We see little incentive for the ECB to precipitate things at the beginning of the year, especially as core inflation continues to disappoint, but there could be hints at “gradual changes” in forward guidance.We expect no policy decision and no major change in the ECB’s communication at its 25 January meeting. There is no incentive for the ECB to fuel further hawkish market re-pricing at this stage, especially after core inflation disappointed again and the EUR has strengthened once more. The...

Read More »A more neutral tactical stance on the EUR/USD rate

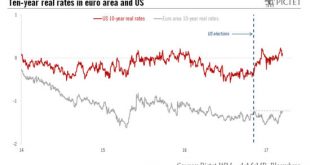

Barring a French election surprise, the downside potential for the euro against the US dollar looks limited in the next few months, but there is still room for the US dollar to strengthen again.The monetary policy meetings of the European Central Bank (ECB) on 9 March and of the Federal Reserve on 15 March have put upward pressure on the euro versus the US dollar. Euro area real rates have risen on prospects for an early rate hike whereas US real rates have declined on the perceived...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org