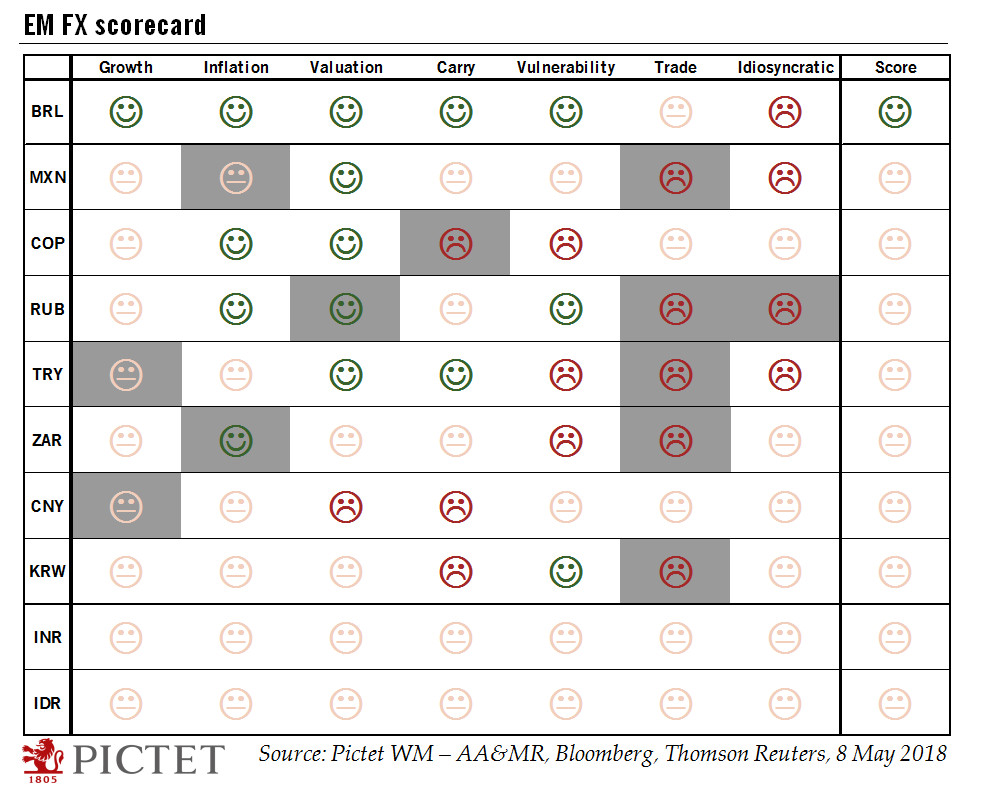

Trade tensions are likely to hold the key to the longer-term outlook for EM currencies.Our EM FX scorecard ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks. There have been few changes over the past month. The scorecard shows the Brazilian real as the most attractive EM currency over the coming 12 months.EM currencies have generally been weak recently for a combination of reasons. This has led to the relative outperformance of ‘defensive’ EM currencies such as the Korean won and the Chinese renminbi.Some negative factors weighing on EM currencies are seen as temporary. However, trade tensions likely hold the key to their prospects.Read full report here

Topics:

Luc Luyet considers the following as important: Currency forecast, Currency scorecard, Emerging market currencies, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Trade tensions are likely to hold the key to the longer-term outlook for EM currencies.

Our EM FX scorecard ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks. There have been few changes over the past month. The scorecard shows the Brazilian real as the most attractive EM currency over the coming 12 months.

EM currencies have generally been weak recently for a combination of reasons. This has led to the relative outperformance of ‘defensive’ EM currencies such as the Korean won and the Chinese renminbi.

Some negative factors weighing on EM currencies are seen as temporary. However, trade tensions likely hold the key to their prospects.