The reversal of accommodative lending conditions and rising volatility mean we will stick to quality.While the US economy continues to grow, knowledge that we are late in the cycle means we are closely watching two developments of significance to credit markets: US corporate leverage and US Federal Reserve (Fed) rate hikes.Many indicators are pointing to rising leverage among US companies, be it the non-financial corporate debt-to-GDP ratio (which reached an all-time high of 46% in 2018), or...

Read More »Time to be more constructive on high yield

High yield bonds are benefiting from improved credit fundamentals and macroeconomic trends.We have just moved from an underweight to a neutral position on US and euro high yield bonds. Several factors underpin this relatively more constructive view.First, in spite of historically low spreads, the carry offered by high yield remains attractive and acts as a cushion at a time of rising government yields. Second, fundamentals remain sound, as the increase in corporate profits has outstripped...

Read More »Euro area: Credit rebounds sharply

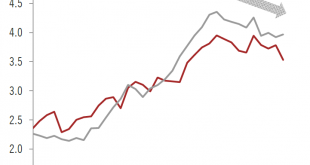

After a large and unexpected fall in December, largely due to a collapse in lending to non-financial corporations in the Netherlands, euro area bank credit flows rebounded sharply in January, in line with other indicators such as the ECB’s Bank Lending Survey We continue to believe that the credit cycle has legs and we therefore maintain our forecast for the euro area GDP growth unchanged at 1.8% for 2016. Nevertheless, we also remain cautious. January bank credit flows came before the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org