Nice sentence: Tears won’t be confined to Wall Street however: let’s not forget that none other than the Swiss National Bank is also long some 10.4 million shares of AAPL. First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing to explain. The FAANGs (Facebook, Apple, Amazon, Netflix and Google) own their niches and not so long ago were expected to...

Read More »Wall Street In Pain: 163 Hedge Funds Are Long AAPL Stock

First it was the blow up of hedge fund darling Valeant that crushed countless funds who were long the name. Then, one month ago after the collapse of the Allergan-Pfizer deal, we showed (one of the reasons) why the hedge fund world continued to underperform the broader market: Allergan was one of the most widely held hedge fund stocks. And now, following the biggest Apple debacle in years, here is the reason why the hedge fund community is about to see even more redemption requests and...

Read More »A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world’s savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published “Negative Rates: How One Swiss Bank Learned to Live in a Subzero World“: Alternative Bank Schweiz AG late last year became Switzerland’s first bank to comprehensively pass along negative rates to all of its customers. Violating an almost religious precept in the financial...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It’s official, I’m calling a banking crisis in Europe. Things didn’t go well the last time I did this. Of course, many will say, “But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!”. Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first major bank to fall...

Read More »La chute de la Deutsche Bank se poursuit. Liliane Held-Khawam

La banque allemande qui peut causer le tsunami financier européen. Nous avons publié le 15 février 2016 un dossier intitulé « Deutsche Bank: Une arme de destruction massive de l’Allemagne« . Toute l’analyse qui y avait été faite reste bien évidemment d’actualité. La charge phénoménale en produits dérivés continuera de représenter un puissant détonateur… Gigantesque charge spéculative! Le sort de cet établissement est donc à suivre de près puisque nous pouvons raisonnablement supposer que...

Read More »Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke. Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the country’s biggest banks, raising speculation that it may be a new member of the so-called ‘national team’ of investors the Chinese government unleashes to support its stock market.” Statists and interventionists around the world (read: `those who...

Read More »With Wall Street Bitten by the Blockchain Bug, How Do We Admit the Truth About the Technology’s Disruptive Potential?

I attended a panel discussion on private blockchains in banking at UBS in NYC last night. There were two overarching misconceptions that appeared to permeate the discussions: Counterparties can be trusted, hence you can build reliable systems with trusted parties, and; Capital markets are, and always will be predicated upon the legacy, highly centralized hub and spoke model that we know today. Basically, the influential gatekeepers that control access to a centralized, authoritative...

Read More »The Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority don't understand how the Forex markets work. It's not insulting - it's a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions - but none against a central bank. Of...

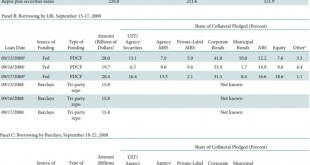

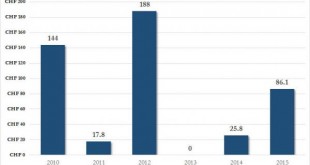

Read More »Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woefully investments in Valeant and the spike in its buying of AAPL stock at its all time high. But while the SNB's stock holdings are updated every quarter courtesy of its informative SEC-filed 13F (we wish the Fed would also disclose the equities...

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another 12.5...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org