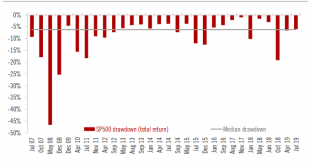

There is an ongoing tug-of-war between trade tensions and fundamentalsDue to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises.Safe haven assets benefitted significantly, with gold gaining 7.4% from the late July equity market peak to the 5 August low and 10-year US...

Read More »Developed market equities update: a fairly reassuring reporting season

There is an ongoing tug-of-war between trade tensions and fundamentals Due to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises. Safe haven assets benefitted significantly, with gold gaining 7.4% from the late July equity market peak to the 5 August...

Read More »Developed-market equities continue to price hard data

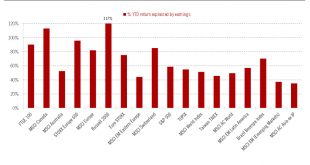

Recent hard macro data confirm the resiliency of the business cycle into year end and 2018.The momentum behind hard macro data is improving investors’ visibility on corporate profit growth in developed markets (DM), which we expect to be the main market risk factor driving equity markets over 2018.According to our analysis, 96% of year-to-date returns of the Stoxx Europe 600 have been due to earnings growth and 59% of the S&P 500’s (see chart). By way of comparison, only 37% of the MSCI...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org