High yield bonds are benefiting from improved credit fundamentals and macroeconomic trends.We have just moved from an underweight to a neutral position on US and euro high yield bonds. Several factors underpin this relatively more constructive view.First, in spite of historically low spreads, the carry offered by high yield remains attractive and acts as a cushion at a time of rising government yields. Second, fundamentals remain sound, as the increase in corporate profits has outstripped...

Read More »Spreads for investment grade credits torn in different directions

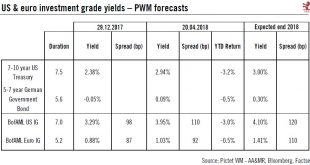

After a difficult start to the year, we remain neutral on prospects for developed market investment grade credits for the coming 12 months.Although US investment grade (IG) and euro IG have posted a negative total return so far this year, credit continues to offer interesting yield pick-up for investors (especially in euro).Overall, we are neutral on prospects for US and euro IG over the coming 12 months. We see US and euro credit yields rising due to higher sovereign yields (especially for...

Read More »Fixed Income: looking for a place to hide

With sovereign yields rising and little room for significant spread tightening in investment grade corporate debt, conditional exposure to high yield may offer more opportunities.Last year credit posted stellar total returns, and the beginning of 2017 has also started well. Investors need to watch three main macroeconomic risk factors in 2017: Inflation, which will normalize; Monetary policy, which will continue to diverge; and Fiscal policy, which will remain accommodative in both the US...

Read More »The High-Yield Dilemma

Fixed-income investors face a difficult dilemma these days. By definition, they seek yield to meet their investment goals, but many financial market observers are predicting trouble in one popular source of such yield – the high-yield bond market. There’s real cause for concern. The junk bond market has seized up several times in the past few years, undergoing sharp, sudden swings due to periodic lacks of liquidity. As the Federal Reserve’s long-anticipated December rate hike began to...

Read More »Digging through the Rubble of the Rout

A selloff as violent as the one global equities markets experienced this past Monday can have effects that mirror a real-life earthquake. Once the earth stops moving, shell-shocked investors have to figure out what caused all the shaking and whether aftershocks are coming. They also have to determine whether anything valuable is hiding in the debris. To the first point, it’s quite clear that trouble in China was the catalyst for the rout. It all started on Friday, August 21, when...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org