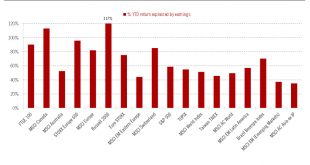

Recent hard macro data confirm the resiliency of the business cycle into year end and 2018.The momentum behind hard macro data is improving investors’ visibility on corporate profit growth in developed markets (DM), which we expect to be the main market risk factor driving equity markets over 2018.According to our analysis, 96% of year-to-date returns of the Stoxx Europe 600 have been due to earnings growth and 59% of the S&P 500’s (see chart). By way of comparison, only 37% of the MSCI...

Read More »Positive margin dynamics, but stretched equity valuations

Second-quarter results were well above estimates, but average earnings surprises were modest in the US and consensus estimates for 2018 have stalled.The Q2 2017 reporting season demonstrated that corporate results dynamics remain robust across developed economies. Sales and profit figures came in well above estimates in the US, Europe and Japan. The trend for profit growth has sustained equity markets’ total returns year to date. But due to the weakness of the US currency, returns in that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org