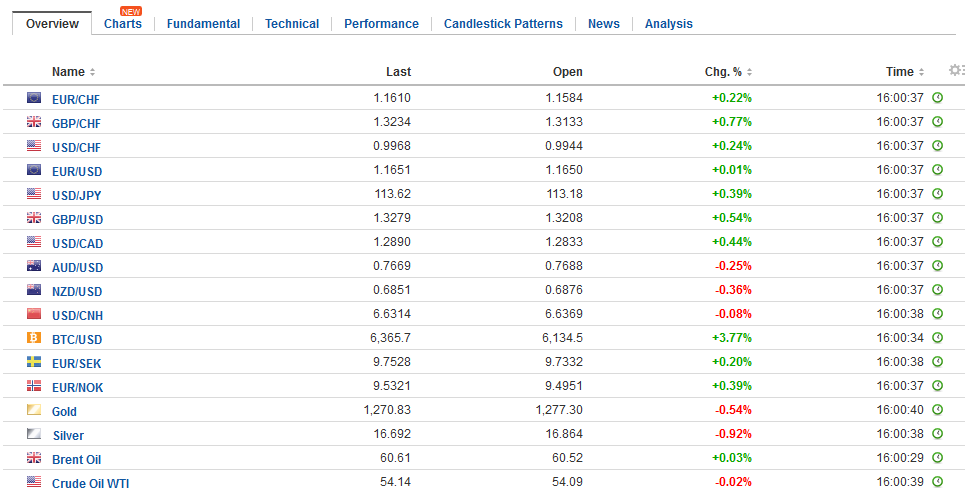

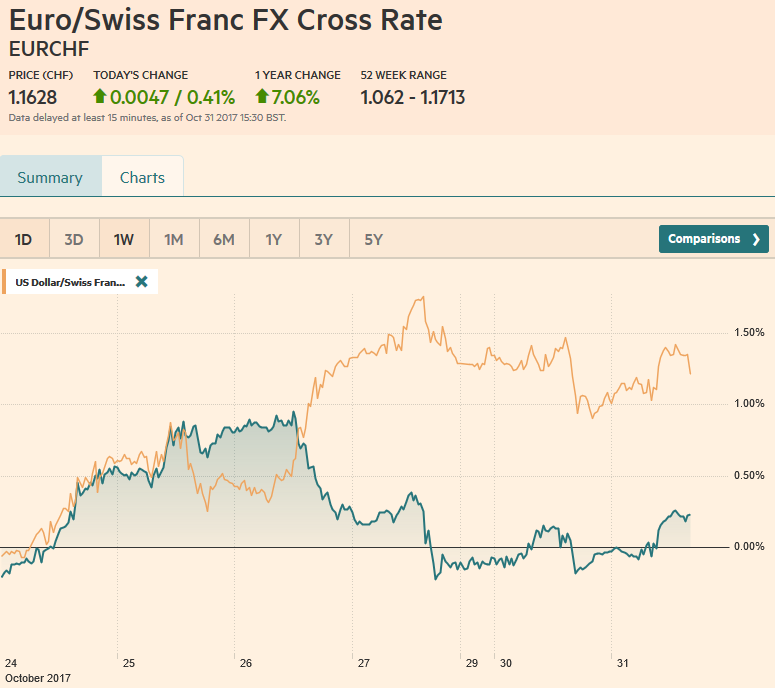

Swiss Franc The Euro has risen by 0.41% to 1.628 CHF. EUR/CHF and USD/CHF, October 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equity markets are closing another strong month. The MSCI Asia Pacific Index was little changed on the day, but up 4.3% in October, the 10th consecutive monthly advance. Europe’s Dow Jones Stoxx 600 is also flattish today, but up 1.6% on the month. It is the second monthly advance after a June-August swoon. The benchmark is closing in on the high for the year set in May. The S&P 500 made new record highs at the end of last week. Coming into today’s session, the S&P 500 is up 2.1% on the month, and since last October, has only

Topics:

Marc Chandler considers the following as important: CAD, China Manufacturing PMI, China Non-Manufacturing PMI, EUR, EUR/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Eurozone Gross Domestic Product, Eurozone Unemployment Rate, Featured, France Consumer Price Index, France Gross Domestic Product, FX Trends, GBP, Italy Consumer Price Index, Japan Construction Orders, Japan Household Spending, Japan Industrial Production, Japan Unemployment Rate, newsletter, NZD, SPY, TLT, U.S. Chicago PMI, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.41% to 1.628 CHF. |

EUR/CHF and USD/CHF, October 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

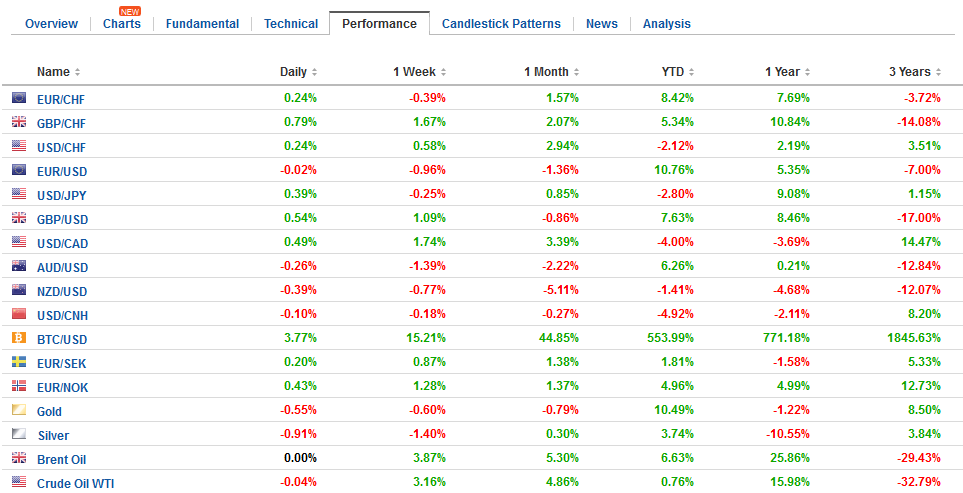

FX RatesGlobal equity markets are closing another strong month. The MSCI Asia Pacific Index was little changed on the day, but up 4.3% in October, the 10th consecutive monthly advance. Europe’s Dow Jones Stoxx 600 is also flattish today, but up 1.6% on the month. It is the second monthly advance after a June-August swoon. The benchmark is closing in on the high for the year set in May. The S&P 500 made new record highs at the end of last week. Coming into today’s session, the S&P 500 is up 2.1% on the month, and since last October, has only posted a single losing month (March -0.04%). While global equity markets rally, seemingly no matter what, the bonds and currencies know more than one direction. The US 10-year yield recorded the low for the year just above 2.0% in early September. It has since risen to around 2.47% and has backed off in recent sessions. A few attempts in Q2-Q3 to push above this area have failed. We suggested that a move below around 2.35% would spur ideas that this recent attempt has also failed. This area was approached earlier today, and it held. Interest rate differentials have moved against the US dollar in Q2-Q3 but have moved more forcefully in the dollar’s direction recently. The dollar is likely to close higher against all the major currencies this month. However, here the too market is testing key levels. For example, the $1.1600-$1.1660 band in the euro is important, and while the euro had edged into the high $1.1500s, but the break has not yet been convincing. A convincing break would suggest losses toward $1.1250. On the other hand, if it holds, another the euro can recover back to $1.18, if not higher. |

FX Daily Rates, October 31 |

| The dollar has been turned back from the JPY114 area in May and July, and again probed this area last week. The poor price action ahead of the weekend warned of the risk of a setback, we thought, toward JPY113.00. This was tested earlier today and it, reinforced by the 20-day moving average (~JPY112.90), held.

Sterling rallied in strongly in the first half of September on the back of the latest hint that the BOE would likely raise rates. However, Brexit and political issues seemed to weigh it into the first part of October, and this month has chopped around a two-cent range. A dovish hike by the BOE, or no hike, for that matter, could send sterling back toward $1.30 for a more significant challenge. On the other hand, a broader dollar pullback and a hawkish comments or forecasts could see sterling challenge $1.3350-$1.3400. The US dollar has trended higher against the Canadian dollar, and with last week’s gains, retraced 50% of this year’s slide. To keep the upward momentum intact, the greenback must convincingly surmount the CAD!.2930 area. On the other hand, the support is seen in the CAD1.2725-CAD1.2750 area. |

FX Performance, October 31 |

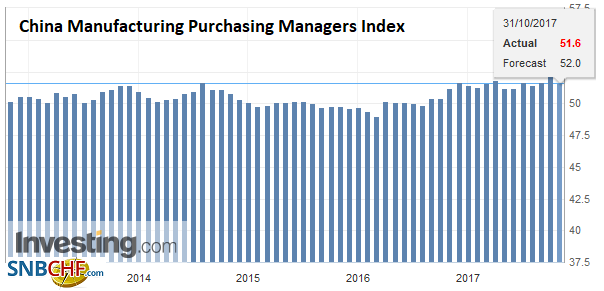

ChinaToday’s news stream and month-end adjustments will likely prevent a decisive move today. In terms of economic developments, there have been a few highlights. First, China’s PMI. It will not surprise many that some less favorable news on the economy may have been held back ahead of the recent 19th Party Congress. In any event, the October PMIs softened. The manufacturing PMI slipped to 51.6 from 52.4, which is a bit larger of a drop than expected. |

China Manufacturing Purchasing Managers Index (PMI), Oct 2017(see more posts on China Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

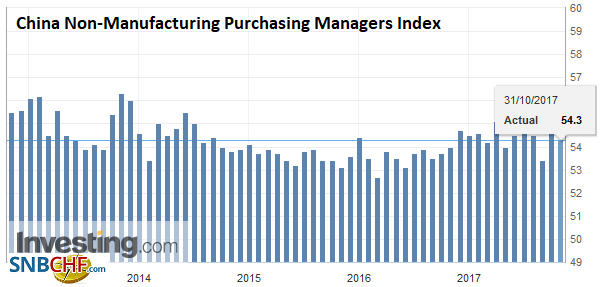

| The non-manufacturing PMI eased to 54.3 from 55.4. Forward-looking new orders and prices moved lower. President Xi did not repeat the goal of doubling China’s GDP in the 2010-2020 period, and many observers recognize that this could allow the country to report slower growth, which would be consistent with the shift toward quality issues. |

China Non-Manufacturing Purchasing Managers Index , Oct 2017(see more posts on China Non-Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

JapanSecond, the BOJ did not change policy. It did, though, recognize the inevitable and brought this year’s inflation forecast to 0.8% from 1.1%. |

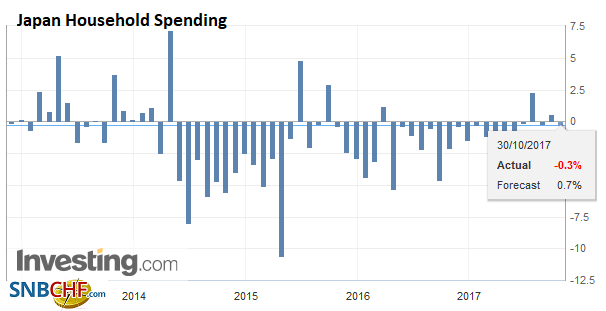

Japan Household Spending YoY, Sep 2017(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

| Next years was shaved to 1.4% from 1.5%. The GDP forecast was tweaked to 1.9% from 1.8% this year and left unchanged at 1.4% next year. |

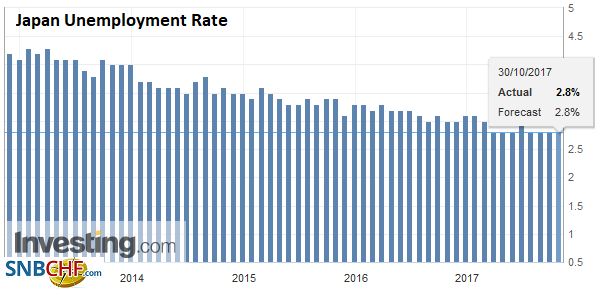

Japan Unemployment Rate, Sep 2017(see more posts on Japan Unemployment Rate, ) Source: Investing.com - Click to enlarge |

| Of note, the new board member, Kataoka dissented again, arguing for new measures to achieve the 2% inflation target. |

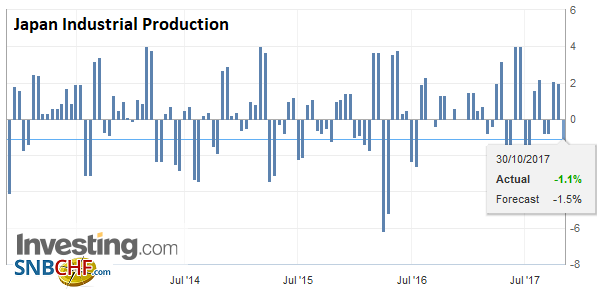

Japan Industrial Production, Sep 2017(see more posts on Japan Industrial Production, ) Source: Investing.com - Click to enlarge |

| He argued to cap the 15-year yield below 20 bp. It is currently near 30 bp. Also of interest, Governor Kuroda did not waver on the ETF purchases (JPY6 trillion target). The Nikkei 400, which the ETF tracks is up 5.7% this month, and the BOJ is believed to have pulled away from its purchases. |

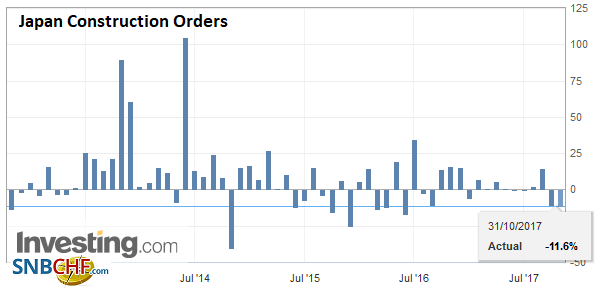

Japan Construction Orders YoY, Sep 2017(see more posts on Japan Construction Orders, ) Source: Investing.com - Click to enlarge |

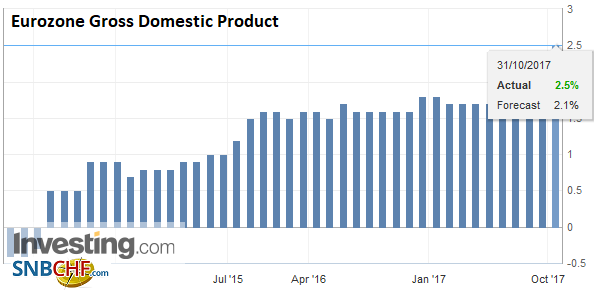

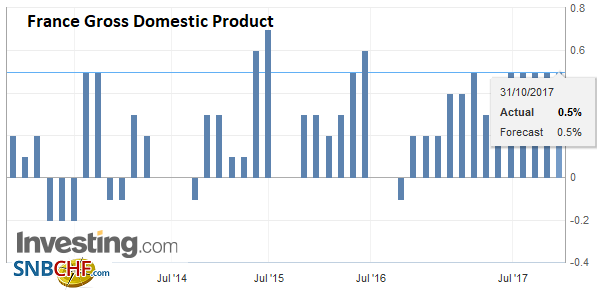

EurozoneThird, the eurozone reported better growth, but less inflation, than expected. The first look at Q3 GDP showed a 0.6% increase, and Q2 was revised to 0.7% from 0.6%. Growth is not the immediate challenge in the eurozone. |

Eurozone Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

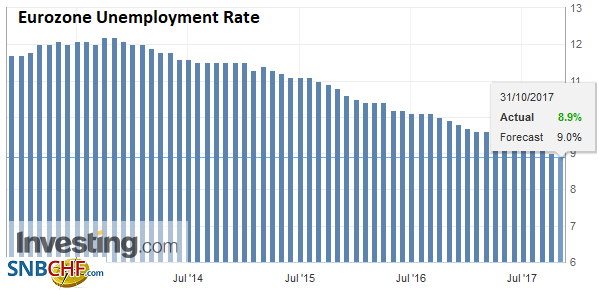

| Unemployment also continues to fall. At 8.9% in September, it is a new cyclical low. That the August figure was revised to 9.0% from 9.1% underscores the trend improvement. |

Eurozone Unemployment Rate, Sep 2017(see more posts on Eurozone Unemployment Rate, ) Source: Investing.com - Click to enlarge |

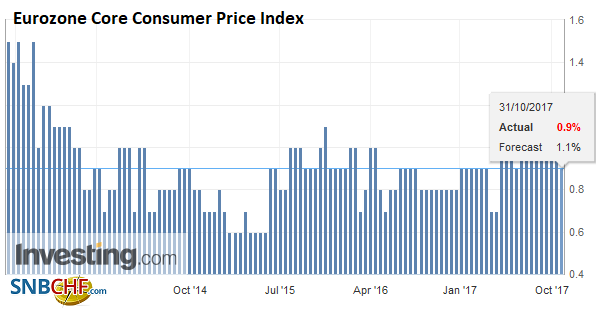

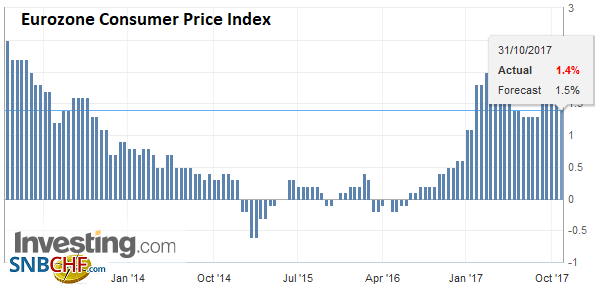

| On the other hand, price pressures eased. The headline pace slipped to 1.4%, but the real challenge to the ECB comes from the core rate, even though it does not directly target it. |

Eurozone Core Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The core rate slipped to 0.9% from 1.1%. This indicates that it is not just energy prices, which Draghi had warned would likely drag inflation lower in the near-term. The key issue is what the ECB will do next September, as its course until then has been largely mapped out, with all the due caveats of its flexibility. |

Eurozone Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

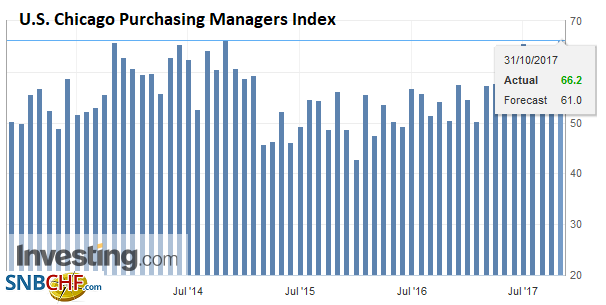

United StatesThere are some large options that expire in NY today. There is a 1.1 bln euro options truck at $1.16, and a $614 mln option struck at JPY113.00. There is a GBP350 mln option struck at $1.3200 that will be cut today. In the US despite, the two indictments and a surprised guilty plea from a third person in the investigation into Russia’s attempt to influence the US election, the market impact was limited. It is a bit like a game of bridge where players are signaling each other, in this investigation, with the type of charges and the like, which creates subtext and bit of Kabuki theater. The takeaway seems to be that the investigation is still in the early stages and it will probably linger through at least most of next year. |

U.S. Chicago Purchasing Managers Index (PMI), Oct 2017(see more posts on U.S. Chicago Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

France |

France Gross Domestic Product (GDP) QoQ, Q3 2017(see more posts on France Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

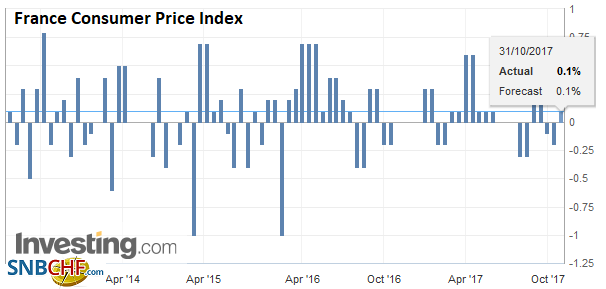

France Consumer Price Index (CPI), Oct 2017(see more posts on France Consumer Price Index, ) Source: Investing.com - Click to enlarge |

|

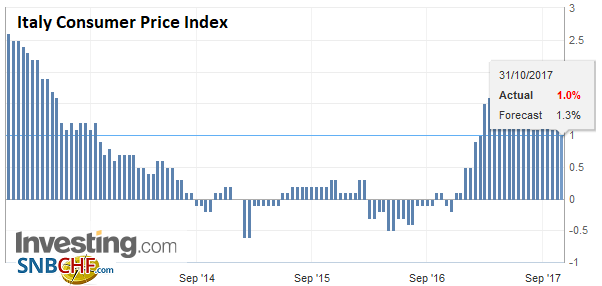

Italy |

Italy Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

The Catalan secessionist move has been thwarted. The leader, Puigdemont, reportedly is in Brussels seeking asylum. Madrid invoked Article 155, but importantly, it simultaneously called for quick elections (before Christmas). Madrid was taking away its autonomy and then giving it back quicker than anyone anticipated. Spanish stocks and bonds are outperforming a bit today, but note that the peak in the crisis was actually several weeks ago.

The New Zealand’s dollar appears to be trying to bottom, from a technical point of view, but the political/policy headwinds are a deterrence. Comments from the Finance Minister give the bears little reason to fear official concern despite 10% slide in the Kiwi over the past three months. The moves to deter foreign speculation (investment?) in New Zealand real estate is seen cutting into an important source of demand for the currency. That said, we continue to suspect that just as the market overreacted to Trudeau’s victory in Canada and his effort to buck the new fiscal orthodox and stimulate, the market may be exaggerating the negatives of the new government, like giving the central bank a dual mandate.

Meanwhile, investors are more interested in the tax reform, and here the situation, even at this late date is very fluid. Although the speculation has been around for a couple of weeks, the possibility of gradually phasing in the corporate tax cuts (three percentage points a year from 2018 through 2022), was disappointing to those who wanted a big move, while it seemed to be a compromise on cost. News that Treasury Secretary Mnuchin had given up, for the time being, on extra-long dated bond spurred a quick though small reaction in the curve at the very long end.

Tags: #GBP,#USD,$CAD,$EUR,$TLT,China Manufacturing PMI,China Non-Manufacturing PMI,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Gross Domestic Product,Eurozone Unemployment Rate,Featured,France Consumer Price Index,France Gross Domestic Product,Italy Consumer Price Index,Japan Construction Orders,Japan Household Spending,Japan Industrial Production,Japan Unemployment Rate,newsletter,NZD,SPY,U.S. Chicago PMI,USD/CHF