UK wanted to still negotiate other trade deals, which would seem to be a Trojan Horse. The UK’s other trade partners would have access to common market through the back door, if you will, without a treaty with the EU. EU officials seemed wary, but the report was denied. Sterling returned to levels when the news first broke in early Asia, a little below $1.35, before recovering toward $1.3540. Sterling has spent the past two and a half weeks in a $1.3450-$1.3620 trading range. It has not seen $1.36 this week. The sideways trading is alleviating the oversold technical condition. |

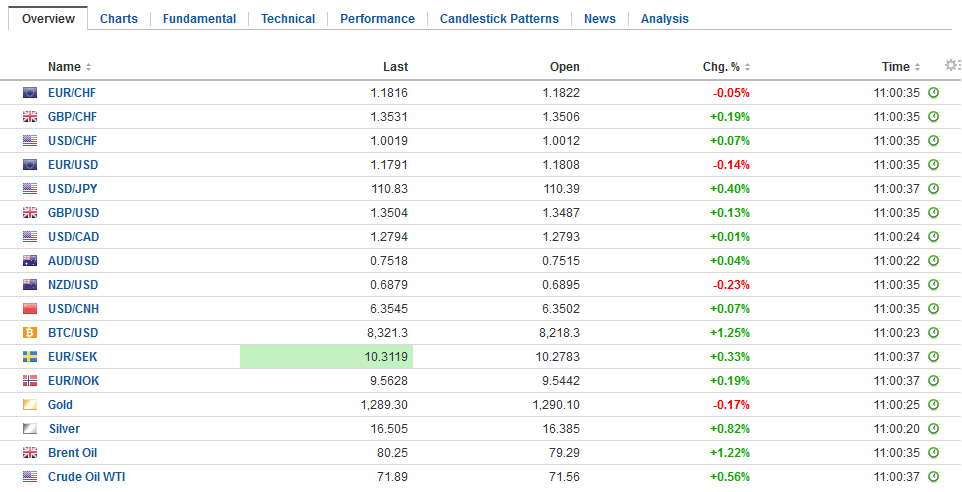

FX Daily Rates, May 17 |

| After finally convincingly breaking above 3.0%, the US 10-year Treasury yield is continuing to probe higher. It is through 3.10% level now. Although in Q1, rising US yields were not sufficient to offset the upside pressure on the yen, the correlations have improved, and the dollar has convincingly broked above the JPY110 level. The yen is off 3.3% over the past month. It is the weakest of the major currencies today, off about a quarter percent. The next target is seen near JPY111.20.

Rising US yields are serving to drag global yields higher. Core European bond yields are mostly up a couple of basis points, the peripheral bonds bond yields are a couple of basis point softer. Italy is lagging, but its bond (and equity) market has stabilized after yesterday’s near panic reaction to a leaked document that played up the radical tendencies of what still could become the governing coalition. While progress is reportedly being made between the Five Star Movement and the (Northern) League, the failure to reach an agreement yet is frustrating and leaves open the possibility that it reflects the inability to reach a final deal. The most difficult issues are often left for last in such negotiations, and it may turn on who is going to be the prime minister. |

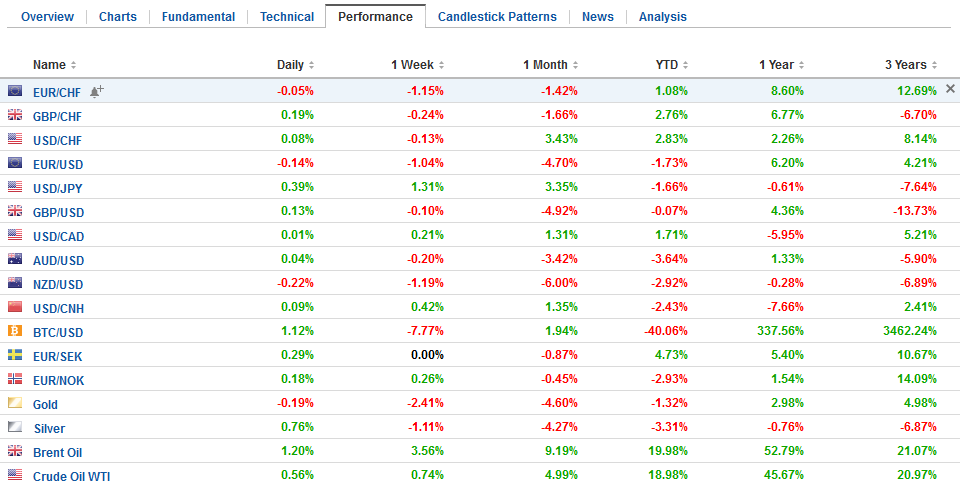

FX Performance, May 17 |

GBP/CHFThe Pound has remained fairly range bound against the Swiss Franc during the last couple of weeks as the markets appear to adopting a wait and see approach as to what might happen in the medium to long term. The Pound fell marginally during this time after the Bank of England once again decided to keep interest rates on hold at a split of 7-2 in favour of keeping the rates the same. Over the next couple of days there is limited data published both here and in Switzerland so the focus in terms of data is likely to come out from the Eurozone with the release of Construction Output data at 10am today. Data has been improving in this sector lately on the continent and typically if we have some positive news in the Eurozone this will often result in some strength for the Swiss Franc. Arguably more important in terms of data will be the release of Eurozone Trade Balance data at 10am tomorrow morning. This will show how well the Eurozone economy is performing at the moment and if we see another positive release this could see the Swiss Franc have a strong end to the week against the Pound. The US Dollar has weakened marginally against the Swiss Franc overnight and this has helped the Franc vs the Pound as well. With the political landscape a little concerned with how the talks between the US and North Korea may go in the near future the Swiss Franc has seen the benefit of being a safe haven currency. |

GBP/CHF, May 17(see more posts on gbp-chf, ) Source: markets.ft.com - Click to enlarge |

The US granted the EU, Canada, and Mexico exemptions from the steel and aluminum tariffs until June 1. Japan, which was not granted sanctions, indicated today that it will notify the WTO of its retaliatory measures. Trade tensions are likely to rise ahead of month-end. Today is the deadline the Speaker of the House of Representatives (Ryan) for a NAFTA deal if this Congress can vote on it. We will be sharing observations of the implication of the passing the deadline (next post), but for now, note that the Canadian dollar is the second strongest of the majors today, rising about 0.3%. The US dollar has returned to the week’s low which was sent on Monday near CAD1.2750. Nearby support is seen at CAD1.2730, while a break of CADF1.2700 would be seen as more significant from a technical perspective. The CAD1.27 level is where large options expire today ($1.3 bln) and tomorrow ($1.3 bln). The Mexican peso is also firm before the local market opens.

The Australian dollar is also holding on to small gains against the US dollar. Its nearly 0.2% gain puts in third place today. The jobs data were mixed. The small outperformance in jobs creation in April was offset by the downward revision to the March series. Full-time employment though rose 32.7k, which is the most since last November. The participation rate ticked up as did the unemployment rate (to 5.6%). The Australian dollar ran out of steam near $0.7550. There is an A$580 mln option struck at $0.7540 expires today, and an A$1.6 bln option expire at $0.7548 on Monday. The New Zealand budget did not deter the selling of the Kiwi on the cross against the Aussie. The Kiwi is trading at new four-month lows against the Australian dollar.

The euro is consolidating yesterday’s fall to new lows for the year. It continues to straddle the $1.18 area. There are no significant options the expire today, but tomorrow that is a 1.5 bln euro strike at $1.18 that will be cut. We had thought there was potential for the euro to test the 200-day moving average a little above $1.20 at the start of the week, but the pressure to cut back stale long exposure and for bottom pickers in the futures market cut new longs quick proved too much. Even now shallow euro bounces are being sold.

The pressure on the Hong Kong dollar peg continues. The HKMA reportedly bought HK$9.5 bln to defend the floor for the Hong Kong dollar today in a few operations. This is a sharp increase of the funds over what was spent yesterday (~HKD1.57 bln). The Malaysian ringgit extended its losing streak for a seventh session. The threat of official action gave the Turkish lira a brief reprieve yesterday. The currency is under pressure again today and is near the record low seen earlier this week (TRY4.5). More reports suggest US-based fund managers were larger buyers of both short and long-term debt sold by Argentina this week. The situation does not appear to have stabilized yet.

The US reports weekly jobless claims and the Philly Fed Survey for May. Investors will also be watching the oil market where Brent traded at $80 for the first time since November 2014 and WTI for June delivery is north of $72.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$TLT,EUR/CHF,Featured,gbp-chf,MXN,newsletter,USD/CHF