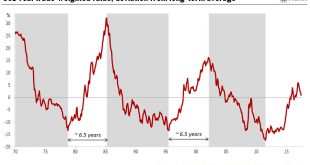

Extreme negative sentiment on the greenback and improving US data should pave the way for a significant US dollar rebound.Following disappointing US economic data and another failure to form a Republican majority on key legislation, the US dollar has slipped to a 10-month low, at 94.68 on 18 July.This extreme USD weakness has led to strong negative market sentiment, as highlighted by speculative positions on the futures market.Although we acknowledge that the foundations (rising inflation...

Read More »The dollar should rebound in the coming months

The euro rose sharply against the US dollar after a speech by Mario Draghi today. We still expect the US dollar to strengthen in the coming months.The euro appreciated significantly against the US dollar (by as much as 1.4% at one stage) on 27 June, reaching a 10-month high. The main reaon was a speech by ECB President Mario Draghi at the ECB forum on central banking at Sintra. To a lesser extent, the ongoing struggle to find legislative consensus among the US Republican Party, highlighted...

Read More »Too much pessimism surrounding the US dollar

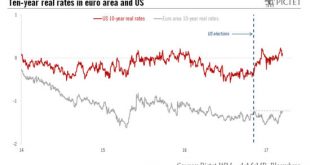

Relatively robust growth in the US and an active Fed suggest markets are too bearish on the USD versus the euro, but the greenback’s potential is limited.The euro has significantly appreciated against the US dollar since the start of the year (roughly 7% by 8 June). The single currency has benefited from strong activity in Q1, higher inflation and reduced political uncertainties in the euro area, especially after the French presidential election. Meanwhile, the US dollar has been damped by...

Read More »A more neutral tactical stance on the EUR/USD rate

Barring a French election surprise, the downside potential for the euro against the US dollar looks limited in the next few months, but there is still room for the US dollar to strengthen again.The monetary policy meetings of the European Central Bank (ECB) on 9 March and of the Federal Reserve on 15 March have put upward pressure on the euro versus the US dollar. Euro area real rates have risen on prospects for an early rate hike whereas US real rates have declined on the perceived...

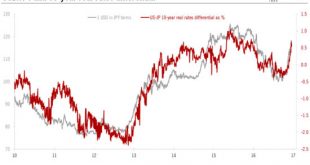

Read More »Limited short-term potential for dollar, yen will continue to weaken

Recent policy meetings at important central banks chime with our currency outlook for major currencies in the coming months.US dollar/euro. The recent break to a fresh 14-year price low after 21 months of consolidation opens the way for a move towards parity in the EUR/USD rate in the next few months. Still, growth in the US is likely to be hurt in the coming months by the ongoing tightening in monetary conditions brought about by the stronger USD and the rise in interest rates before the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org