Swiss Franc EUR/CHF - Euro Swiss Franc, May 03(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact on the broader investment climate. US 10-year Treasuries are hovering just below 2.30% and remains within the range set since the popping higher in response to the first round of the French presidential election a week and a half ago. FX Daily Rates, May 03 - Click to enlarge The US dollar is posting minor gains against all the major currencies and many in the emerging markets. The euro’s gains fizzled in Asia near .0935, the upper end of the recent range. The first estimate of Q1 17 GDP was in line with expectations rising 0.5%. The year-over-year pace slipped to 1.7% from 1.8% when it had been for the past two quarters. We note that the slower growth that we had anticipated on ideas that the survey data was running ahead of the real sector was picked up GDP of the broader EU. Growth for the 28 members slowed to 0.4% from 0.

Topics:

Marc Chandler considers the following as important: AUD, EUR, EUR/CHF, Eurozone Gross Domestic Product, Eurozone Producer Price Index, Featured, FOMC, FX Daily, FX Trends, GBP, Germany Unemployment Change, Germany Unemployment Rate, newslettersent, NZD, U.K. Construction PMI, U.S. ADP Nonfarm Employment Change, U.S. ISM Non-Manufacturing PMI, U.S. Services PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 03(see more posts on EUR/CHF, ) |

FX RatesThe global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact on the broader investment climate. US 10-year Treasuries are hovering just below 2.30% and remains within the range set since the popping higher in response to the first round of the French presidential election a week and a half ago. |

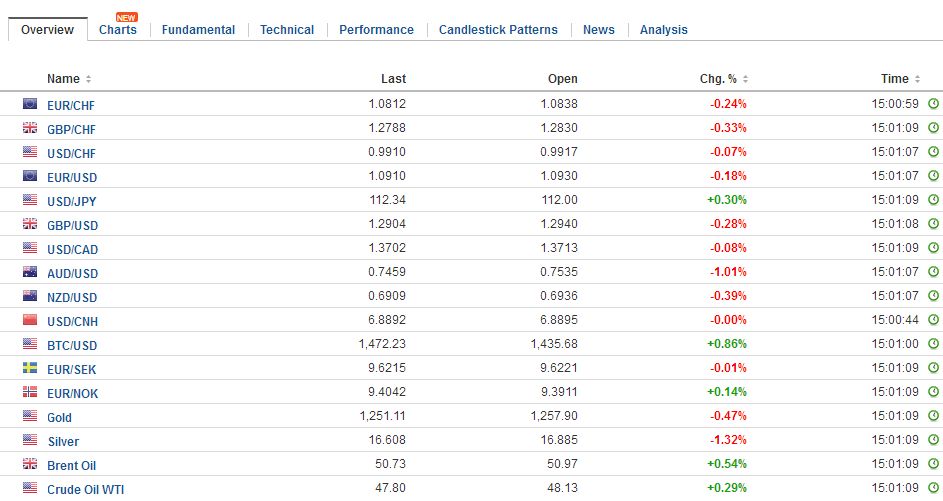

FX Daily Rates, May 03 |

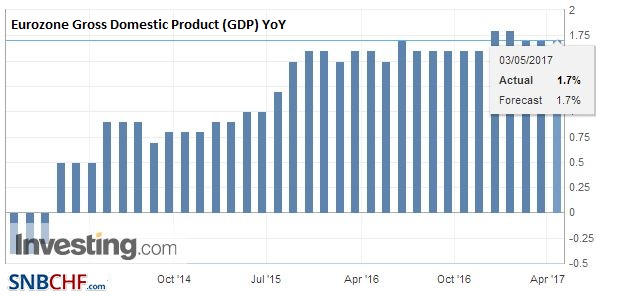

| The US dollar is posting minor gains against all the major currencies and many in the emerging markets. The euro’s gains fizzled in Asia near $1.0935, the upper end of the recent range. The first estimate of Q1 17 GDP was in line with expectations rising 0.5%. The year-over-year pace slipped to 1.7% from 1.8% when it had been for the past two quarters. We note that the slower growth that we had anticipated on ideas that the survey data was running ahead of the real sector was picked up GDP of the broader EU. Growth for the 28 members slowed to 0.4% from 0.6%, though the year-over-year pace was steady at 1.9%.

The Australian dollar is the weakest of the majors. It is off about 0.7% at ~$0.7485. It is snapping a three-day advance that brought it up from $0.7440 to $0.7555 yesterday. A sell-off in financials and material sectors dragged Australian shares 1% lower, which is the largest loss in six weeks, after reaching a two-year high at the start of the week. |

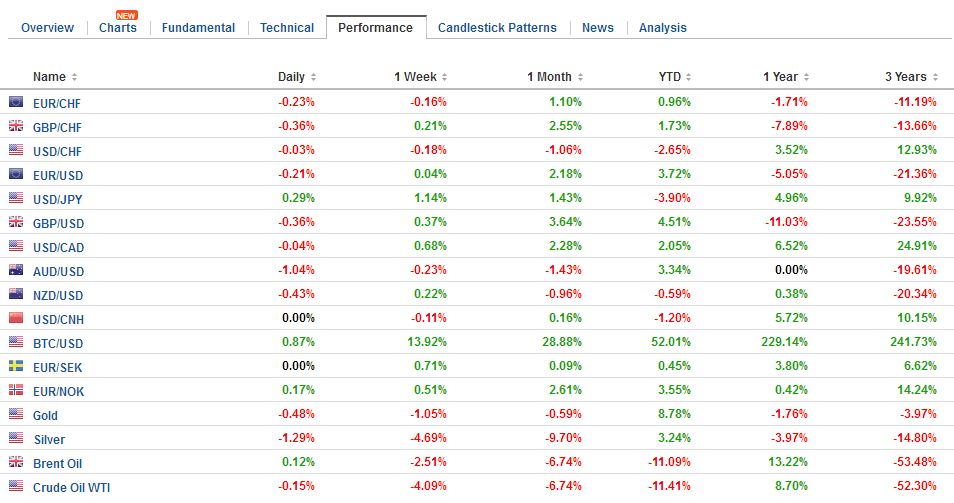

FX Performance, May 03 |

Eurozone |

Eurozone Gross Domestic Product (GDP) YoY, Q1 2017(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

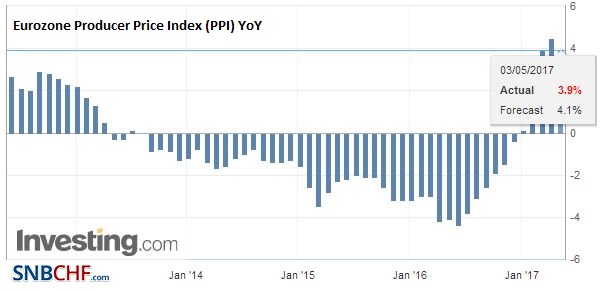

Eurozone Producer Price Index (PPI) YoY, March 2017(see more posts on Eurozone Producer Price Index, ) Source: Investing.com - Click to enlarge |

|

Germany |

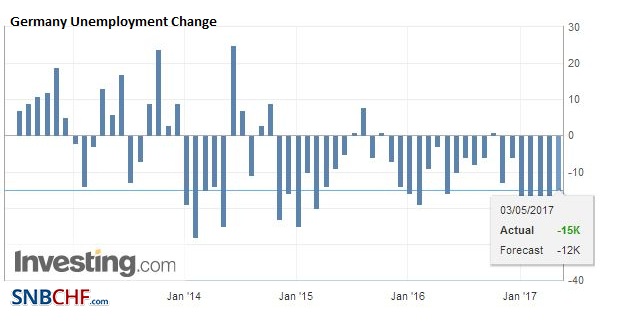

Germany Unemployment Change, April 2017(see more posts on Germany Unemployment Change, ) Source: Investing.com - Click to enlarge |

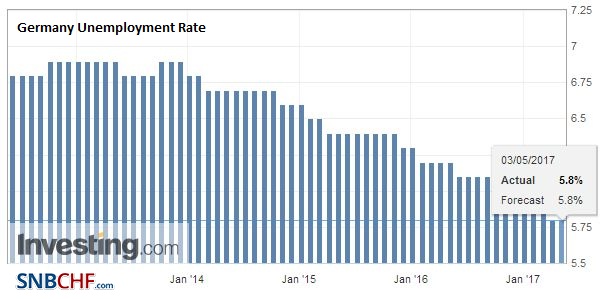

Germany Unemployment Rate, April 2017(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

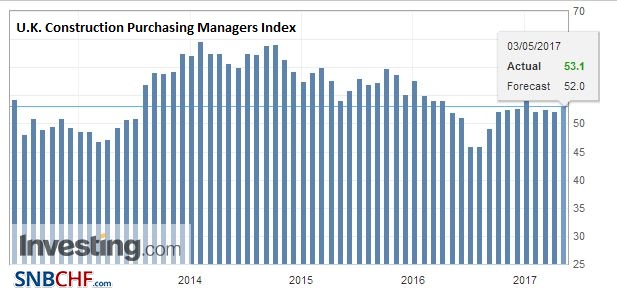

United KingdomUK BRC Shop price index fell 0.5%, which was large as expected. The aggregate conceals that food prices rose and non-food prices fell. Following the yesterday’s stronger than expected manufacturing PMI, the UK reported an unexpected rise in the construction PMI. It rose to 53.1 from 52.2. Many had looked for a small pullback. It is the strongest reading since December and is above the Q1 average (52.3). Sterling is a little softer against the dollar. Although the market is not showing much penchant for testing the $1.3000-$1.3055 area, pullback remains limited too. Support over the past five sessions has been build in the $1.2865-$1.2885 area. |

U.K. Construction Purchasing Managers Index (PMI), April 2017(see more posts on +, U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

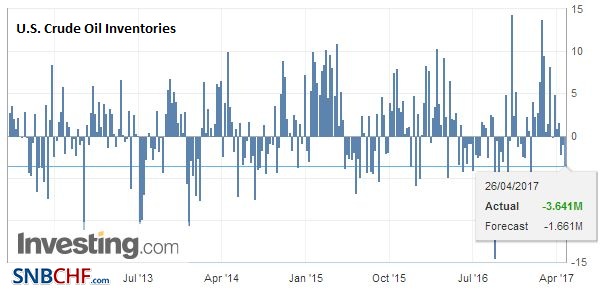

United StatesIron ore and copper prices are weaker today. We note that oil prices have stabilized after yesterday’s 2.4% drop on news of stepped up Libyan output. The decline in the API inventory estimate steadied prices after hitting six-week lows. According to the API, US crude inventories fell 4.16 mln barrels last week and gasoline inventories fell by 1.93 mln barrels. The DOE estimate is due out later today. By its calculations, oil inventories have fallen for the past two weeks. |

U.S. Crude Oil Inventories, April 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

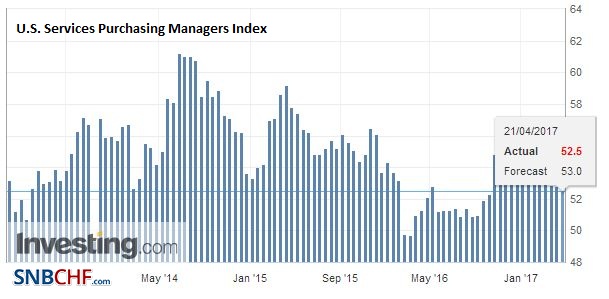

| The US also reports services PMI and non-manufacturing ISM. The flash PMI slipped to 52.5 from 52.8. It was the third consecutive decline. |

U.S. Services Purchasing Managers Index (PMI), April 2017(see more posts on U.S. Servie, ) Source: Investing.com - Click to enlarge |

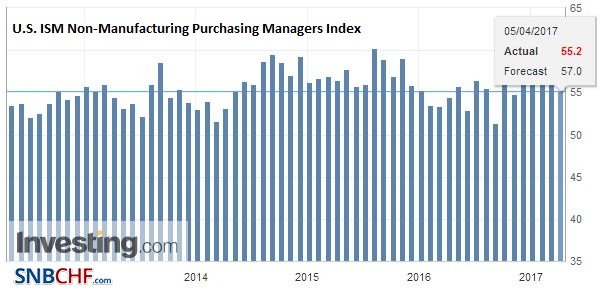

| The Bloomberg survey has the April ISM rising to 55.8 from 55.2. The peak since October 2015 was set in February at 57.6. |

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), April 2017(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

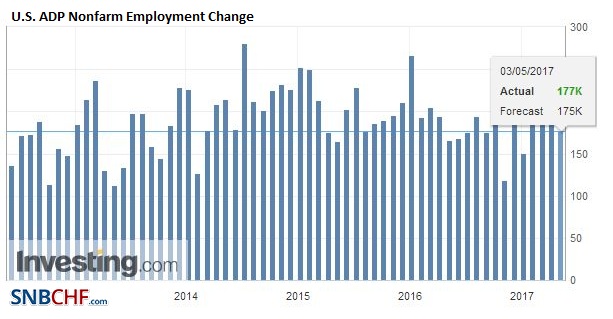

| Before getting to the FOMC meeting, investors will learn the ADP estimate for private sector jobs (~175k after 263k in March). It so badly missed the March BLS non-farm payrolls estimate (89k) that today’s report may not have much impact. Shortly after the ADP report, the US Treasury will make two announcements. First, it will announce the size of the Q2 refunding. Second, it will release the minutes of the recent advisory committee meeting that likely discussed the issuance of a ultra-long Treasury bond. |

U.S. ADP Nonfarm Employment Change, April 2017(see more posts on U.S. ADP Nonfarm Employment Change, ) Source: Investing.com - Click to enlarge |

This is a decision that the Treasury Department makes without Congress. Many participants are skeptical that a sufficient supply of say 50-year bonds can be issued that will significantly impact the average duration of the $14 trillion (marketable securities) market. There is also concern that in order to draw investors into that duration, a concession (higher yields) will be demanded.

There is no press conference following the FOMC meeting. Besides some minor adjustments to its economic assessment, we do not expect the statement to change very much. It is too much to expect strong clues into the June meeting. The Bloomberg calculation puts the odds of a June hike at almost 61%, while the CME’s estimate puts it at 63%. Yet the US two-year yield is lower than it was when the Fed hiked rates last December and in March.

New Zealand

In contrast, New Zealand posted a healthy jobs report, the unemployment rate unexpectedly ticked down to 4.9% from 5.2%, on stronger than expected jobs growth. The New Zealand dollar initially rallied to almost $0.6970, a six-day high, before reversing lower, setting the stage for a possible shooting star candlestick formation, depending on the close.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,EUR/CHF,Eurozone Gross Domestic Product,Eurozone Producer Price Index,Featured,FOMC,FX Daily,Germany Unemployment Change,Germany Unemployment Rate,newslettersent,NZD,U.K. Construction PMI,U.S. ADP Nonfarm Employment Change,U.S. ISM Non-Manufacturing PMI,U.S. Services PMI