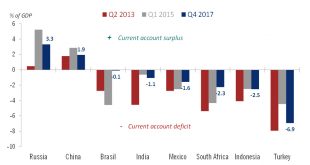

Selectiveness will be key to navigating between 2019 tailwinds and headwinds.Overall, we think there are reasons for investors to be more optimistic on emerging market (EM) debt in 2019. A Fed pause, a limited rise in US Treasury yields, a weaker US dollar and an eventual US-China trade truce could all be tailwinds for EM debt after poor returns in 2018.Furthermore, monetary and fiscal stimulus should help put a floor on the recent Chinese growth slowdown. Along with some policy relaxation...

Read More »A storm in a teacup: emerging-market debt

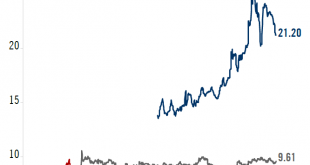

In the coming months, we expect that many quality emerging-market investments will be oversold, as investors ‘sell first and ask questions later’.Emerging market (EM) debt has been suffering lately, posting a disappointing performance year-to-date. While we expect that at some point this sell-off will offer compelling opportunities for investors who have the patience to ride out the storm, we still recommend caution as, on a shorter horizon (the coming three months), US Treasury yields could...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org