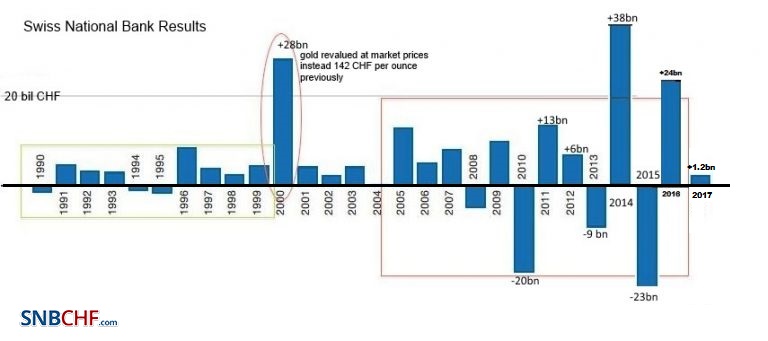

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But in 2017, the picture is changed. Assuming a “biblical” cycle of seven good years and seven bad years, the SNB could now increase profits every year – thanks to a weaker franc and the seven good years. … until the next recession comes and the seven bad years start. At that moment the SNB will have to tolerate a massive loss: Given that the recession would be inflationary, she will tolerate a far stronger franc, for example EUR/CHF may fall from 1.25 to 0.90 over some years. Which will result into up 60-80 bn. CHF loss at the peaks. SNB

Topics:

George Dorgan considers the following as important: Featured, newsletter, SNB, SNB balance sheet, SNB equity holdings, SNB Gold Holdings, SNB Press Releases, SNB profit, SNB results, SNB sight deposits, Swiss National Bank

This could be interesting, too:

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

investrends.ch writes Schweizer Firmen ziehen wieder Investitionen aus dem Ausland ab

The increasing volatility of SNB EarningsAnnual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But in 2017, the picture is changed. Assuming a “biblical” cycle of seven good years and seven bad years, the SNB could now increase profits every year – thanks to a weaker franc and the seven good years. … until the next recession comes and the seven bad years start. At that moment the SNB will have to tolerate a massive loss:

|

SNB Results Longterm H1 2017 |

|

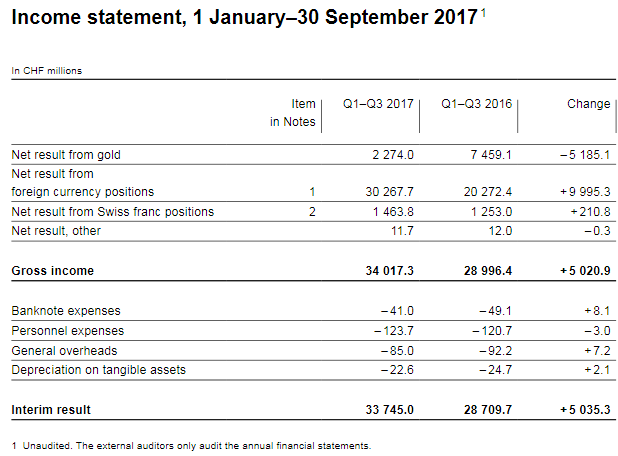

Income statement, 1 January–30 September 2017 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||

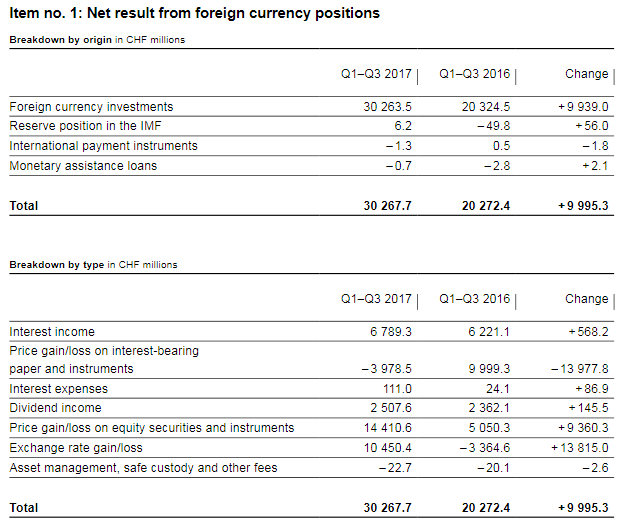

Profit on foreign currency positions

|

SNB Profit on Foreign Currencies Q1-Q3 2017 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||

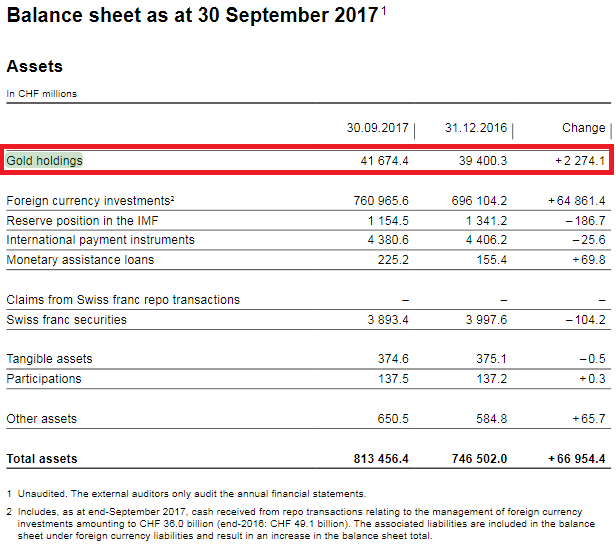

Valuation gain on gold holdings

Percentage of gold to balance sheetThe percentage of gold compared to the total balance sheet is falling.

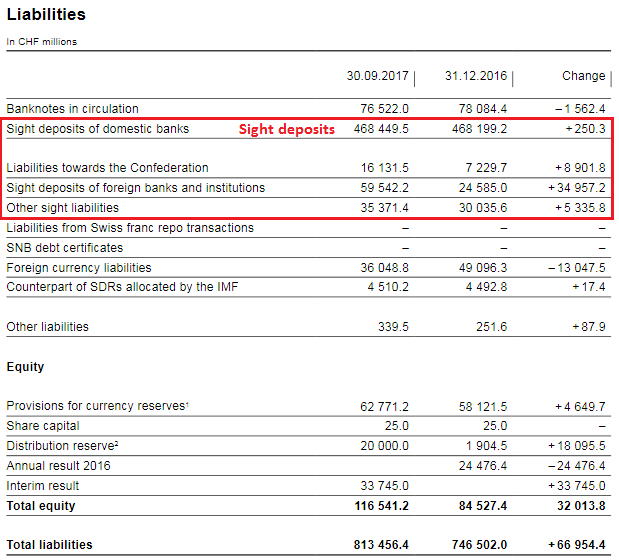

Balance Sheet The balance sheet has expanded by over 66.5 bn. francs by 8.91%.

|

Balance Sheet as at 30 September 2017 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||

While the SNB supports foreign stock markets and foreign companies, it does not invest in Swiss stocks.

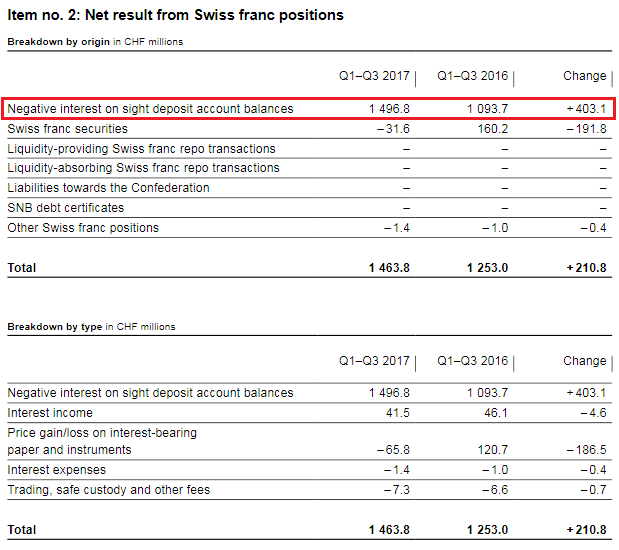

Profit on Swiss franc positionsThe net result on Swiss franc positions totalled CHF 1.5 billion overall, which essentially resulted from negative interest charged on sight deposit account balances.

Negative Interest ratesFurthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability.

|

SNB Result for Swiss Franc Positions, Q1-Q3 2017 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||

SNB LiabilitiesElectronic Money Printing: Sight Deposits Sight deposits is the biggest part of SNB interventions.

Paper Printing Banknotes in circulation: -1.6 bn francs to 76.5 bn. CHF

Provisions for currency reserves

|

SNB Liabilities and Sight Deposits, Q3 2017 Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter,SNB balance sheet,SNB equity holdings,SNB Gold Holdings,SNB profit,SNB results,SNB sight deposits,Swiss National Bank