See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Election Effect Debate Last week, we talked about the effect of the French election on the gold and silver markets, and noted: Of course, traders want to know how this will affect gold and silver. As we write this, we see that silver went down 30 cents before rallying back up to where it closed on Friday. Gold went down about , and then half way back up. At this point, we are not sure if the metals are supposed to go up because more printing. Or go down because the euro constrains France from printing. Or silver at least should go up because the economy is going to be better with France remaining in the Eurozone. Or go down because the ongoing malaise will only progress as it has been. Or some other logic… and the price gyrations this evening show that traders don’t agree either. French precious metals terrorizers sow discord among traders [PT] Photo credit: Christian Hartmann / Reuters - Click to enlarge Silver Price in Terms of Real Money It didn’t take too long. Here is what happened to silver this week. The graph below shows the price of silver in real money (i.e. gold). Silver has been falling for going on one year, but clearly since March 1.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold silver ratio, newslettersent, Precious Metals, silver basis, Silver co-basis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Election Effect DebateLast week, we talked about the effect of the French election on the gold and silver markets, and noted:

|

|

Silver Price in Terms of Real MoneyIt didn’t take too long. Here is what happened to silver this week. The graph below shows the price of silver in real money (i.e. gold). Silver has been falling for going on one year, but clearly since March 1. After one last hurrah at the end of March, it has been taking the elevator down. And by its fundamentals it should be quite a bit lower — 0.0125. |

Silver Price in Terms of Real Money(see more posts on silver price, ) |

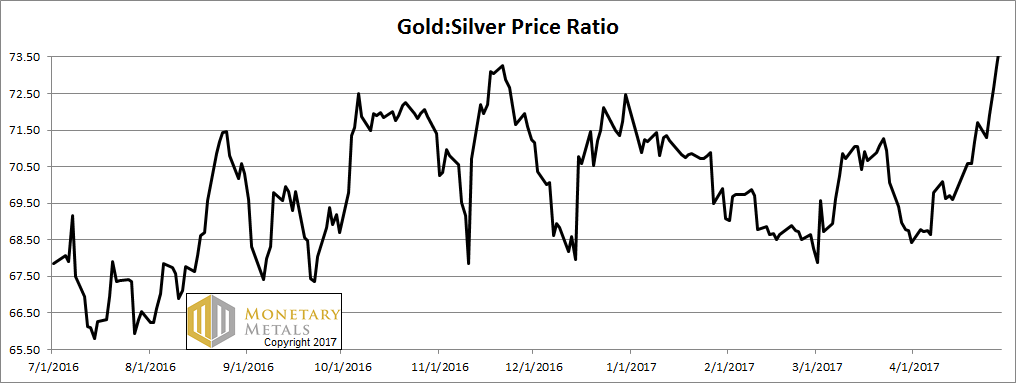

Fundamental DevelopmentsIn any case, we are interested in watching what the fundamentals of the metals are doing. We will take a look at the graphs below, but first, the price and ratio charts. Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It had another major move up this week, after a major move up last week. Last week, we said:

|

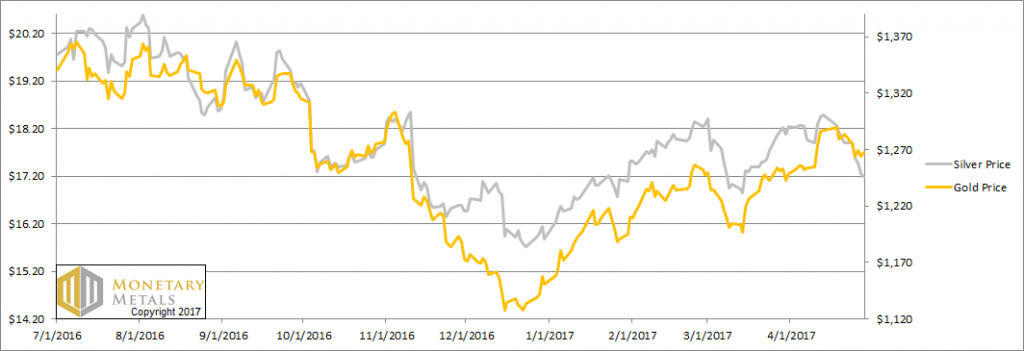

Gold and Silver Price(see more posts on gold price, silver price, ) |

Gold:Silver RatioWell, it broke those levels and ended the week just under 74.

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

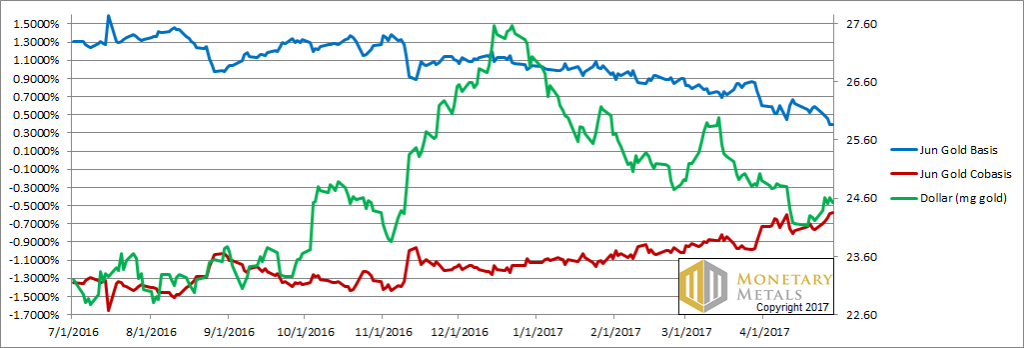

Gold Basis and Co-basis and the Dollar priceHere is the gold graph. The scarcity (i.e. the co-basis, the red line) was on the rise this week. It makes sense, that as the price of gold drops (which is the mirror of what this graph shows, the price of the dollar in gold milligrams) the metal becomes scarcer. This means speculators are selling their paper. If owners of metal were selling, then the metal would not become scarcer and might even become more abundant. However, it only became a little scarcer while the price dropped almost twenty bucks. So our calculated fundamental price fell $15 to $1,274, a few bucks above the market price. |

Gold Basis and Co-basis and the Dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

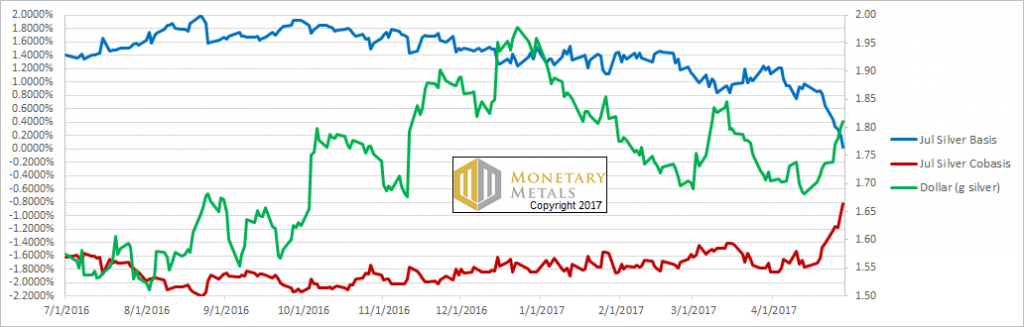

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. In silver, the price fell a lot. 72 cents. The co-basis rose (i.e., abundance dropped and scarcity increased). Last week, we asked:

Clearly it happened to more of them this week. And, unless the fundamentals get stronger, it is likely to flush even more leveraged futures positions. Our calculated fundamental price fell three cents this week, now a buck thirty under the market price. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Tags: dollar price,Featured,gold basis,Gold co-basis,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis