With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the shellacking it took after the shockingly poor jobs data, the US dollar has only managed a shallow recovery against the euro and yen. The euro peaked near .1375 before the weekend. The mild pullback to almost .1335 drew some fresh buying. The dollar made a marginal new low just below JPY106.40 in early Asia. It ticks to nearly JPY107.30 in late Asian turnover as the Nikkei climbed back after gapping lower and closed at session highs. The greenback would have to resurface above the JPY107.80-JPY108.10 to begin repairing the technical damage inflicted last week. Click to enlarge. United Kingdom Sterling peaking near .4425 before the weekend. At least three polls showed those favoring Brexit were leading ahead of the June 23 referendum. Reports indicated that the bookmakers in London also narrowed the odds of a vote to leave the EU. Sterling slid to .4350, its lowest level since May 16, where it found support in Asia and again in early Europe.

Topics:

Marc Chandler considers the following as important: Berlusconi, China, EUR, Featured, FX Daily, FX Trends, GBP, Janet Yellen, JPY, Matteo Renzi, Minister Valls, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

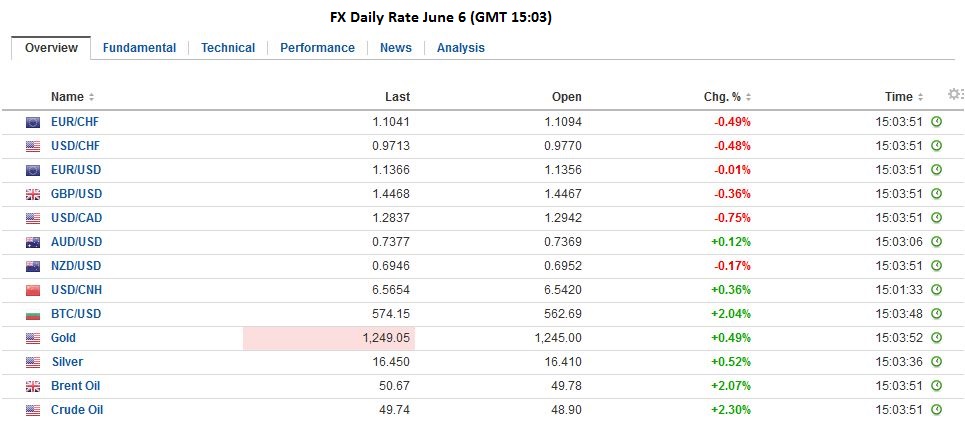

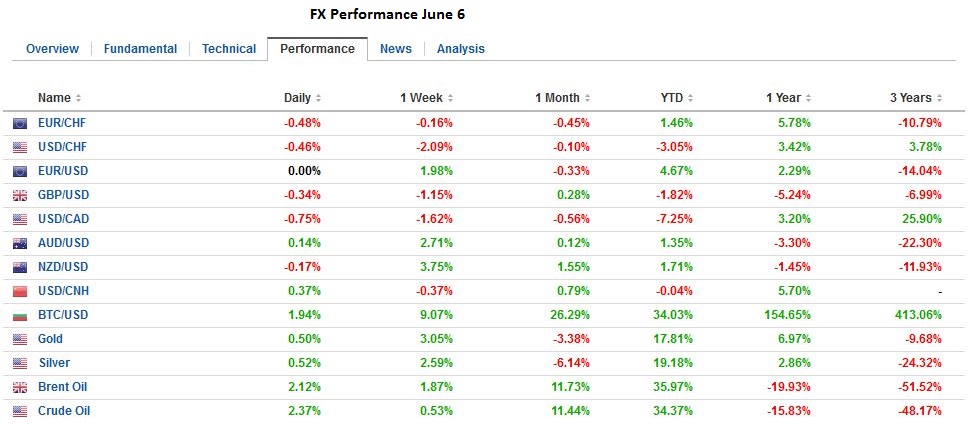

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips.

|

After the shellacking it took after the shockingly poor jobs data, the US dollar has only managed a shallow recovery against the euro and yen. The euro peaked near $1.1375 before the weekend. The mild pullback to almost $1.1335 drew some fresh buying.

The dollar made a marginal new low just below JPY106.40 in early Asia. It ticks to nearly JPY107.30 in late Asian turnover as the Nikkei climbed back after gapping lower and closed at session highs. The greenback would have to resurface above the JPY107.80-JPY108.10 to begin repairing the technical damage inflicted last week.

|

|

United KingdomSterling peaking near $1.4425 before the weekend. At least three polls showed those favoring Brexit were leading ahead of the June 23 referendum. Reports indicated that the bookmakers in London also narrowed the odds of a vote to leave the EU. Sterling slid to $1.4350, its lowest level since May 16, where it found support in Asia and again in early Europe. One-month volatility is quoted at 22% today, up from 17.1% a week ago. The put-call skew remains at near a record extreme (~6.6%).

|

|

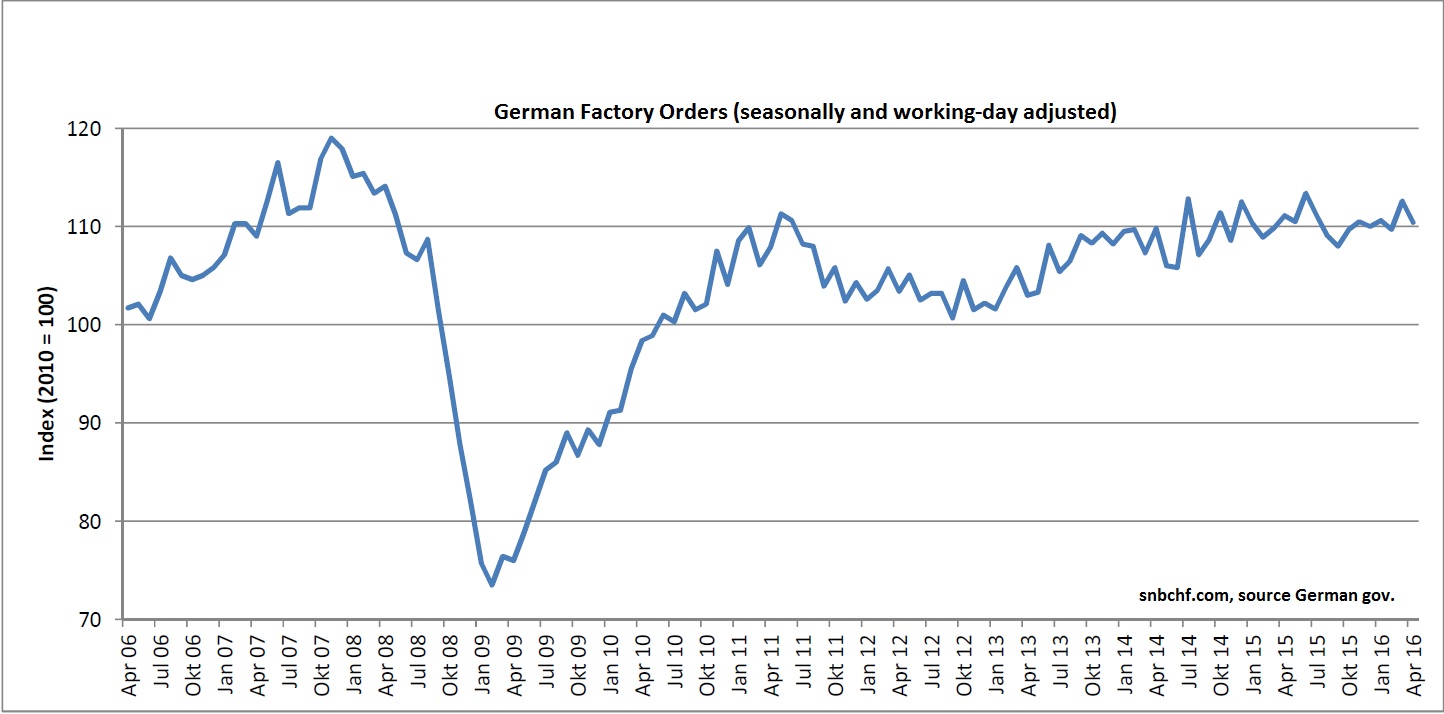

EurozoneThe main economic news is from Germany today. April factory orders fell 2.0%, four times more than the Bloomberg median expected. The sting was only partly blunted by the upward revision in the March series to 2.6% from 1.9%. Domestic orders were the bright spot. They rose (1.3%) for a third consecutive month. Orders from the eurozone were also favorable with a 2.5% increase. The main drag was the 87.3% drop in orders from countries outside the euro area. Investment goods were especially hard hit, falling 13.3% (after 11% gain in March).

It is tempting to dismiss the Germany factory orders as payback in a volatile series. However, the report plays on fears that the slowing of the Chinese economy in particular, and emerging markets general may be taking a tool and that the strong growth in Q1 (0.7% quarter-over-quarter) will not be repeated. In fact, before the weekend, the Bundesbank shaved its growth forecast for this year to 1.7% (vs. 1.8%) and 2017 to 1.4% from 1.7%.

The French central bank also shaved next year’s growth to 1.5% from 1.6%. It anticipates 1.4% growth this year, which seems to be put at risk by the combination of floods and labor activity pushing against Prime Minister Valls reforms.

|